Smart Strategies for Paying off Medical Debt in 2025

Historical context: how we got here

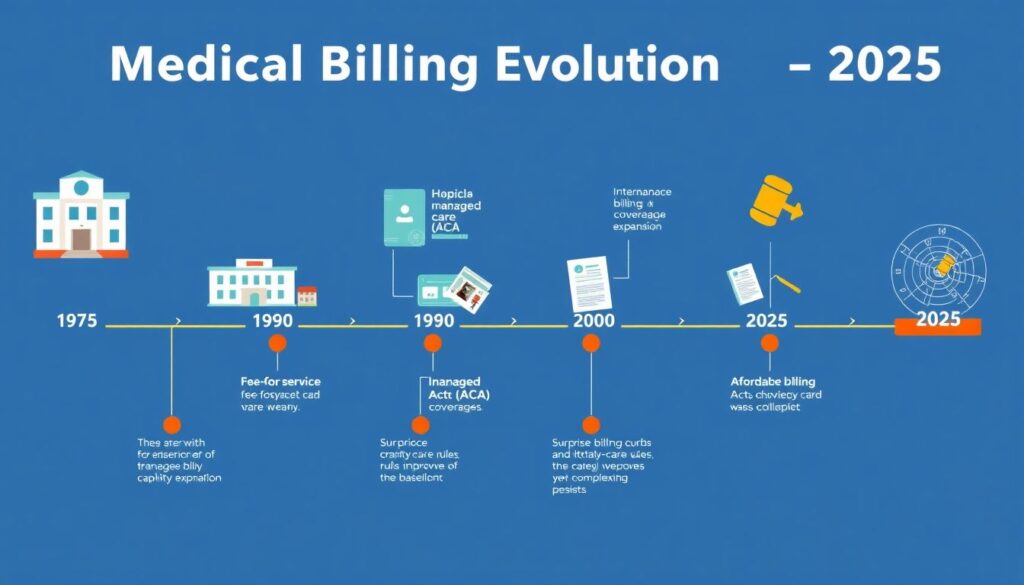

From the 1970s fee-for-service boom to the managed care wave of the 1990s and the ACA’s coverage expansion in the 2010s, the mechanics of medical billing evolved faster than consumer protections. By 2025, surprise billing curbs and charity-care rules improved the baseline, yet complexity persists: CPT/HCPCS coding granularity, out-of-network leakages, and opaque chargemasters still generate friction. Understanding this arc matters: it explains why medical debt relief programs now emphasize income-based screening, eligibility analytics, and standardized appeals. A smart payoff plan treats debt like a technical system: inventory, verification, error isolation, negotiation, and only then financing—never the reverse.

Inspiring examples: resilience meets process

A teacher in Ohio audited her EOBs against itemized statements, flagged duplicate lab panels by CPT code, and used a hospital’s charity portal to trigger automatic recalculation; her balance fell 68% before she even discussed terms. A gig worker in Arizona bundled four ER bills and, after confirming ICD-10 coding accuracy, used one of the best medical bill negotiation services to secure a unified payment plan with zero interest, preserving cash flow for rent. A retired machinist leveraged a county grant plus a nonprofit advocate to convert “bad debt” to financial assistance, then set up payroll-deducted micro-payments; interest avoided became his emergency fund seed.

Development recommendations: build capability, not just plans

Treat payoff as a capability stack. First, data hygiene: request itemized bills, compare to EOBs, and maintain a ledger with aging buckets, APRs, and delinquency risk scores. Second, negotiation literacy: learn anchoring, reference-based pricing, and how to cite policy—IRS 501(r) for nonprofit hospitals and state charity mandates. Third, financing discipline: prioritize 0% in-house plans before considering medical bill financing options; if unavailable, compare true APR and deferred-interest clauses. Fourth, risk controls: understand how collections report, your dispute rights under FCRA, and timing tactics that prevent score shocks. Fifth, escalation: know when to use medical debt settlement companies versus nonprofit advocates; model credit-impact scenarios before committing.

Cases of successful projects: what works at scale

A Midwestern health system deployed an AI triage to pre-screen charity eligibility at intake; by aligning screening with medical debt relief programs, it cut bad-debt write-offs and halved patient defaults, proving that early segmentation reduces downstream harm. A union benefits fund built a centralized negotiation hub that benchmarked claims to Medicare rates; members saw median liability drops of 35% after structured counteroffers, then used medical bill financing options only for residuals under 12 months. A community coalition partnered with data-driven medical debt settlement companies for stale, unverifiable accounts; settlements were executed only after validation and error correction, minimizing ethical hazards and optimizing credit trajectories.

Financing and consolidation: use with precision

Consolidation can simplify, but math first. Medical debt consolidation loans make sense when you replace multiple balances with a lower fixed APR and clear amortization, not when you convert zero-interest hospital plans into higher-cost credit. If a lender offers a teaser, simulate total cost of ownership including fees and utilization effects on your credit score. For settlement, define thresholds: pursue only when liabilities are accurately validated and you can fund lump sums without compromising housing or insurance. Remember: negotiation and relief come before financing; otherwise, you memorialize errors into hard debt and pay interest on mistakes.

Resources for learning and action

Leverage reputable nonprofits and regulators that publish stepwise playbooks. The CFPB provides samples for disputes and clarity on collection practices; NFCC-accredited counselors can model payoff scenarios; Patient Advocate Foundation and Dollar For help navigate hospital policies and connect to medical debt relief programs. For complex disputes, consider the best medical bill negotiation services that disclose fee structures and success metrics. If considering settlements, perform due diligence on medical debt settlement companies, checking complaint histories and contract terms. For financing, compare medical bill financing options via APR, deferment clauses, and prepayment penalties; insist on transparent disclosures and written hardship policies before you sign.