Why a Budget Can Actually Bring You Closer

Most people hear “budget” and imagine spreadsheets, arguments and guilt. Let’s flip that. A family budget is simply a shared plan for how money moves in and out of your lives over time. “Shared” is the key word. When done right, it works less like a control sheet and more like a relationship contract. You’re basically saying: here’s what we value, here’s what we’re willing to trade off, and here’s how we’ll protect each other from stress. Money becomes a tool to coordinate, not a reason to fight.

Clear Definitions Before You Start

Before diving into how to create a family budget, agree on basic terms. “Income” is all regular money coming in each month (salary, benefits, child support). “Fixed expenses” are stable bills like rent or mortgage. “Variable expenses” change with behavior: groceries, fuel, fun. “Sinking funds” are mini‑savings buckets for future big costs like holidays or car repairs. A “family budget planner” is any system—app, notebook or spreadsheet—that tracks these flows in one place so everyone can see and discuss them.

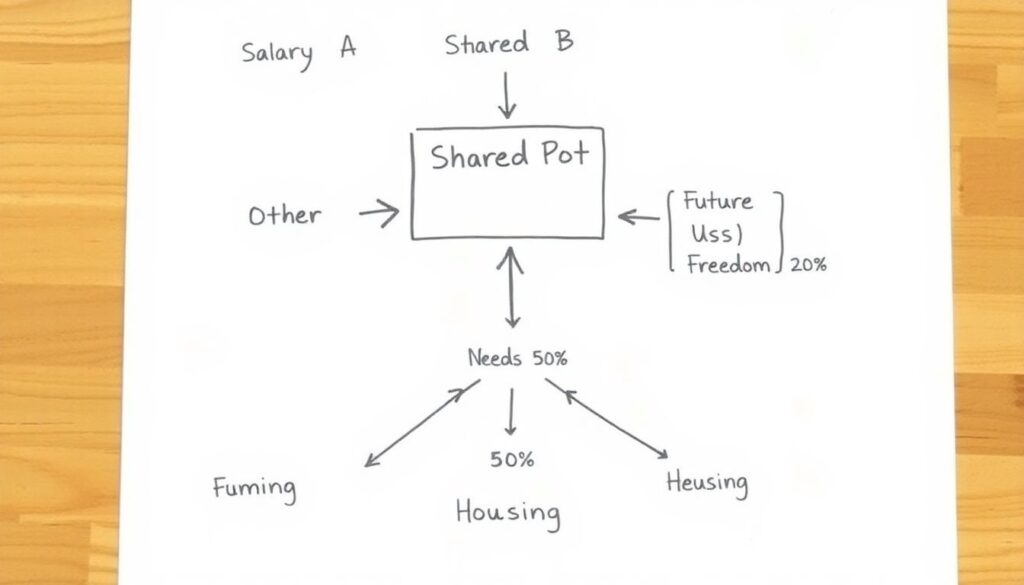

Turning Numbers Into a Simple Diagram

To keep things visual, sketch a text diagram together on paper. For example: “Diagram: at the top, three arrows labeled Salary A, Salary B, Other flow into a box named ‘Shared Pot’. From this box, three arrows go out: Needs (50%), Future Us (30%), Fun & Freedom (20%). Under Needs, branch to Housing, Food, Transport, Essentials. Under Future Us, branch to Emergency Fund, Sinking Funds, Investing. Under Fun & Freedom, branch to Pocket Money, Dates, Kids’ Activities.” This picture makes trade‑offs easier to discuss than staring at cells and formulas.

Designing a Budget Like a Relationship Contract

Instead of copying a random monthly budget template for families, design categories around your real life. Start with three guiding questions: What must we protect at all costs? What makes our days feel rich even when money is tight? What do we want life to look like in five years? Use answers to set your main buckets. For instance, if weekly family outings are sacred, that becomes a core line, not an “extra”. The budget then reflects your family identity, instead of some generic internet standard.

Non‑Standard Rule: Everyone Gets Personal Money

One unconventional but powerful rule: every adult gets non‑negotiable “no‑questions” money in the plan. Even if it’s small, it prevents micro‑arguments over coffee, hobbies or treats. Build a line called “Autonomy Money” for each partner and, if age‑appropriate, for kids. From a technical standpoint, this is just a variable expense category. Emotionally, it’s a pressure valve. Example: you might cut restaurant spending by 30%, but keep personal budgets intact, so nobody feels policed or secretly resentful when making small purchases.

Choosing the Right Tools and Apps Together

A family budget planner only works if everyone tolerates the tool. Compare analog and digital options. Paper notebooks are flexible but hard to sync. Spreadsheets offer control but can be intimidating. The best family budgeting apps, on the other hand, sync across phones, categorize transactions automatically and let you tag expenses by person or goal. Talk through trade‑offs: ease of use versus data privacy, automation versus manual awareness. Try two tools in parallel for a month, then deliberately keep the one people actually open without nagging.

Practical Steps to Build the First Version

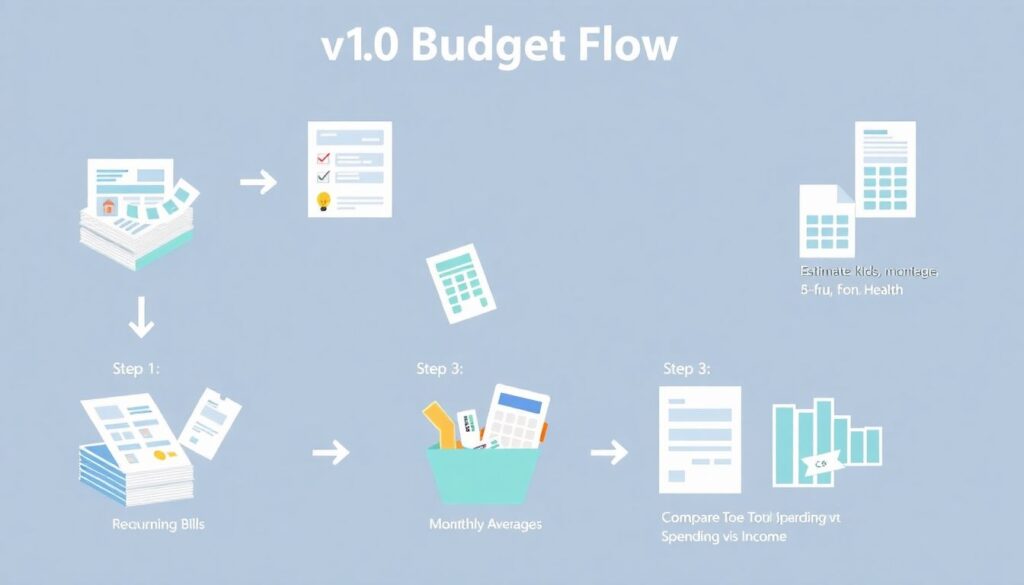

Use a clear, step‑by‑step flow when you create v1.0 of the budget:

• Pull the last 2–3 months of statements and list every recurring bill.

• Group the rest into realistic categories: groceries, kids, transport, fun, health.

• Estimate monthly averages, then compare totals to your income.

Now design a lightweight monthly budget template for families: top section for income, middle for needs, bottom for wants and savings. Keep it rough; you’re aiming for a living prototype, not perfection. Plan a “debug session” after month one to adjust limits based on reality.

Advanced, Slightly Weird Budgeting Ideas

If standard budgeting tips for families to save money bore you, test some experimental tricks. Try “category fasting”: for one month, freeze a single nonessential category, like clothes or takeout, and channel savings to a joint fun goal. Or use “reverse envelopes”: instead of stuffing cash into envelopes, create digital “spending caps” on cards and move any unused leftovers automatically into savings each week. Another twist: schedule a monthly “money date” where you pair budget review with a treat, like dessert or a walk, so it feels less like a chore.

Comparing Manual Tracking and Apps

Manual tracking—writing each expense by hand—builds strong awareness but costs time. App‑based tracking is fast but can turn invisible; you forget to look. Compare them like this in your heads: manual is like cooking from scratch, app is like using a slow cooker. Both make dinner; the experience differs. Many of the best family budgeting apps now offer shared dashboards where each person tags their spending. A hybrid method works well: use the app for data capture, then summarize key numbers manually during your monthly discussion so they actually sink in.

Making Savings and Goals Feel Tangible

Abstract goals like “save more” don’t motivate. Convert them into visible progress. Create a text‑based progress bar in your planner: “Diagram: [Emergency Fund: |██████____| 60% of target]” and update monthly. Use separate online “vaults” or labeled savings accounts for each sinking fund so you can see amounts grow. For kids, turn goals into stories: “We’re building a ‘Freedom Fund’ so Mom can work four days a week.” That way, every time you use budgeting tips for families to save money, it’s clear what you’re buying with that discipline.

Keeping the Budget Alive and Conflict‑Friendly

A dead budget is one nobody revisits. Set a recurring, short check‑in—20 to 30 minutes, same day each month. Agenda: quick look at balances, note what felt tight, decide a single experiment for next month. If tensions rise, switch from blame to debugging language: not “You overspent on food” but “Our groceries category clearly doesn’t match reality; do we raise it or change how we shop?” Treat your system like software: versioned, imperfect and always improving. Over time, that mindset makes the budget a shared project instead of a scoreboard.