Understanding the Basics: What Are These Methods Anyway?

Before you dive into the whole debt snowball vs debt avalanche debate, it helps to strip both methods down to the basics. The snowball method tells you to line up your debts from smallest balance to largest and attack the smallest one first, regardless of interest rate. The avalanche method, on the other hand, focuses on the highest interest rate first. Both approaches keep you paying minimums on all debts, but they differ in what gets “extra” money. Same inputs, different order — and that order changes both math and motivation.

—

Step 1: List Out Your Debts

Start by putting everything on paper (or in a spreadsheet) so this isn’t just a vague stress cloud in your head. Write each debt with four key details: total balance, minimum payment, interest rate, and due date. Include credit cards, personal loans, buy-now-pay-later plans, medical bills, and any other commitments that require monthly payments. This simple snapshot becomes your roadmap for any debt repayment strategy. Without it, even the best plan turns into guesswork and emotional reactions instead of data-driven decisions.

—

Step 2: How the Debt Snowball Works

Mechanics of the Snowball

With the snowball method, you sort debts from smallest balance to largest, ignoring interest rates for now. You keep paying minimums on everything, then throw every spare dollar at the smallest debt. Once that one is gone, you roll its old payment into the next smallest, creating a “snowball” of cash that grows with each paid-off account. The big selling point here isn’t mathematical perfection, but quick emotional wins that make it easier to stay consistent during the long, boring middle of the process.

Pros and Cons of the Snowball Approach

Supporters argue that the snowball is the best method to pay off credit card debt if your main problem is motivation rather than math. Clearing a small balance fast can feel like a real turning point, especially if you’re used to feeling stuck. The downside: you can end up paying more interest over time, particularly if you’ve got a high-rate card with a big balance further down the list. You’re buying psychological momentum at the cost of some financial efficiency, which is not always a bad trade if it keeps you in the game.

—

Step 3: How the Debt Avalanche Works

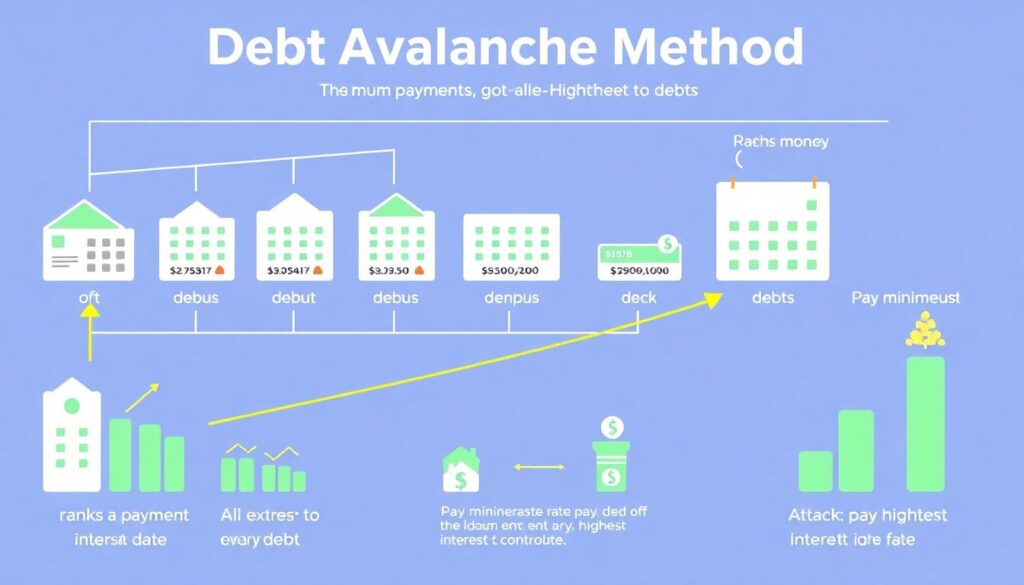

Mechanics of the Avalanche

Now let’s flip the logic. With the avalanche method, you rank your debts from highest interest rate to lowest, ignoring balance size. Again, minimums go to every account, and all extra money attacks the highest-rate debt. Once that one disappears, you move to the next highest rate, and so on. Mathematically, this is almost always the winner in a debt repayment strategies comparison, because it cuts interest costs and often shortens the total payoff time, assuming you stick with it month after month.

Pros and Cons of the Avalanche Approach

The big advantage of the avalanche is efficiency: you waste less money on interest and usually get out of debt faster. The catch is psychological. If your highest-rate debt is also your largest, you may be staring at it for months without seeing it disappear. That can feel discouraging, especially at the beginning. Some people stall out because there’s no quick “win” to hook their brain. So while avalanche looks perfect on a spreadsheet, it demands more patience and discipline in real life.

—

Step 4: Direct Comparison — Snowball vs Avalanche

When you run a clear debt repayment strategies comparison, three factors stand out: cost, speed, and emotional fit. Avalanche usually wins on cost and speed, particularly when interest rate differences are large. Snowball wins on emotional traction, especially if you have several small, annoying balances. Think of avalanche as the “engineer’s choice” and snowball as the “psychologist’s choice.” Both will eventually clear your debts if you fund them consistently, but they manage your behavior differently — and behavior is often the real battlefield.

—

Step 5: How to Choose Between Debt Snowball and Debt Avalanche

Key Questions to Ask Yourself

To figure out how to choose between debt snowball and debt avalanche, it helps to be brutally honest rather than idealistic. If you’ve started budgets before and abandoned them after a couple of months, you may benefit more from the fast wins of the snowball. If you’re naturally numbers-driven and don’t mind delayed gratification, avalanche probably suits you better. Also look at your debt profile: if one card has a huge, painful rate, ignoring it for long might not be smart, even if the balance isn’t the smallest.

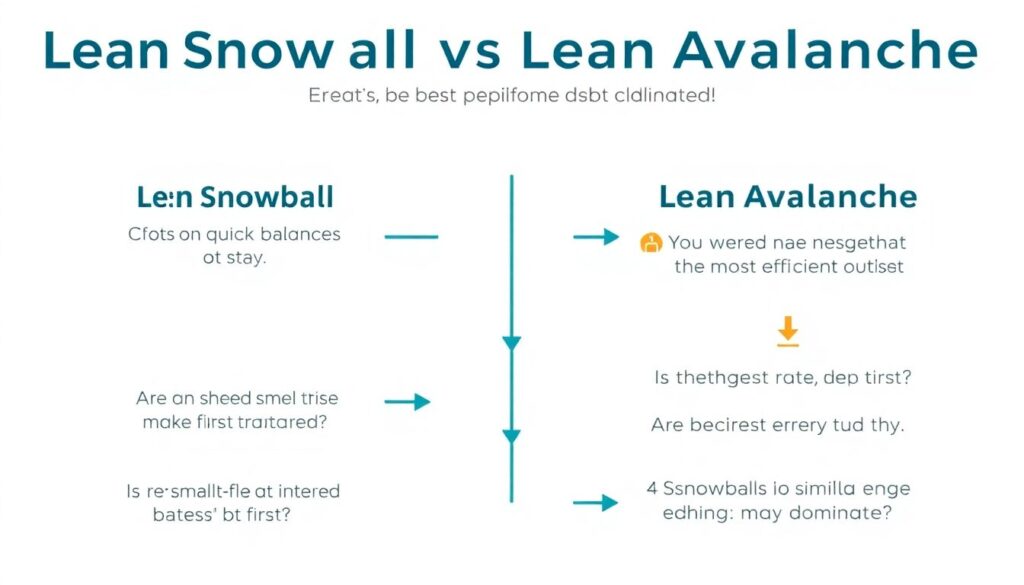

A Simple Decision Checklist

– Do you need quick wins to stay motivated? → Lean snowball

– Are you comfortable chasing the most efficient outcome? → Lean avalanche

– Is your highest-rate debt also tiny? → Both methods are nearly identical

– Are interest rates similar across debts? → Snowball’s motivation edge may dominate

– Do you feel paralyzed and overwhelmed? → Start snowball, then revisit later

This isn’t dogma; it’s about selecting a tool that you’ll actually keep using for the next year or two.

—

Step 6: Hybrid and Flexible Approaches

You’re not required to swear loyalty to one method forever. Many people start with the snowball for the first few months, use the early wins to build confidence, then pivot toward an avalanche structure once they feel more stable. Another hybrid option: clear a couple of tiny nagging debts first, then switch to targeting the highest interest rate. This way, you get both psychological and mathematical advantages. The point is not purity of method; the point is progress that you can sustain under real-life pressures.

—

Step 7: Common Mistakes to Avoid

Frequent Errors with Any Method

A lot of people sabotage themselves with avoidable mistakes that have nothing to do with the method chosen. Watch out for these:

– Continuing to add new debt while trying to pay off old balances

– Skipping an emergency fund entirely, then using cards when life happens

– Changing strategies every month and never giving one approach a fair test

Another big mistake is not tracking your balances and payments. If you don’t see progress, your brain assumes nothing is working, even when the numbers are slowly improving. Visual proof matters more than you think.

Snowball- and Avalanche-Specific Pitfalls

Snowball users often underestimate the real cost of ignoring high-interest cards for too long and may celebrate early wins while interest quietly piles up. Avalanche users, in contrast, sometimes underestimate how demoralizing a slow start can be; they choose the “smart” plan and then abandon it halfway. A subtle danger for both groups: overestimating how much extra you can pay each month. Being too optimistic leads to broken promises to yourself, which is more damaging than a conservative but realistic plan.

—

Step 8: Tips for Beginners Starting from Scratch

When you’re just starting out, keep things simple and focus on building sustainable habits, not heroic one-time efforts. First, cover the basics: set up automatic payments at least for minimums to avoid late fees and credit score damage. Next, aim for a tiny starter emergency fund so that a flat tire doesn’t undo three months of progress. Then, choose your preferred method and commit to testing it for at least three to six months before judging the results, unless your circumstances drastically change.

Useful beginner tips:

– Do a quick monthly review of balances, interest, and progress

– Celebrate milestones (first card paid off, total balance dropping below a threshold)

– Avoid comparing your journey to others; income and obligations differ massively

Consistency and realism beat intensity and guilt. The plan that fits your life will always outperform the perfect plan you can’t stick to.

—

Step 9: When to Ask for Professional Help

Sometimes the numbers are too tight, the stress is too high, or the situation is tangled with legal and family issues. That’s where a financial coach help with debt payoff can be worth the cost, especially if you need someone to keep you accountable and help you see blind spots. In more extreme cases — like threats of collections, wage garnishments, or impossible minimums — nonprofit credit counseling or a bankruptcy attorney may be more appropriate. Asking for help is not failure; it’s a strategy to avoid worse outcomes later.

—

Step 10: Putting It All Together and Moving Forward

Debt payoff is less about finding a perfect formula and more about picking a direction and walking in it consistently. You’ve now seen how debt snowball vs debt avalanche differ in structure, psychology, and cost. The “right” choice is the one you’ll keep funding monthly while avoiding new, unnecessary debt. If you’re unsure, start small: pick one method, automate payments, and track your progress. After a few months, you’ll have real data and experience — and that’s the most reliable guide you can get.