Why Estate Tax Planning Matters Right Now

If you want a clear, practical path through estate tax planning, start with the basic goal: move assets to the right people at the right time with the least friction, tax, and risk. In the U.S., federal estate tax applies above a threshold that changes with legislation and inflation, and several states impose their own estate or inheritance taxes. That shifting landscape is why estate tax planning strategies must be flexible. We’ll keep things conversational but precise, so you can apply what you read the moment you close this guide.

Core Concepts You’ll Actually Use

Let’s define the essentials without legalese overload. The “estate” is everything you own at death—real estate, investments, business interests, insurance you control, and personal property. “Estate tax” is a transfer tax on the estate itself; “inheritance tax” hits recipients in certain states. “Basis step-up” is the reset of an asset’s cost basis to fair market value at death, which can reduce capital gains later for heirs. “Probate” is the court process to validate a will; it’s public and can be slow, but not always avoidable. These definitions matter because they dictate how to reduce estate taxes without accidentally increasing income taxes or administrative hassle.

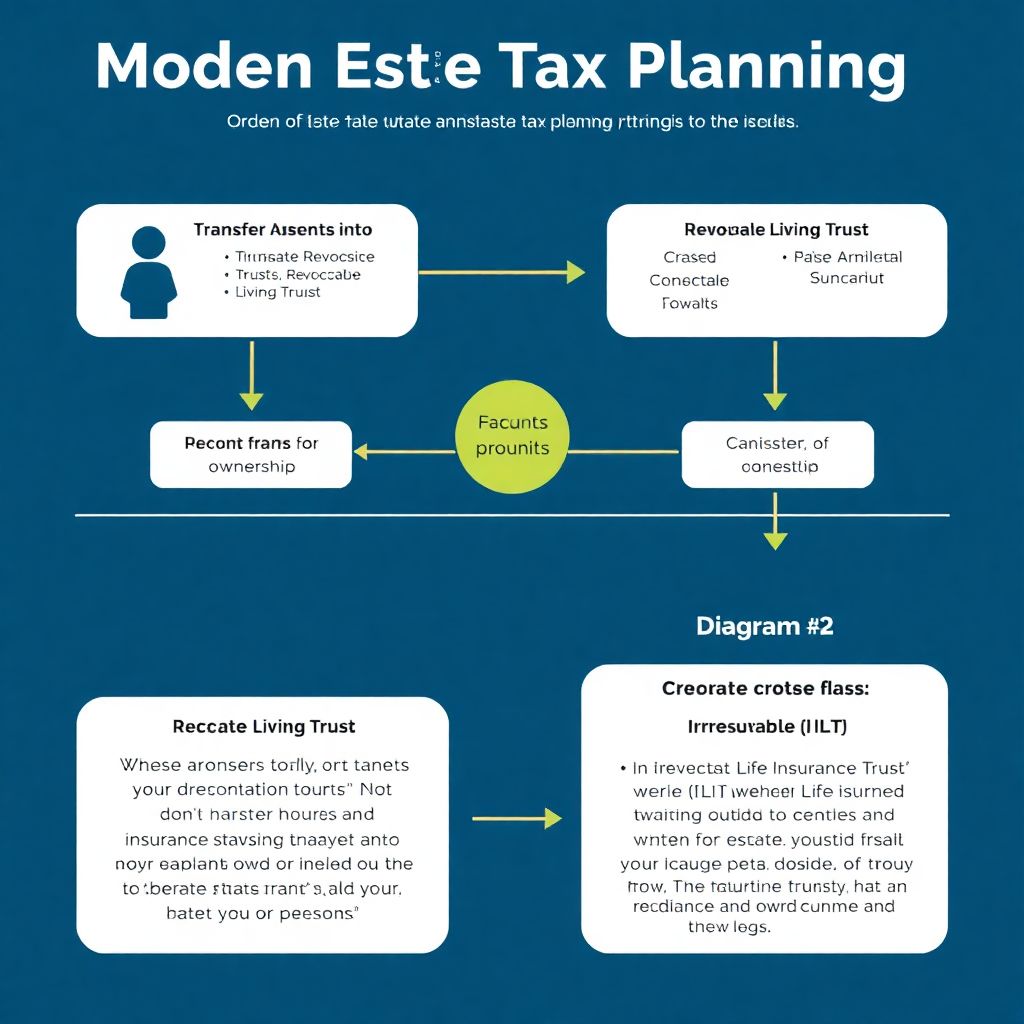

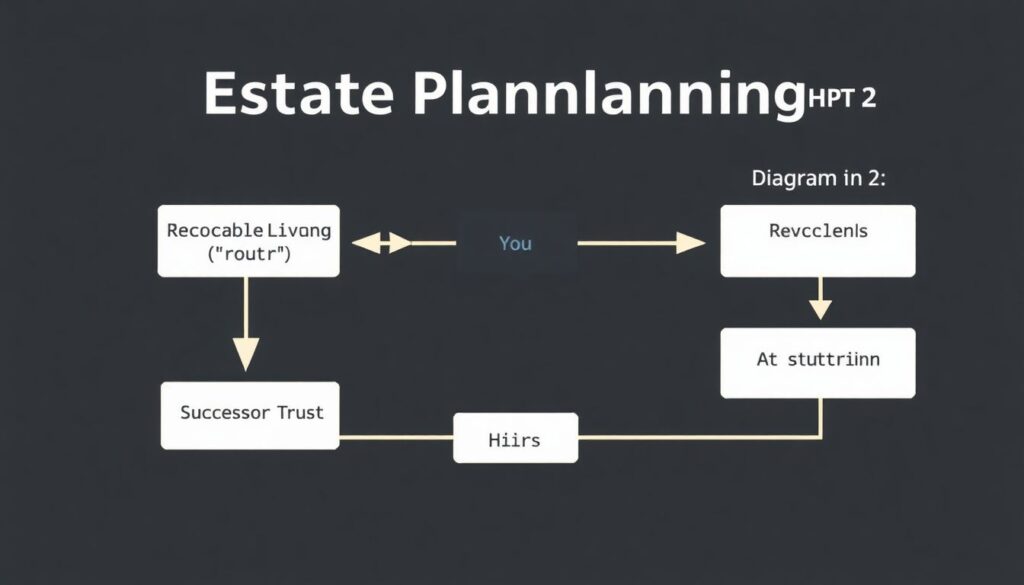

Visualizing the Flow of Ownership (Text Diagrams)

Think in flows. Diagram 1: [You] -> [Revocable Living Trust (you control)] -> (at death) -> [Successor Trustee] -> [Heirs]. This avoids probate but does not reduce estate tax because you retain control. Diagram 2: [You] -> [Irrevocable Life Insurance Trust (ILIT)] -> [Policy owned outside your estate] -> [Heirs receive tax-free death benefit not included in your estate]. Diagram 3: [You] -> [Grantor Retained Annuity Trust (GRAT)] -> [Annuity payments back to you] -> [Remainder to heirs with minimized gift value], effective when asset growth exceeds the IRS hurdle rate.

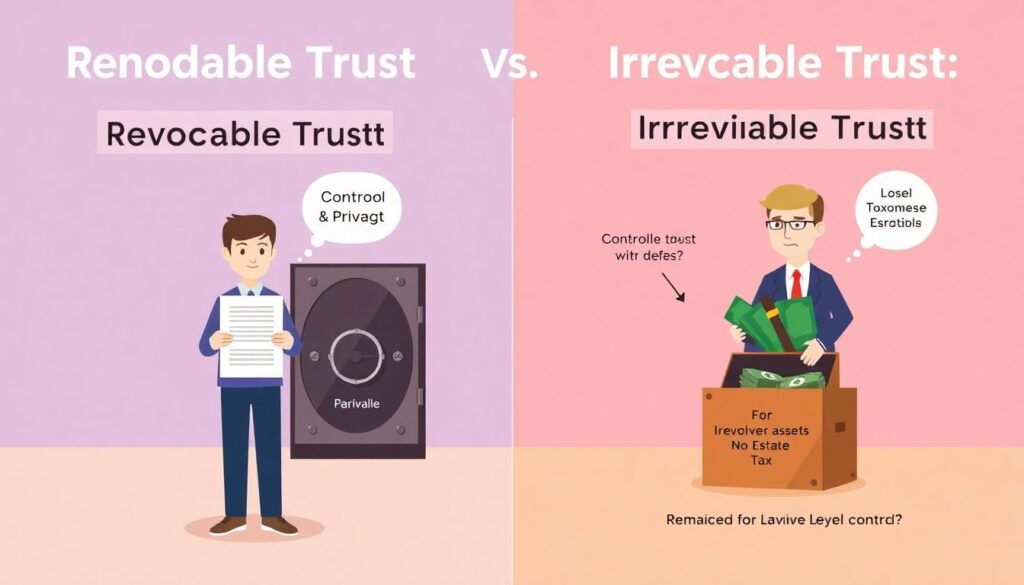

Choosing between Similar Tools: A Quick Comparison

People often confuse tools that sound alike. A revocable trust versus an irrevocable trust: the former gives control and privacy but no estate tax savings; the latter can remove assets from your taxable estate at the cost of control and future flexibility. A donor-advised fund versus a charitable remainder trust: both are charitable, but a donor-advised fund gives an immediate deduction and simple grantmaking, while a CRT can pay you income for life and potentially remove highly appreciated assets from the estate. Compared with outright gifts, strategies like a GRAT or Spousal Lifetime Access Trust (SLAT) balance tax results with access and governance.

Step-by-Step Playbook: From Snapshot to Execution

1) Inventory and valuation: list assets, ownership title, beneficiary designations, and current debt. Cross-check life insurance ownership and policy values.

2) Tax exposure modeling: estimate federal and state estate taxes, plus downstream capital gains from basis step-up tradeoffs.

3) Control and governance: decide who acts as trustee, executor, and business successor, and set distribution standards.

4) Select tactics: match goals to tactics—GRAT for concentrated growth assets, ILIT for large insurance, Family Limited Partnership (FLP) for discounts and control, charitable split-interest trusts for dual goals.

5) Implementation: retitle assets, fund entities and trusts, file gift tax returns (Form 709 in the U.S.) where needed, and sync your will, powers of attorney, and healthcare directives.

6) Monitor and adjust: revisit after life events, law changes, or significant asset swings; measure outcomes against your benchmarks.

Practical Tactics that Actually Move the Needle

If you’re wondering how to reduce estate taxes without derailing investment goals, start with low-friction moves. Use annual exclusion gifts to shift appreciating assets early; add 529 plan front-loading when funding education. For larger moves, a SLAT lets one spouse gift assets to a trust for the other spouse and descendants, potentially removing future growth from the estate while preserving indirect access. When you own fast-growing private stock, a GRAT can “skim” excess appreciation out of your estate with modest gift value. Pair these with an ILIT for sizable insurance so the death benefit isn’t dragged back into your estate via incidents of ownership.

When Income Tax and Estate Tax Pull in Different Directions

Not every tax-saving move is a pure win. Gifting appreciated stock during life transfers your low basis to the recipient, potentially increasing their future capital gains, whereas holding until death could secure a basis step-up. Conversely, if you expect estate tax to exceed the gain benefit, lifetime gifting might still prevail. A common pitfall: placing a highly appreciated primary residence into an irrevocable trust too soon and losing homeowner exclusions or flexibility. The practical approach is scenario modeling: project estate tax, expected asset growth, state taxes, and family time horizons, then choose the lesser of two tax frictions.

Governance, Control, and Family Dynamics

Technical mechanics only work if human factors align. Define distribution standards—HEMS (health, education, maintenance, support) is a common, creditor-resistant framework. For business owners, create a voting/non-voting equity split so you can transfer value while retaining control. Use independent trustees or trust protectors to add oversight and adjust for law changes. Draft buy-sell agreements funded by insurance to avoid fire sales. And document intent; a brief letter of wishes can guide trustees on values, not just valuations, without creating binding conflict with the trust.

Real-World Example: Concentrated Stock and a Short Window

Suppose you hold $12M of concentrated stock with significant unrealized gain and anticipate rapid appreciation after a product launch. You might seed a two-year rolling GRAT with the stock; if the shares outperform the IRS Section 7520 rate, the excess passes to heirs with nominal gift value. Simultaneously, harvest risk by gifting some shares via annual exclusions and QSBS-aware planning where applicable. If liquidity is needed for philanthropy and tax offsets, add a charitable remainder unitrust funded with a slice of the position, deferring gain and producing an income stream while reducing your taxable estate.

How to Choose Help without Overpaying

Early on, a solid CPA and an estate attorney cover most needs; together they deliver estate tax planning services that integrate wills, trusts, and tax filings. As complexity rises—family business, private equity, multi-state situs—consider a corporate fiduciary or family office. Look for the best estate tax advisors who can quantify tradeoffs, not just draft documents. Demand models and memos, not jargon. Fee transparency matters: flat fees for documents, hourly for modeling, and clear ongoing trustee schedules. Good advisors will tailor estate tax planning tips to your jurisdiction, because state thresholds and portability rules can materially change your plan.

Risk Management You Shouldn’t Skip

Funding mistakes sink more plans than the IRS does. If you set up an ILIT, make sure the trust, not you, owns the policy, and that premium gifts follow “Crummey” notice procedures. Keep clean documentation for discounted transfers via FLPs or LLCs—business purpose, formal meetings, and arm’s-length behavior. Avoid “reciprocal trust doctrine” issues when spouses create similar trusts; vary timing, terms, and trustees. And remember, adding adult children as joint owners can trigger immediate gift consequences and creditor exposure—use trusts and beneficiary designations instead.

Putting It All Together

A durable plan blends technical precision with practical execution. Start with modeling, apply estate tax planning strategies matched to your asset mix, and keep paperwork and titling immaculate. Revisit annually, and especially before large liquidity events or law sunsets. You’ll get the most value by coordinating charitable intent, insurance, and business succession in one roadmap. That’s the quiet secret behind the most effective how to reduce estate taxes playbooks: no single trick, just consistent, coordinated moves.

Field Notes and Quick Wins

– Confirm beneficiary designations across retirement accounts and insurance; these bypass probate and can be aligned with trusts using see-through rules when appropriate.

– If charitably inclined, pair a donor-advised fund with Roth conversions in low-income years to optimize brackets and future tax-free bequests.

– Use portability elections promptly if a spouse dies; timely filing can preserve unused exemption even for smaller estates, adding resilience if laws tighten.

These aren’t generic estate tax planning tips—they are practical checkpoints that prevent small errors from becoming expensive problems.

When to Re-Run the Plan

Review after any of these: marriage, divorce, birth or adoption, sale of a business, major real estate transaction, significant interstate move, sharp asset volatility, or tax law changes. Treat your plan like a software release: versioned, tested, and patched. By aligning your updates with market and policy cycles, you reduce friction, keep optionality high, and get more from the professionals you hire—whether that’s a nimble boutique or a firm known for comprehensive estate tax planning services.