Step 1: Get Real About Your Starting Point

Before digging into numbers, you need a clear snapshot of where your money actually goes. Open your banking apps, scroll through the last two–three months, and list all inflows and outflows: salaries, side gigs, rent, groceries, subscriptions, debt payments, kids’ activities, impulse buys. Treat this like debugging, not self‑criticism: you’re just gathering data. Many people jump straight to cutting costs and then wonder why their plan collapses. A true family budget planner starts with facts, not wishes, so you can see patterns: weekday food delivery, forgotten subscriptions, seasonal spikes. Only after this audit will your budget reflect your real life instead of an idealized version.

Step 2: Define Shared Family Priorities

A budget that “sticks” is less about spreadsheets and more about alignment. Sit down with everyone who affects spending decisions—partner, older kids if relevant—and discuss what matters in the next 6–12 months: debt reduction, an emergency fund, a vacation, extracurriculars, home repairs. Turn vague wishes into ranked priorities with rough price tags. This is where many novices fail: they build numbers before building agreement, so one person feels restricted while another keeps spending freely. By agreeing on what the money is *for*, you transform the budget from a constraint into a tool that protects what your family actually values.

Step 3: Map Income and Non‑Negotiable Expenses

Now convert that understanding into a structured view. List all reliable monthly income sources, then all fixed or nearly fixed obligations: rent or mortgage, utilities, insurance, minimum debt payments, school fees, transport passes. These are your non‑negotiables. From an analytical standpoint, you’re defining the lower layer of your cash‑flow “stack.” A common beginner mistake is mixing these with flexible costs, which hides how much room you truly have left. Once you subtract non‑negotiables from income, the remainder is what you can deliberately allocate to food, savings, fun, and goals—rather than letting them compete chaotically.

Step 4: Build a Simple Category System (Not 30 Envelopes)

You don’t need a hyper‑detailed scheme with dozens of envelopes to learn how to create a family budget. In fact, too many categories raise the cognitive load and make you quit. Start with 5–8 broad buckets: housing, food, transport, kids, health, debt & savings, fun & extras. Assign rough target amounts based on your earlier audit, then compare with what’s actually available after fixed costs. If the math doesn’t work, trim categories in small, testable steps instead of sweeping cuts. The aim is a beginner‑friendly framework that is easy to track week to week, not a flawless but unusable system.

Step 5: Use Tech, But Don’t Outsource Thinking

In 2026, there’s no shortage of tools that promise to be the best budgeting app for families—many connect to your bank, auto‑categorize, and even suggest savings. Helpful, yes, but dangerous if you let the app become a black box. Choose a tool that fits your style: simple spreadsheets, a shared cloud document, or an app your partner will actually open. Automations should reduce friction, not hide the logic of your choices. Technology can’t decide trade‑offs between soccer lessons and faster debt payoff; it can only make those trade‑offs more visible and easier to revisit together.

Step 6: Create a Basic Monthly Template You’ll Actually Use

A practical monthly budget template for families doesn’t need fancy formulas. It needs three clear lines per category: planned, actual, and difference. At the start of the month, fill in the “planned” column using your chosen categories. Once a week, update the “actual” column from your bank data, and glance at the differences. That quick review loop is where learning happens. Over two or three months you’ll see which categories are consistently under‑ or overestimated, and you can adjust instead of feeling like you’ve “failed.” Treat the template as a living model, not a rigid contract.

Step 7: Run Weekly Micro‑Meetings, Not Long Lectures

Long, emotional “money talks” usually happen when problems are already acute. Replace those with 15‑minute weekly check‑ins. Look at three things: where you are versus plan, any upcoming irregular costs, and one small tweak for next week. Keep the mood practical and data‑driven: the numbers are information, not a verdict on anyone’s character. Over time, this routine normalizes financial transparency and reduces blame. Couples and families that maintain short, regular check‑ins almost always adapt faster to surprises—job changes, medical bills, school trips—because decisions are already a habit, not an emergency response.

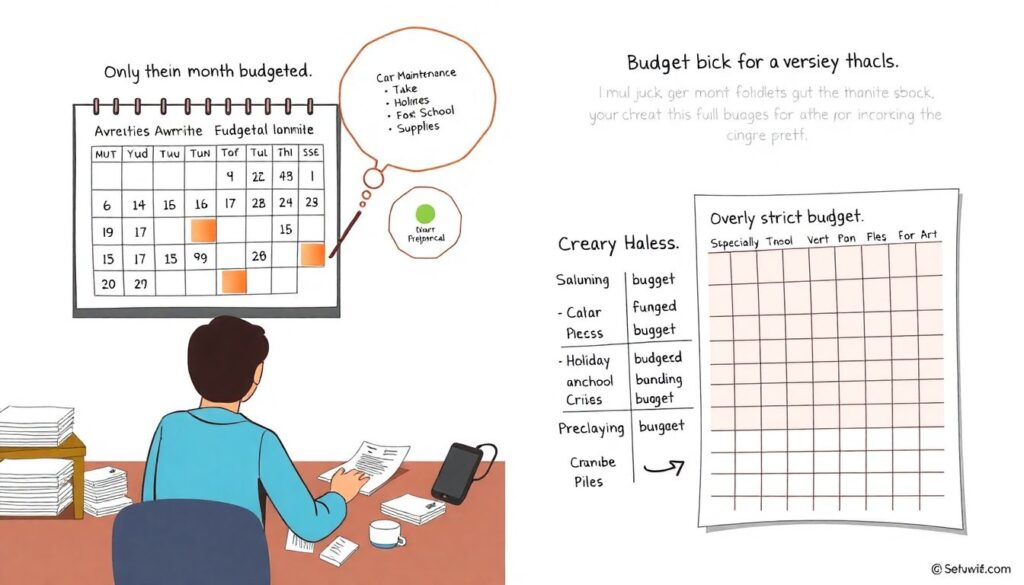

Step 8: Classic Beginner Mistakes to Avoid

Several predictable traps derail novices. First, budgeting only for “average” months and ignoring annual or irregular expenses like car maintenance, holidays, or school supplies; these then look like crises instead of foreseeable costs. Second, making the plan too restrictive, especially for food and fun, which leads to rebound spending and guilt. Third, confusing tracking with changing: logging every purchase without altering behavior. Finally, skipping a basic emergency fund, so every unexpected bill goes on a credit card. The antidote is modest goals, realistic categories, and a gradual tightening—treat your first three months as experiments, not a final exam.

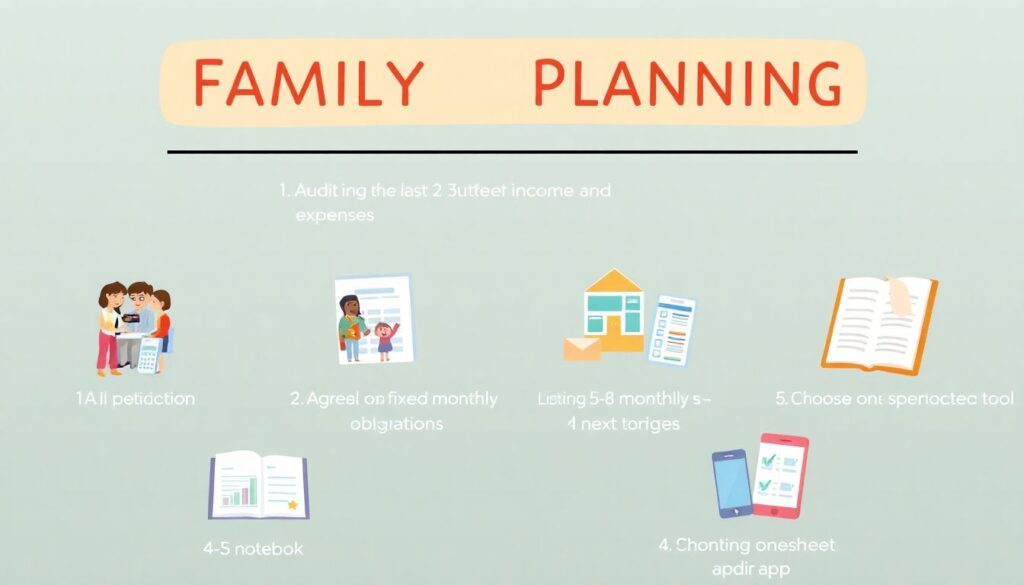

Step 9: Action Plan for Absolute Beginners

1. Audit the last 2–3 months of income and expenses.

2. Agree on top three family priorities for the next year.

3. List fixed monthly obligations and subtract from income.

4. Create 5–8 spending categories and set starting targets.

5. Pick one tool—a notebook, spreadsheet, or app—and commit to it for 90 days.

6. Hold a weekly 15‑minute budget check‑in.

7. Build a starter emergency fund, even if it’s only a small amount monthly.

These steps are deliberately minimalistic so you can focus on consistency over complexity. Once this backbone works, you can refine and add detail.

Step 10: Choosing Tools Without Getting Overwhelmed

When you look for a family budget planner, filter options by one criterion: “Will everyone who needs to use it, actually use it?” An elegant tool that only one partner opens is worse than a simple shared note that both update. For some households, the best choice is a basic spreadsheet synced across devices; for others, a dedicated app with shared access, alerts, and goal‑tracking. Many marketing claims around budgeting tools focus on features, but for real families, adoption and habit‑formation matter more. Start small, test for 1–2 months, and switch only if the friction stays high.

Step 11: Budgeting Tips for Beginners Under Stress

If money already feels tight, complex strategies like optimization of investment accounts are premature. Focus on three levers: awareness, predictable routines, and small gaps. Awareness means daily or every‑other‑day check‑ins with your balance instead of “I’ll look at it next week.” Routines include setting bills to auto‑pay right after payday and scheduling transfers to savings before you see the leftover. Small gaps are where you negotiate: cheaper alternatives for recurring costs, slightly smaller “fun” budgets instead of total bans. Tiny, repeated optimizations accumulate; dramatic sacrifices rarely last once stress or fatigue hits.

Step 12: How AI and Automation Will Shape Family Budgeting (2026–2031)

Looking ahead from 2026, budgeting is moving from manual planning toward predictive, AI‑assisted cash‑flow management. Apps already analyze transaction histories to forecast upcoming bills and suggest reallocations; over the next five years, expect more tools that auto‑build personalized spending plans and negotiate some bills on your behalf. The future “best budgeting app for families” will likely integrate shared calendars, kids’ activities, and even local price data to warn you before your plan is at risk. Still, human judgment will stay central: algorithms can flag that your lifestyle doesn’t match your income, but only your family can decide what to change and why.

Step 13: Keeping Your Budget Flexible as Life Changes

No family stays static, and neither should its budget. New jobs, babies, medical situations, or moves all shift the picture. Treat your plan as a versioned document: every major change triggers a mini‑rebuild where you re‑audit income, obligations, and priorities. The key discipline is updating your categories and targets instead of trying to force old assumptions onto new realities. Over time, this adaptive mindset turns the budget into a decision‑making framework rather than a one‑time exercise. In practice, that’s what makes a beginner‑friendly system “actually work”: not perfection, but the habit of revising when life does.