Why “small wins” beat grand financial plans in 2025

In 2025, building financial confidence isn’t about nailing a perfect budget once; it’s about stacking small, repeatable wins that compound. The macro backdrop keeps shifting—after the rate hikes of 2022–2024, borrowing costs remain elevated compared with the 2010s, while inflation has cooled from its peak but still nibbles at purchasing power. People who feel in control today aren’t those who guessed the market right; they’re the ones who automated savings, trimmed one wasteful subscription, refinanced a pricey card, and kept going. That cadence—small goal, fast feedback, slight upgrade—creates momentum and cushions you against economic surprises.

The data: why incremental change works

The numbers back this strategy. U.S. credit card balances crossed $1.1 trillion in late 2024, according to the New York Fed, with delinquency rates ticking up among younger borrowers. At the same time, high-yield savings account rates averaged in the neighborhood of 4–5% APY through early 2025, far higher than the near-zero era—meaning your emergency fund actually earns something again. Behavioral research consistently shows that clear, immediate feedback loops drive better habits; think rounding up transactions into savings or auto-increasing 401(k) contributions by 1% each year. When you combine those nudges with tools that reduce friction—like best budgeting apps that categorize spending in real time—adherence jumps, anxiety drops, and you start to trust your own process.

Small wins that compound fast

Big outcomes often emerge from tiny, boring adjustments that you barely notice after a month. The trick is sequencing them so each win funds the next.

– Set a savings “floor” and automate it: start with $25–$50 per paycheck into a high-yield account, then bump it by 10% whenever you get a raise.

– Trim one high-leak category: restaurants, rideshares, or subscriptions. Redirect the freed cash to debt principal.

– Refinance toxic debt: use debt consolidation loans judiciously when the blended rate is lower and terms are clean.

– Lock in credit hygiene: pay on time, keep utilization under 30%, fix errors quickly to improve credit score fast.

Each item is small on its own, but together they generate a cash-flow tailwind. For example, shaving $60/month in subscriptions plus a 1% APR reduction via consolidation can free over $1,000/year—enough to build a starter emergency fund without feeling deprived.

Modern tools that make small wins effortless

The tooling landscape matured rapidly. Many best budgeting apps now pull in real-time balances via open banking, flag unusual transactions using machine learning, and simulate how a change—say, cooking at home twice more per week—translates into debt-free timelines. On the savings side, high-yield savings account rates remain competitive even as the Federal Reserve cautiously nudges policy rates lower; banks are still vying for sticky deposits, so features like automated “round-ups,” goal vaults, and bonus tiers for direct deposit are normal. Credit optimization tools can scan your credit file for quick fixes—incorrect limits, stale addresses, or legacy collections—and suggest precise actions that can improve credit score fast without gimmicks. And if you’re overwhelmed, searching “financial coach near me” surfaces credentialed professionals who blend behavioral coaching with cash-flow planning, often via virtual sessions.

Economic context: rates, inflation, and wages in 2025

The 2025 economy is a study in normalization. Headline inflation has cooled from the 2022 spike, but services prices remain sticky, which keeps household budgets tight. Wage growth has moderated but still outpaces pre-pandemic norms in many sectors, helping consumers tread water. Interest rates, while off their peaks, are still meaningfully higher than the 2010–2019 average; mortgages and auto loans feel heavier, and revolving credit costs bite. For savers, this is a quiet gift: high-yield savings account rates, even if they drift lower from 2024 highs, continue to pay more than a decade’s worth of near-zero yields. For borrowers, the imperative is prioritization—tackle variable-rate debt first, lock in lower-cost fixed options if available, and carefully evaluate debt consolidation loans only when the math and the fine print align.

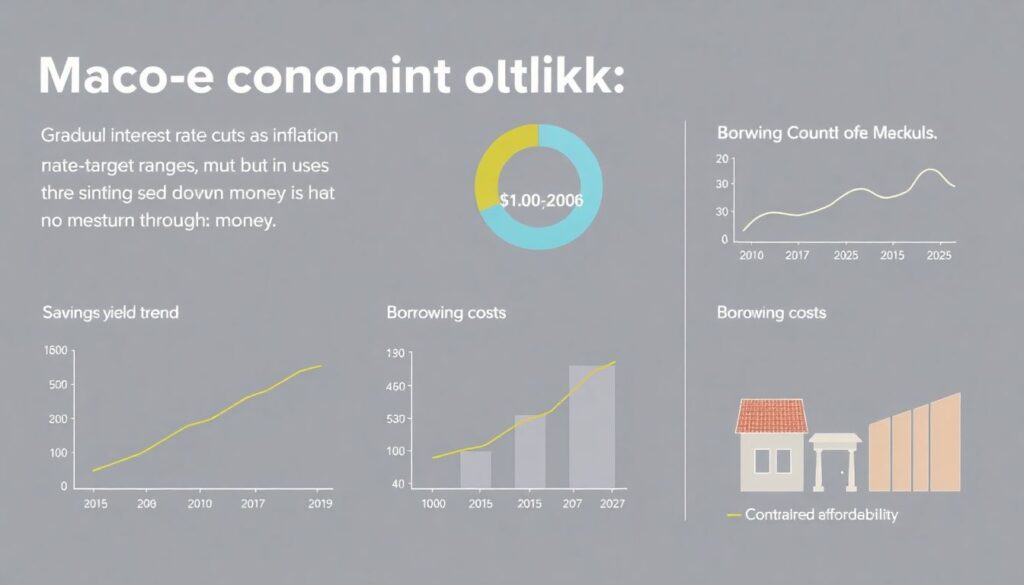

Forecasts: what the next 12–24 months likely bring

Most baseline outlooks call for gradual rate cuts as inflation moves closer to target ranges, but not a return to ultra-cheap money. Translation: savings yields may step down modestly through 2026, while borrowing stays pricier than in the 2010s. Housing affordability will remain constrained by limited supply, nudging many households to delay purchases or favor renovation and house-hacking strategies. Delinquency rates could stay elevated in certain consumer credit buckets if wage growth cools faster than expenses. Yet the rise of smarter cash-flow software and employer financial wellness benefits should keep adoption of small-win tactics rising. Expect consolidation in fintech—fewer apps, tighter bank partnerships, and more embedded finance inside payroll, commerce, and tax platforms.

From analysis to action: a 30–60–90 day roadmap

Momentum loves clarity. You don’t need a spreadsheet with 20 tabs; you need a starting line and a handful of rules you’ll actually follow. Here’s a pragmatic flow that reflects 2025 realities.

– Days 1–30: Open a no-fee HYSA and automate a small transfer each payday; connect accounts to one of the best budgeting apps to categorize the last 90 days; set alerts for bills and low balances; knock out one credit report error if you spot it.

– Days 31–60: Negotiate one recurring bill (internet, phone), cancel two discretionary subscriptions, and channel those savings to the smallest high-rate balance; explore balance-transfer offers or debt consolidation loans if the total cost drops and you won’t reset the clock with new spending.

– Days 61–90: Increase retirement contributions by 1–2% if you have an employer match; set a sinking fund for predictable annual costs (insurance, holidays); consider a check-in with a financial coach near me (virtual counts) to pressure-test your plan.

These steps aren’t flashy, but they lower the temperature fast. Within three months, you should see cash buffers grow, interest costs shrink, and credit markers stabilize—an early flywheel of confidence.

Credit confidence: fast, fair, and sustainable fixes

Improving credit used to feel opaque. Now, transparency helps. Start by paying every bill on time—payment history is king. Keep utilization below 30% overall and on each card; if you can’t pay down balances quickly, ask for a credit limit increase on accounts with good standing to reduce utilization. Dispute genuine errors; bureaus must investigate. Consider adding rent or utility reporting if your file is thin. These tactics improve credit score fast without resorting to risky shortcuts. If you consolidate debt, keep older credit lines open when possible to preserve average age, and don’t close your longest account unless fees make it unavoidable.

Industry impact: where small wins reshape the market

Consumer behavior at scale changes the industry. As millions automate savings and scrutinize subscriptions, banks compete on UX, not just on rates. Expect more granular goal-based accounts and nudges baked into everyday banking. With customers favoring clarity, lenders promoting debt consolidation loans are being pushed to disclose total interest costs and payoff dates clearly—opaque teaser rates won’t cut it. Insurance, payroll, and HR tech now embed financial wellness modules because employers see reduced turnover when workers feel stable. And with best budgeting apps integrating tax-loss harvesting tips, micro-investing, and bill negotiation, we’re watching the edges between “budgeting,” “banking,” and “advice” blur into one platform.

Economic spillovers and fintech consolidation

Higher-for-longer rates have a dual effect: they reward savers and strain overleveraged borrowers. Fintech firms that relied on free money are trimming burn, merging, or partnering with banks to access cheaper funding and robust compliance. This consolidation should improve reliability and data security for users, but it also means fewer, larger platforms setting norms—like standardized cash-flow categories and verified savings goals. Meanwhile, deposit competition keeps high-yield savings account rates comparatively attractive even as policy rates ease, because institutions value stable, digitally engaged customers. The net effect is an ecosystem that nudges you toward healthier habits by default, which magnifies the payoff of small wins.

Choosing tools and allies without the hype

The right setup is simple, affordable, and boring in the best way. Look for apps that make your money easier to manage, not more exciting. A few guardrails help you sift the noise:

– Clear fee structures and easy exits: no gotchas if you move your money.

– Strong automation: paycheck rules, round-ups, goal buckets, and bill alerts.

– Privacy you can verify: plain-English data policies and multi-factor security.

– Accountability options: the ability to share a plan with a partner or a financial coach near me for occasional tune-ups.

When comparing high-yield accounts, prioritize APY, transfer speed, and FDIC/NCUA coverage. With consolidation loans, weigh the all-in cost, not just the monthly payment; watch for origination fees and prepayment penalties. If an offer doesn’t survive a simple break-even check, walk away.

The confidence loop: measure, adjust, repeat

Confidence isn’t a destination; it’s a loop. You act, your numbers respond, you adjust. In 2025, that loop is shorter and clearer thanks to live dashboards, smart alerts, and better coaching. Your job is to keep the friction low: automate what you can, schedule a 20-minute money check-in weekly, and celebrate the wins you can measure—another $100 in the emergency fund, a 2% utilization drop, a renegotiated bill. Over a year, those micro-upgrades transform your baseline. The economy will zig and zag, but your system won’t. And that’s the heart of financial confidence: not predicting the future, but designing a process that keeps working when the future shows up.