Most people don’t lack motivation; they lack a clear, numbers-based roadmap. When you ask yourself how to achieve financial goals faster, start by turning vague dreams (“be richer”) into deadlines with price tags. A $20,000 house deposit in 3 years is about $555 a month. That single calculation rewires decisions: dinners out, impulse buys, even job moves. According to the OECD, households that track goals and spending build net worth roughly 15–20% more effectively over a decade than those that don’t. Goals that feel “too big” suddenly become a series of monthly, doable choices.

Stats that Change How You Treat Your Money

Global data from Fidelity and Vanguard show a similar pattern: households that automate saving and invest at least 15% of income hit major milestones (home, education, retirement cushion) 7–10 years earlier. Yet surveys say over 60% of people have no written plan at all. That gap explains why two colleagues on the same salary end up in totally different places in ten years. One simply turns goals into line items; the other improvises. The numbers are clear: consistency beats “once‑a‑year” financial heroics every time.

Case Study: Anna’s 5-Year Leap in 3 Years

Anna, 29, earned a modest marketing salary and thought a home purchase was “for later”. Together we broke down her target: $30,000 deposit in five years. Using a couple of budgeting tools and apps to achieve financial goals, redirecting just $14 a day from low‑value spending, she bumped savings to 22% of income. Then she moved idle cash from a 0.01% account into a low‑fee index fund. Market returns plus discipline shaved two years off her timeline; she bought in year three. The lesson: the calendar is flexible when your habits aren’t.

Budgeting: Boring Word, Powerful Weapon

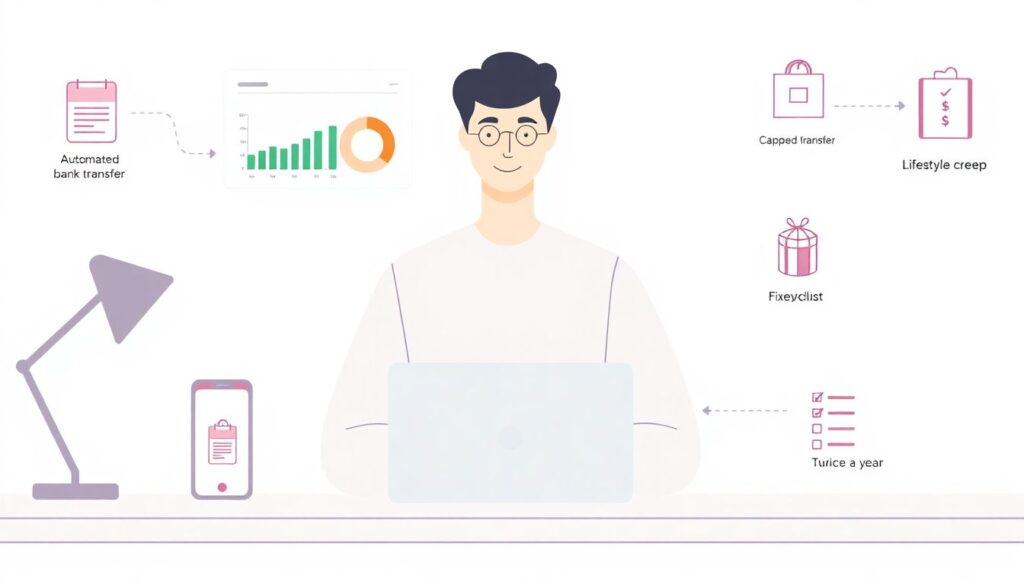

Before chasing “magic” investments, lock in cash flow control. The best money saving tips to reach financial goals are usually unsexy: automate transfers the day you get paid, cap lifestyle creep, and review fixed costs twice a year. Clients who follow a simple 50/30/20 rule often discover they can redirect 5–10% of income without feeling poorer. That extra chunk is what funds opportunity: retraining, moving cities, or seeding a side business. Budgeting isn’t about denial; it’s about deliberately deciding which expenses are allowed to slow you down and which are not.

• Track spending for 30 days, then cut only the “didn’t remember” items

• Move recurring bills (phone, insurance) to cheaper plans once a year

• Set a “fun budget” so enjoyment is planned, not guilt‑driven

Smart Tools, Not Just Self-Control

Willpower gets tired; systems don’t. Automation consistently shows up in research as a predictor of success. People who auto‑save are several times more likely to stay the course during market drops. Use apps that round up purchases, separate “future you” money, and monitor investment fees. Many tools now use AI to flag wasteful subscriptions and renegotiate bills. Over a decade, trimming just 1% in hidden fees can mean tens of thousands extra in your portfolio. Technology doesn’t replace discipline, but it handles the grind so you can focus on bigger financial decisions.

Case Study: Miguel’s Debt Turnaround

Miguel, 35, had $18,000 in credit card debt and felt frozen. Together we built personal finance strategies for faster wealth building that started with stopping the bleed. He consolidated cards into a lower‑rate loan, then automated payments above the minimum. We sold unused electronics, redirected a small freelance income, and cut just two recurring “comfort” expenses. Result: debt gone in 24 months instead of the projected 7 years, with $300 a month freed for investing. His net worth didn’t just crawl upward; it flipped from negative to positive in less than three years.

Where Professional Advice Actually Speeds You Up

Not everyone needs a private banker, but many underestimate how targeted financial planning services to reach goals faster can be. A good planner won’t just sell products; they’ll map cash flow, taxes, and risk so your efforts stop leaking. For mid‑career professionals, a single tax‑efficient decision—like using retirement accounts strategically—can accelerate results by years. Industry studies show advised households often invest earlier, stay invested through volatility, and rebalance on time. That behaviour, not “secret funds”, is what tends to create the performance gap between casual savers and methodical wealth builders.

• Use professionals for complex milestones: business sale, inheritance, relocation

• Ask planners to explain fees in plain language and show net benefit

• Review your plan annually; life changes faster than most portfolios

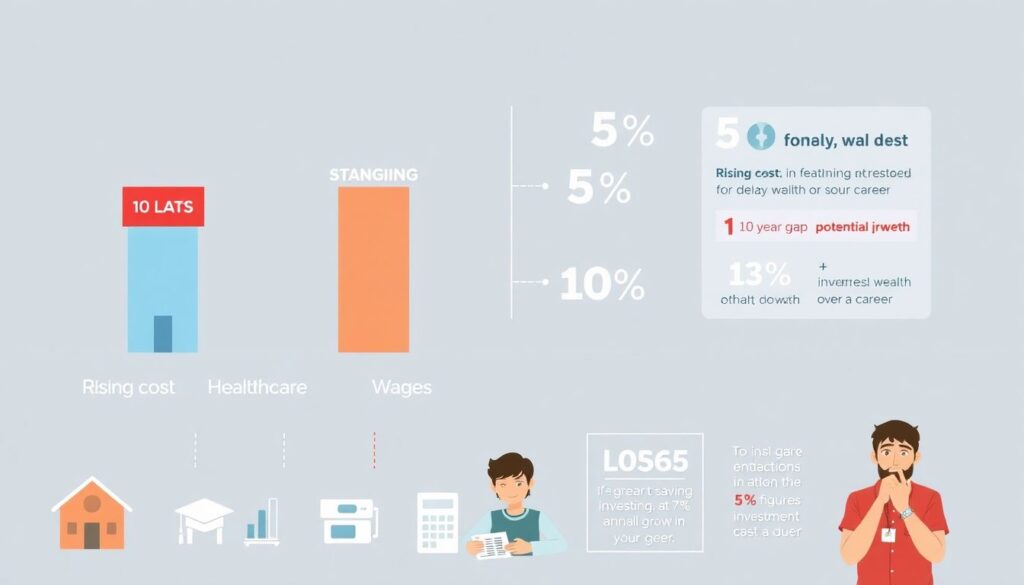

Economic Context: Why Speed Matters More Now

Housing, education, and healthcare have grown faster than wages in many countries. That means waiting ten extra years to start saving isn’t neutral; it’s a penalty. Opportunity costs get brutal: skipping five years of investing at 7% annual growth can erase six figures over a career. Learning how to achieve financial goals faster isn’t about greed; it’s a defence against structural headwinds. At the same time, access to low‑cost index funds and fractional investing has never been better, shifting power from high‑fee intermediaries to informed, organised individuals.

Industry Impact: Tech, Data and Behaviour Design

The explosion of budgeting tools and apps to achieve financial goals is reshaping finance. Banks and fintechs mine anonymised data to see which nudges actually change habits: savings challenges, visual goal trackers, or small “wins” when you hit streaks. This behavioural layer is becoming as important as interest rates. Providers that help you act—not just store money—gain loyalty and market share. Expect more “autopilot” products that raise your savings rate when income grows, cut investment risk as you approach goals, and integrate with employers to automate raises straight into wealth‑building buckets.

Final Case: Nina’s “Middle-Class Millionaire” Path

Nina, a 31‑year‑old nurse, never aimed to be rich—just “comfortable”. We translated that into numbers and built a simple roadmap using best money saving tips to reach financial goals and low‑cost investing. She pushed savings to 18%, invested primarily in global index funds, and ignored market noise. Using conservative projections, her plan moves her toward a seven‑figure portfolio in her late 50s—without extreme frugality. Her story shows that you don’t need genius or huge income; you need a clear plan, steady execution, and time working in your favour.