How to Prepare Financially for a Wedding: A Real-World Playbook

Planning a wedding is part spreadsheets, part emotions, and a lot of prioritizing. Money doesn’t have to steal the joy—if you set up the right system early. Let’s walk through a practical, no-fluff approach that real couples are using right now.

What weddings actually cost in 2023–2025

Before we talk tactics, let’s anchor to real numbers.

– In the U.S., the average wedding cost reported by major industry trackers hovered around:

– 2023: about $35,000 (The Knot Real Weddings Study; urban markets often exceeded $40,000)

– 2024: early reports and venue/vendor rate cards showed a mild bump to roughly $35,000–$37,000, driven by food inflation and labor

– 2025: year-to-date inquiries and contracts suggest a further 2–4% increase in many metro areas, with coastal cities regularly landing $40,000–$55,000 and small-town weddings often in the $18,000–$28,000 range

Those ranges vary widely by guest count, location, and day-of-week. But they’re honest benchmarks to sanity-check your plan.

Real couple snapshot

Maya and Luis booked a Saturday in late September, 110 guests, mid-sized city. Their initial quotes in 2024 came to $36,200. Re-checking in early 2025, the same caterer revised menus +3.5% and staffing +2%. They trimmed guest count to 100 and moved to a Friday to land at $33,800—without compromising on photography or live music.

Start with a number and a date (in that order)

Pick a cap you won’t cross. Then set the date around vendor availability that fits that budget, not the other way around.

– Cap first, calendar second

– Guest count drives everything

– Non-negotiables get funded before “nice-to-haves”

Technical details: A quick budget math block

– Target cap: $32,000

– Guests: 100

– All-in per guest: $32,000 ÷ 100 = $320 (helpful for tradeoffs)

– 8-month runway: $32,000 ÷ 8 = $4,000/month required savings

– If you already have $8,000 saved: Gap $24,000 → $3,000/month

If that number makes you sweat, reduce guests by 10–20, move to Friday/Sunday, or extend the timeline.

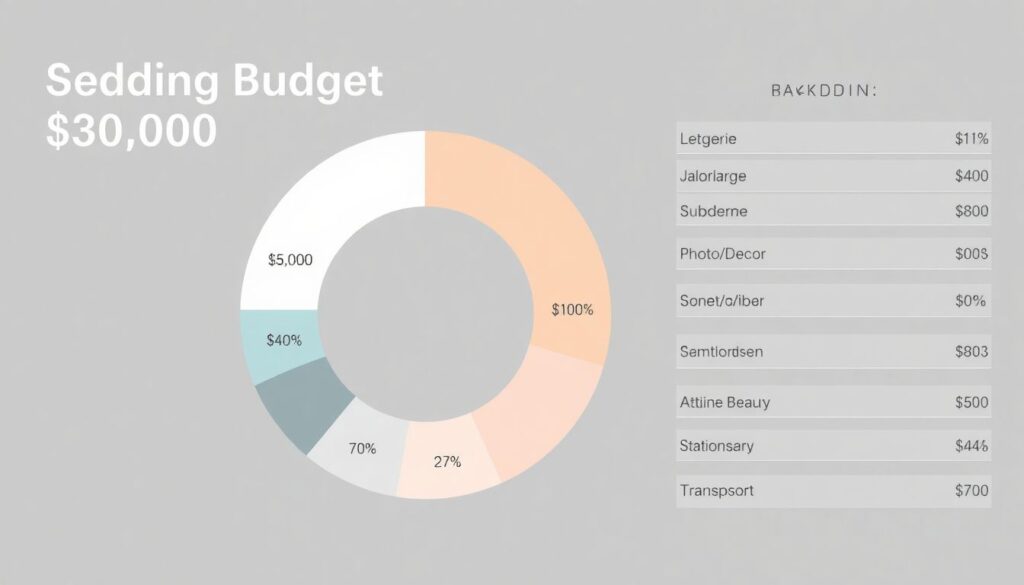

A practical wedding cost breakdown you can actually use

Here’s a realistic split many planners use as a baseline, then adjust:

– Venue + catering + bar: 45–55%

– Photo/video: 10–12%

– Attire/beauty: 6–8%

– Music/entertainment: 8–10%

– Florals/decor/rentals: 8–12%

– Stationery/favors/website: 2–4%

– Planner/coordination: 5–10%

– Transportation: 1–3%

– Misc/insurance/permits/fees: 3–5%

– Contingency: 5–10%

On a $30,000 cap, a 50% venue/catering share means $15,000. If your favorite venue quotes $18,000 all-in for food/bev/space, you’ll need to compress other categories or raise the cap. That’s the point of a working wedding cost breakdown—it shows tradeoffs in plain sight.

Technical details: Turning a split into dollars

Budget $30,000 example:

– Venue/catering/bar (50%): $15,000

– Photo/video (11%): $3,300

– Music (9%): $2,700

– Florals/decor (9%): $2,700

– Attire/beauty (7%): $2,100

– Planner (6%): $1,800

– Stationery (3%): $900

– Transport (2%): $600

– Misc + insurance (3%): $900

– Contingency (5%): $1,500

If service fees + tax are not included (commonly 20–28% combined in the U.S.), back them into the venue/catering line or you’ll blow the cap at contract time.

How to save money for a wedding without feeling deprived

You don’t need austerity; you need automation and a couple smart levers.

– Open a high-yield savings account (HYSAs in 2023–2025 have commonly paid ~3–5% APY). Automate transfers the day you’re paid.

– “Reverse budget”: Pay wedding and essentials first, then discretionary.

– Trim the big 3 for six months: housing (sublet a room or negotiate), transportation (pause rideshares, use transit), dining (set a weekly cap).

– Cut guest list by 10–20 people. At $180–$260 per guest in many markets, that’s an immediate $1,800–$5,200 saved.

– Choose a Friday or Sunday; off-peak months (Jan–Mar, late Nov) can shave 10–25% on venues and vendors.

Technical details: A 10-month savings schedule

Goal: $24,000 in 10 months

– Employer bonus earmark: $4,000

– Monthly auto-transfer: $1,600 × 10 = $16,000

– Side income (two weekends/month): $400 × 10 = $4,000

– Expected HYSA interest at 4% APY (declining balance): ≈ $250–$350

Total: ≈ $24,250–$24,350

Jess and Andre used this exact structure, plus swapped a Saturday to a Sunday, freeing $2,800 that covered their videographer.

Use tools, not guesswork

A good wedding budget calculator is worth its weight in gold. Plug in guest count, city, and must-haves to see category ranges instantly. Then override with actual quotes from vendors. Update weekly; your budget is alive, not a PDF.

– Keep quotes, deposits, due dates, and balances in one shared sheet

– Track “quoted vs. contracted vs. paid”

– Add a “decision deadline” column to avoid indecision penalties

What’s changed since the pandemic-era surge

– Staffing and food costs stayed elevated through 2023–2024; 2025 hasn’t fully reversed that.

– Demand normalized, but prime Saturdays still book 12–18 months out in popular metros.

– Cancellation clauses are stricter than pre-2020. Read force majeure and reschedule fees carefully.

Technical details: Deposits and fees you’ll actually see

– Venue deposits: 20–50% at signing; second payment 6 months out; balance 7–14 days pre-event

– Caterer minimums: Often $90–$180 per person before service and tax

– Service + tax: Commonly 20–28% combined; on $15,000 food/bev, that’s $3,000–$4,200

– Insurance: $125–$500 for event liability with host liquor coverage

– Overtime: $300–$1,000 per hour for venue; $200–$500 per vendor per hour

When, if ever, to consider wedding loans

I’m pro-cash-first. But let’s be adults about realities.

– Personal loan APRs in 2024–2025 often range from about 8% to 20% depending on credit

– A $10,000 loan at 12% for 36 months costs about $332/month; total interest ≈ $1,940

– If you’re using debt, set a hard cap and tie repayment to a concrete plan (bonus, RSU vest, car payoff rolling off)

Debt should fund timeline constraints, not upgrades. Fund the date, not the extras.

Technical details: Simple loan math

Loan: $8,000 at 11% APR, 24 months

– Monthly payment ≈ $372

– Total interest ≈ $928

– Compare to saving that $8,000 over 8 months: $1,000/month plus a small HYSA interest gain. If you can wait, saving wins almost every time.

Vendor strategy that protects your budget

– Shortlist three vendors per category; ask for itemized quotes

– Request “value-engineer” options: fewer floral types, smaller wedding party bouquets, or a DJ + live sax hybrid

– Lock what moves: Photographers and planners book out early; linens can wait

– Ask about cash or off-peak discounts—but never at the expense of contract clarity

And always confirm what’s included: setup, teardown, staffing ratios, and equipment. Hidden rentals can ambush you.

Guest count: your master lever

If you need to cut $6,000 fast, don’t start with flowers—start with heads.

– Cut 25 guests at $220/guest average: ≈ $5,500 saved

– Or host a plated dinner for family (60 guests) and a larger dessert-and-dancing reception later

It’s your day; build it around connection, not obligation.

Contingency and “surprise” lines you’ll be glad you planned

– 5–10% contingency for price creep and last-minute needs

– Weather plan: tent holds, heaters/fans

– Transportation buffers if ceremony and reception are far apart

– Postage and reprints for stationery changes

Technical details: A clean, final prepay checklist

– Reconfirm headcount and dietary needs at T–14 days

– Zero out vendor balances; keep receipts and bank confirmations

– Print a one-page payment ledger for day-of coordinator

– Set gratuities in labeled envelopes; typical ranges:

– Lead server or captain: $2–$5 per guest equivalent

– Delivery/setup crews: $25–$50 per person

– Officiant: $75–$150 (or donation)

– DJ/band: $50–$100 per performer

Putting it all together

– Define a non-negotiable cap based on cash flow and timing

– Use a wedding budget calculator to model scenarios quickly

– Build a realistic wedding cost breakdown, then plug in real quotes

– Automate savings; keep money in a separate HYSA

– Book vendors in order of scarcity; read every clause

– Use wedding loans only if the math (and timeline) demand it

You can absolutely design a beautiful celebration without financial whiplash. Set the number, let it guide the plan, and keep your eye on what you’ll remember a decade from now: the faces in the room, not the chair style.