Why insurance belongs in your money plan

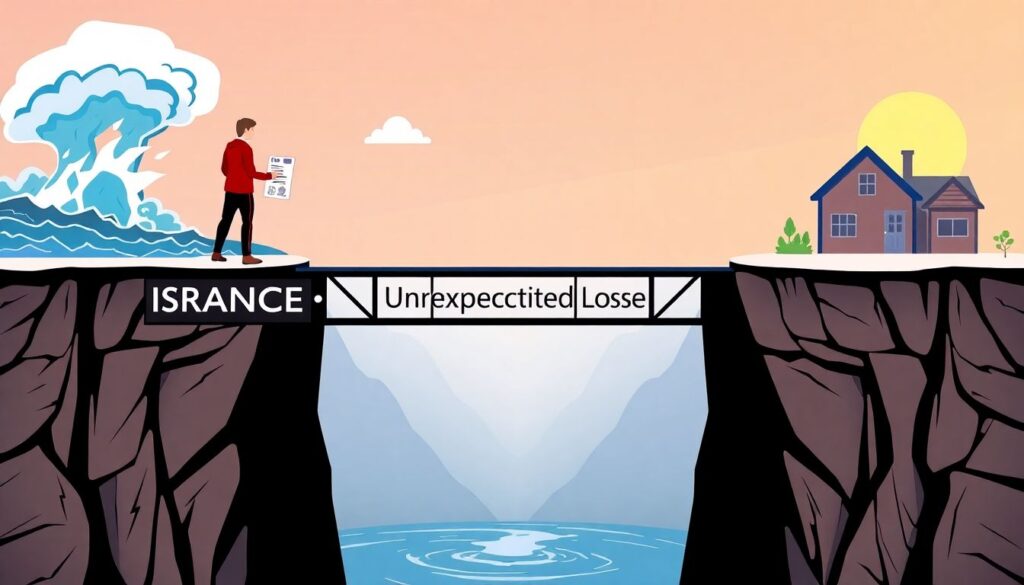

Insurance is not just a bill; it’s a risk-transfer tool that keeps your long-term goals intact when life swerves. The importance of insurance in financial planning is simple: you’re trading a predictable cost today (the premium) to avoid a potentially devastating loss tomorrow. That trade lets investments compound without forced withdrawals after a crisis.

In other words, insurance financial planning is about defending the engine that grows your wealth—your income, your health, your property—so that saving and investing can actually work.

Clear definitions without the jargon fog

Let’s keep the terms straight (you’ll see these everywhere):

– Premium: the price you pay for coverage.

– Deductible: the amount you pay before the insurer pays.

– Coverage limit: the maximum the insurer will pay.

– Exclusion: what the policy explicitly won’t cover.

– Rider: an add-on that modifies coverage.

– Term life: life insurance for a fixed period (e.g., 20 years); no cash value.

– Whole/Universal life: permanent coverage with a cash value component; higher premiums.

– Disability insurance: replaces part of your income if you can’t work due to illness or injury.

– Liability coverage: pays when you’re legally responsible for damages to others.

– Umbrella policy: extra liability protection above home/auto limits.

Short version: premiums buy certainty; deductibles and exclusions define your out-of-pocket risk.

How insurance fits inside a financial plan

Think of your plan as a system that turns income into goals (home, retirement, freedom). Insurance sits between uncertainty and your goals.

Diagram (flow of risk and money):

[Risk event] → [Emergency fund] → [Insurance pays within limits] → [Investments remain intact]

If there’s no insurance in place, that arrow often becomes:

[Risk event] → [High-interest debt / Forced asset sales] → [Goals delayed or derailed]

That’s the essence of how insurance fits in financial plan: it prevents ruin so your investment plan can be boring—in a good way.

The protection ladder (text-based visualization)

Picture layers from most frequent to most catastrophic:

– Top: Frequent, small costs → Paid by cash flow or emergency fund.

– Middle: Moderate shocks → Health, auto, renters/home policies.

– Base: Low frequency, high severity → Life, disability, umbrella, long-term care.

Diagram (pyramid):

[Catastrophic: Life/Disability/Umbrella]

[Moderate: Health/Home/Auto]

[Everyday: Emergency fund/Cash flow]

Types of coverage and what problem each solves

– Health insurance: Shields against unpredictable, large medical bills. In many countries, one major hospital stay can equal a year of salary. A higher deductible often lowers premiums; pair with a robust emergency fund or, where applicable, an HSA.

– Life insurance: Replaces future income so dependents can keep the house, finish school, or maintain stability. For most families, term life is the best insurance for financial security because it’s inexpensive and targeted to the years you’re most needed.

– Disability insurance: Your income is your biggest asset. Long-term disability covers a portion (often 50–70%) if you can’t work. Own-occupation definitions are stronger but cost more.

– Property (homeowners/renters/auto): Protects your stuff and, crucially, your liability if someone gets hurt on your property or due to your driving.

– Umbrella liability: Kicks in after your home/auto limits, adding $1–5M of protection for relatively low cost. It’s about safeguarding current and future assets from lawsuits.

– Long-term care: Helps with extended assistance needs (e.g., memory care). It’s a planning tool for later life; alternatives include reserving earmarked assets.

Short take: match insurance to risks that are large and rare; self-insure small and frequent costs.

Comparing insurance to its “analogs”

– Emergency fund vs insurance: An emergency fund handles small to medium surprises quickly; insurance handles large losses you can’t absorb. They complement each other.

– “Self-insuring” vs paying premiums: Works only if your liquid assets comfortably exceed plausible losses. Most families can’t self-insure a lawsuit or a major medical event.

– Investments vs permanent life cash value: Bond funds provide transparent returns and liquidity; whole life’s cash value is slower-growing, with fees baked into premiums. Use permanent policies for specific needs (estate liquidity, lifelong coverage), not as a default investment.

Step-by-step: build a resilient protection plan

1) Map your risks: income dependency, debts, dependents, property, health, liabilities.

2) Cover catastrophes first: adequate health, disability, life (if dependents), and liability limits.

3) Right-size deductibles: pick a deductible you can pay from your emergency fund to lower premiums without risking cash-flow chaos.

4) Verify exclusions and definitions: check waiting periods, occupation definitions, and whether replacements are actual cash value (ACV) or replacement cost.

5) Set review triggers: marriage, birth, home purchase, job change, business launch, and every 12–24 months.

Short rule: insure what you cannot afford to lose; ignore what you can afford to replace.

Insurance strategies for financial growth

You don’t “grow” money through claims; you grow by protecting compounding and by using smart levers:

– Deductible optimization: Higher deductibles reduce premiums. If the annual premium savings exceeds the increased deductible over your expected claim frequency, it’s rational to raise the deductible.

– Tax alignment: Where available, pair high-deductible health plans with HSAs for triple tax benefits. Premiums for certain coverages may be deductible for businesses—ask a tax pro.

– Buy term, invest the rest: For most households, term life plus low-cost index funds beats overpaying for cash-value policies unless you have specialized needs.

– Umbrella leverage: Cheap coverage for big liability risks means you can keep investing instead of hoarding cash “just in case.”

– Business owners: Consider key-person insurance, disability overhead expense, and buy-sell agreements funded by insurance.

This is where insurance strategies for financial growth show up—by reducing drag on your portfolio during bad years and avoiding panic-selling.

Frequent beginner mistakes (and quick fixes)

– Mistake 1: Chasing the cheapest premium. Fix: Compare coverage definitions, exclusions, and limits first; price second. The cheapest policy that doesn’t pay is expensive.

– Mistake 2: Underinsuring liability. Fix: Increase auto/home liability and add umbrella coverage once you have assets or above-average income.

– Mistake 3: Ignoring disability insurance. Fix: If your lifestyle depends on your paycheck, get long-term disability with a strong definition of disability.

– Mistake 4: Buying whole life as a default investment. Fix: Use term life for income protection; consider permanent insurance only for specific, advanced needs.

– Mistake 5: Too-low deductibles. Fix: Use your emergency fund for small shocks; accept higher deductibles to cut long-run premiums.

– Mistake 6: Not updating beneficiaries. Fix: Review after life events; avoid naming minors directly—use a trust or guardian strategy.

– Mistake 7: Skipping policy reviews. Fix: Re-shop every 2–3 years or after major changes; confirm replacement cost on property.

– Mistake 8: Overlapping or missing coverage. Fix: Coordinate employer benefits with personal policies; watch for gaps during job changes.

Short version: design for claims you’d dread, not dents you’d shrug off.

Cost control and smart shopping

– Shop through independent agents who can compare multiple carriers; ask about financial strength ratings and claim reputation.

– Bundle (home/auto) when it actually lowers total cost; verify that coverage quality stays intact.

– Improve what insurers price: safe driving, home safety features, credit-based insurance scores (where legal), and loss history.

– Read exclusions: flood, earthquake, and certain perils are often separate policies.

A little due diligence beats saving $50 and discovering a hidden exclusion later.

When to review and what to change

– New dependents or debts? Increase life coverage.

– Big pay raise? Raise disability benefit and liability limits.

– Mortgage paid off? You might reduce life coverage or shift to longer-term needs.

– Retirement approaching? Reevaluate disability (may be less relevant) and consider long-term care planning.

– Started a side business? You may need professional liability or a business owner’s policy.

Short checkup yearly; deep dive every two years.

Mini case studies

– The young family: Two incomes, a toddler, a mortgage. They choose $1M 20-year term life each (roughly 10–12x one income), long-term disability through work plus a private supplement, and an umbrella policy. When a medical event hits, their investments keep compounding because insurance catches the big shock. That’s the best insurance for financial security for their stage.

– The single renter: No dependents, moderate savings. Focus on health, strong disability, and renters insurance with high liability. Skips life insurance for now; directs savings to retirement and emergency fund.

– The late-career couple: Paid-off home, sizable portfolio. They raise liability and consider long-term care options. Permanent life only if needed for estate liquidity; otherwise they keep low-cost term if still needed, or drop it.

Text diagrams to anchor the concepts

Risk budgeting dial:

Loss size → [Small][■■■ self-insure] [Medium][■■ insurance + EF] [Large][■■■■ insurer’s balance sheet]

Cash-flow shield:

Income → Budget → Savings/Investing

↑ |

Insurance ← Prevents forced withdrawals

Protection stack:

EF (3–6 months) → Health/Auto/Home → Disability/Life → Umbrella/LTC

Bringing it together

If you only remember one thing, remember this: insurance doesn’t make you rich; it keeps you from getting poor at the worst possible moment. That’s why the importance of insurance in financial planning is non-negotiable. Start with the big risks, let small ones ride, and revisit as life changes.

By building your plan this way, you’ll understand how insurance fits in financial plan decisions you make each year and you’ll choose coverage intentionally—not out of fear, but out of math and common sense. And if you lean on insurance strategies for financial growth, your investments can stay the hero of your story rather than a piggy bank you smash after a bad day.