Why milestone purchases deserve a plan

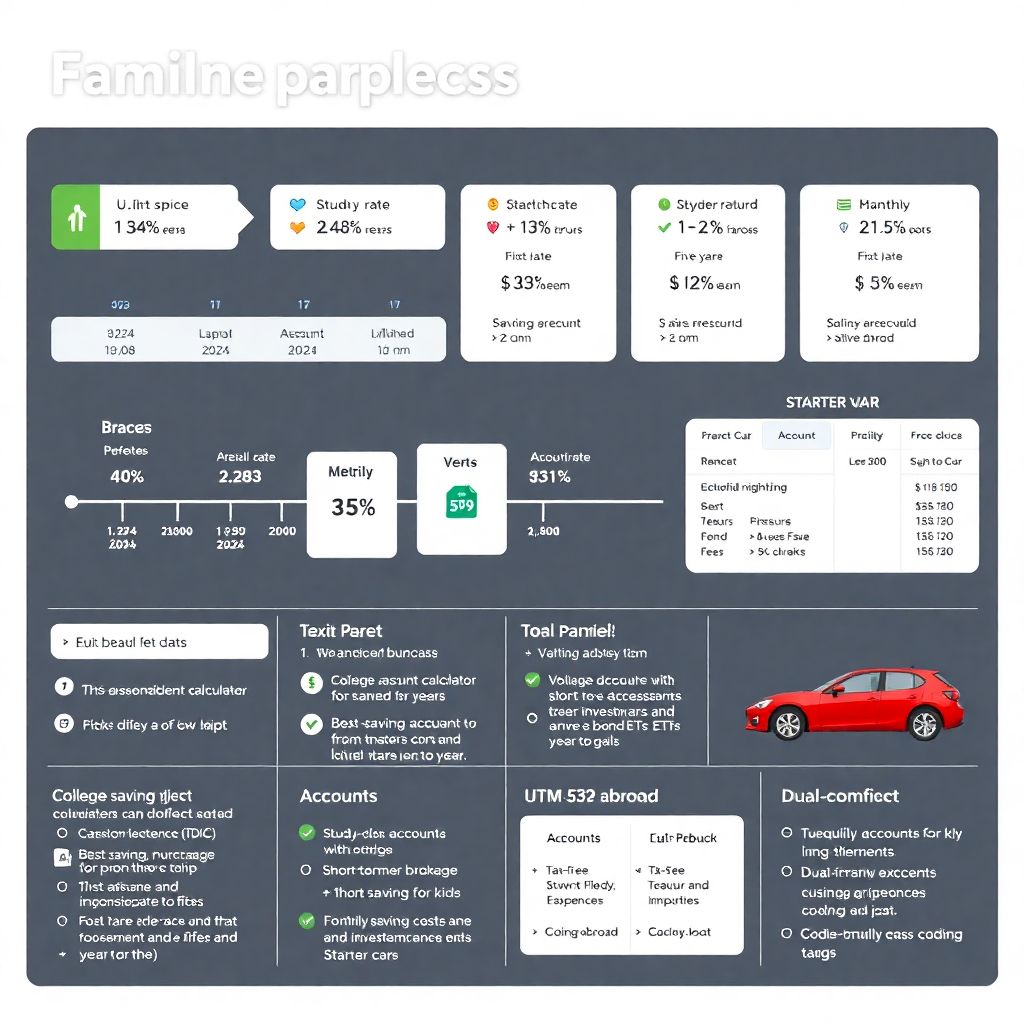

Big-ticket moments creep up faster than we think: braces, a first laptop, study-abroad fees, or the down payment on a starter car. In 2024, the U.S. personal saving rate hovered near 4% (BEA), while used-car prices and extracurricular costs stayed elevated, squeezing family budgets. Treat each milestone as a mini “capital project” with its own timeline, risk tolerance, and exit date. That framing helps you pick the right account, automate contributions, and avoid last‑minute debt. It also keeps you honest about trade-offs: the money for a clarinet upgrade shouldn’t jeopardize next year’s camp tuition or a SAT prep course.

Forecasts and the economic backdrop

Planning works best when you bake in realistic assumptions. Over a five‑year horizon, many economists expect inflation to cool toward 2–3% on average, while wage growth slows from pandemic highs. Education‑adjacent costs—tutoring, tech, travel—often run a bit hotter than CPI, so model them to inflate 1–2 percentage points above headline. For a first car or gap‑year fund, consider price volatility: used vehicles and airfare can swing 10% year to year. Set guardrails: define your “must‑have” date, minimum viable budget, and a stretch goal you’ll pursue only if markets cooperate.

Turn fuzzy wishes into targets with the right tools

Start by translating hopes into dollar figures and due dates. A college savings calculator isn’t just for tuition; repurpose it for any multi‑year goal by entering the target amount, time horizon, and assumed return. Then layer in milestones: braces in two years, a laptop in three, an internship abroad in five. Map cash flows across months to avoid bunching expenses in the same season. Finally, add a 10–15% buffer for surprise costs—insurance, accessories, application fees—so your plan absorbs shocks without raiding emergency savings or derailing other priorities.

Picking vehicles: cash, tax perks, and flexibility

Short horizons (under three years) call for principal safety. High‑yield options among the best savings accounts for kids offer FDIC coverage, easy transfers, and teach useful habits. For goals three to five years out, consider a custodial brokerage account for minors with a conservative mix of short‑term Treasuries and investment‑grade bond ETFs; you’ll trade some yield for stability and liquidity near the deadline. If the purchase could pivot to education, weigh UTMA vs 529: a 529 offers tax‑free growth for qualified education expenses, while a UTMA provides flexibility but fewer tax advantages and may affect financial aid differently.

Optimize for education-adjacent purchases

When a milestone is tightly linked to learning—dual‑enrollment fees, a study‑abroad flight, or a coding bootcamp—check whether the expense qualifies under the best 529 plans. Many states allow tax‑free 529 withdrawals for certain equipment and program costs; rules vary, so confirm eligibility before buying. If it’s not qualified, route funds from an UTMA or cash account to avoid penalties. Use separate sub‑accounts and clear nicknames in your banking app to prevent accidental commingling: “Braces Q1‑2027,” “Laptop Fall‑2026,” and “Car Fund 2028” improve visibility and accountability.

Unconventional ways to stretch the plan

Think beyond deposits. Pre‑buy travel with transferable points earned from category‑bonus cards and pooled in a parent’s account, then reimburse the fund for taxes and fees. Use community “gear libraries” for cameras, musical instruments, or robotics kits, turning purchases into short rentals. Partner with local employers for stipend‑tied internships that fund the goal while building a résumé. For a car, arrange a multi‑family buying co‑op to negotiate fleet‑style discounts on reliable used models. And for tech, target corporate off‑lease auctions—often 30–50% cheaper than retail—with a warranty add‑on.

Automation and behavioral guardrails

1) Pay yourself first: split payday deposits across goals to sidestep willpower. 2) Escalate contributions 1% each quarter; tiny bumps compound without pain. 3) Use “speed bumps”: a 24‑hour delay on transfers out of goal accounts. 4) Trim volatility as the deadline nears—move from short‑term bond funds to cash six months out. 5) Celebrate partial wins: lock in the laptop early if prices dip meaningfully. These nudges reduce friction and keep you compounding, even when life throws curveballs or markets wobble for a spell.

Industry impact: where providers are heading

As families segment goals, providers respond. Expect more hybrid products that blend goal tracking with card‑linked round‑ups, plus fractional Treasuries inside kid‑friendly interfaces. Brokerages are expanding education on UTMA vs 529 trade‑offs and integrating comparison tools for the best 529 plans alongside in‑app calculators. Neobanks are racing to market the best savings accounts for kids with real APY, not gimmicks, while custodial platforms add age‑based guardrails and shared visibility so teens can co‑pilot decisions without risking accidental withdrawals or misallocations.

Risk management and rebalancing discipline

Treat each milestone like a glide‑path fund. Early on, accept modest risk in a diversified short‑duration mix; as D‑day approaches, rebalance on a schedule—quarterly, then monthly in the final six months. Document a sell rule: if the account hits the target early, de‑risk immediately rather than chasing returns. Stress‑test with a 10% price jump for the item and a 1–2% drop in yields. Keep a small overflow reserve—perhaps from cash‑back rebates or side‑gig income—to smooth surprises without tapping retirement or high‑interest credit.

Quick start: a 90‑day action plan

Week 1: list milestones with dates and minimum budgets. Week 2: run each through a college savings calculator to set contributions and buffers. Week 3: open accounts—cash for sub‑3‑year goals, a custodial brokerage account for minors for longer ones; add a 529 if education is plausible. Week 4–8: automate deposits, set speed bumps, and pick a glide path. Week 9–12: hunt unconventional savings—points, co‑ops, off‑lease gear—and lock early wins. Revisit quarterly; update forecasts and rebalance so each purchase arrives on time, paid in cash, and with less stress.