Category: Budgeting Basics

-

Family money talks: building trust and transparency in your finances

Why Money Talks Matter in Families Money is never just about numbers. It’s about security, power, love, fear, and sometimes shame. When families avoid money conversations, those feelings don’t disappear — they just go underground and eat away at trust. A family that talks openly about money doesn’t magically avoid problems, but it handles them…

-

How to teach kids about compound interest in simple, fun ways

If you teach kids just one money skill, make it compound interest. It’s the quiet engine that decides whether their savings crawl or take off—and children can grasp the basics much раньше, чем многие взрослые успевают догадаться. Why start early: stories that hook kids Kids don’t fall in love with formulas; они цепляются за истории….

-

How to budget for holiday shopping without debt and enjoy stress-free spending

Why Holiday Budgets Fail So Often The Emotional Trap of “Once a Year” Most people don’t blow their money at the mall because they’re bad at math; they do it because holidays press on every emotional button at once. You tell yourself it’s “only once a year”, you want to make up for being busy…

-

From side hustle to small business: turn your passion into profit successfully

Laying the Groundwork for a Real Business Defining What You Actually Sell Before asking how to turn a side hustle into a small business, get painfully clear on your offer. Skip vague ideas like “I do design” or “I coach people.” Instead, describe a concrete transformation: “I design landing pages that double email sign‑ups for…

-

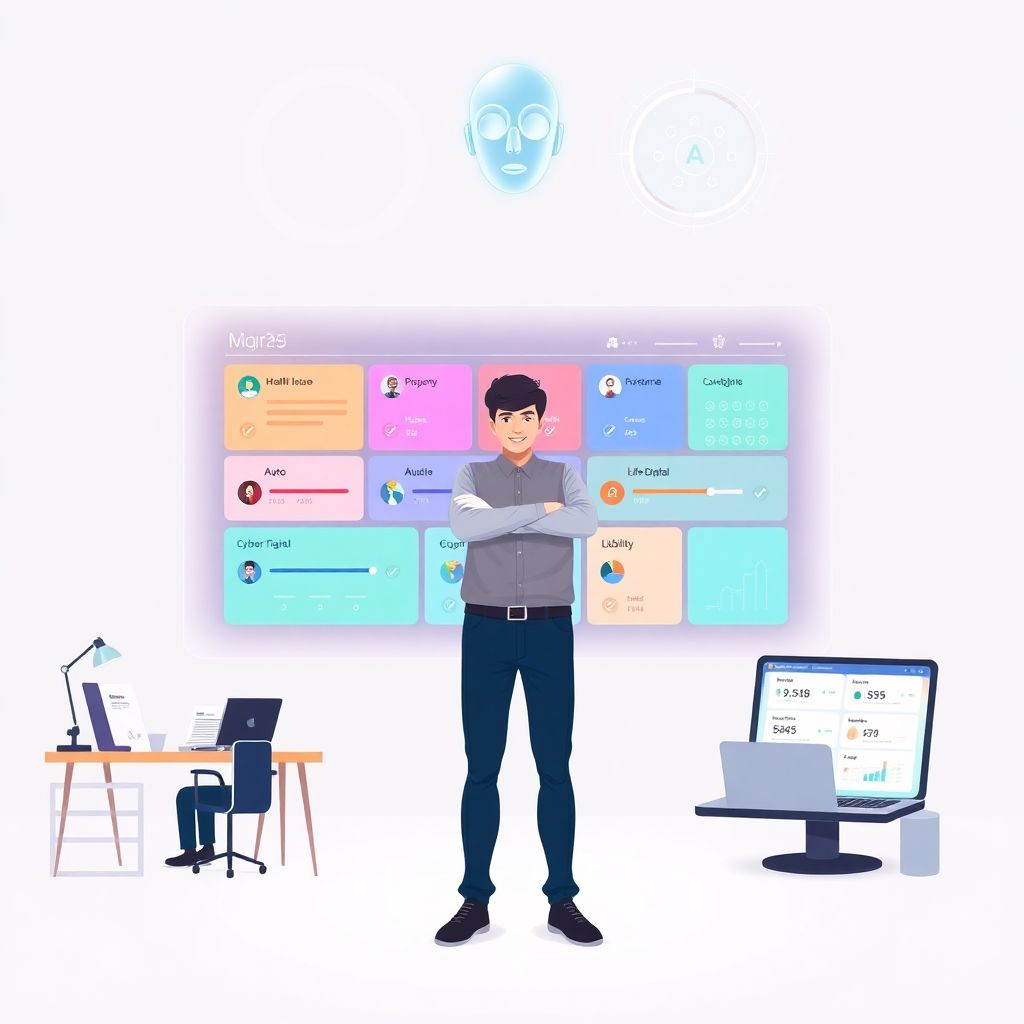

Smart insurance planning: how to find the right coverage at the right price

Why “Smart Insurance Planning” Matters More Than Ever in 2025 If you feel overwhelmed every time you look at an insurance policy, you’re not alone. Policies are packed with exclusions, riders, limits and legal jargon, while your life and finances keep changing. Smart insurance planning is basically about turning that chaos into a system: using…

-

How to prepare for financial audits and tax season to stay compliant and organized

Why financial audits and tax season still matter in 2025 Financial audits и ежегодный налоговый марафон уже давно перестали быть рутиной «для галочки». В 2025 году более 70% средних компаний в США и ЕС сообщают, что усилили внутренний контроль после скачка регуляторных проверок за последние пять лет. Инвесторы, банки и госорганы внимательно смотрят на прозрачность…

-

How to read financial statements like a pro and truly understand company performance

Why Financial Statements Matter More Than You Think If you want to read financial statements like a pro, start by treating them as a story, not a pile of numbers. The income statement shows what the company earned, the balance sheet reveals what it owns and owes, and the cash flow statement explains how money…

-

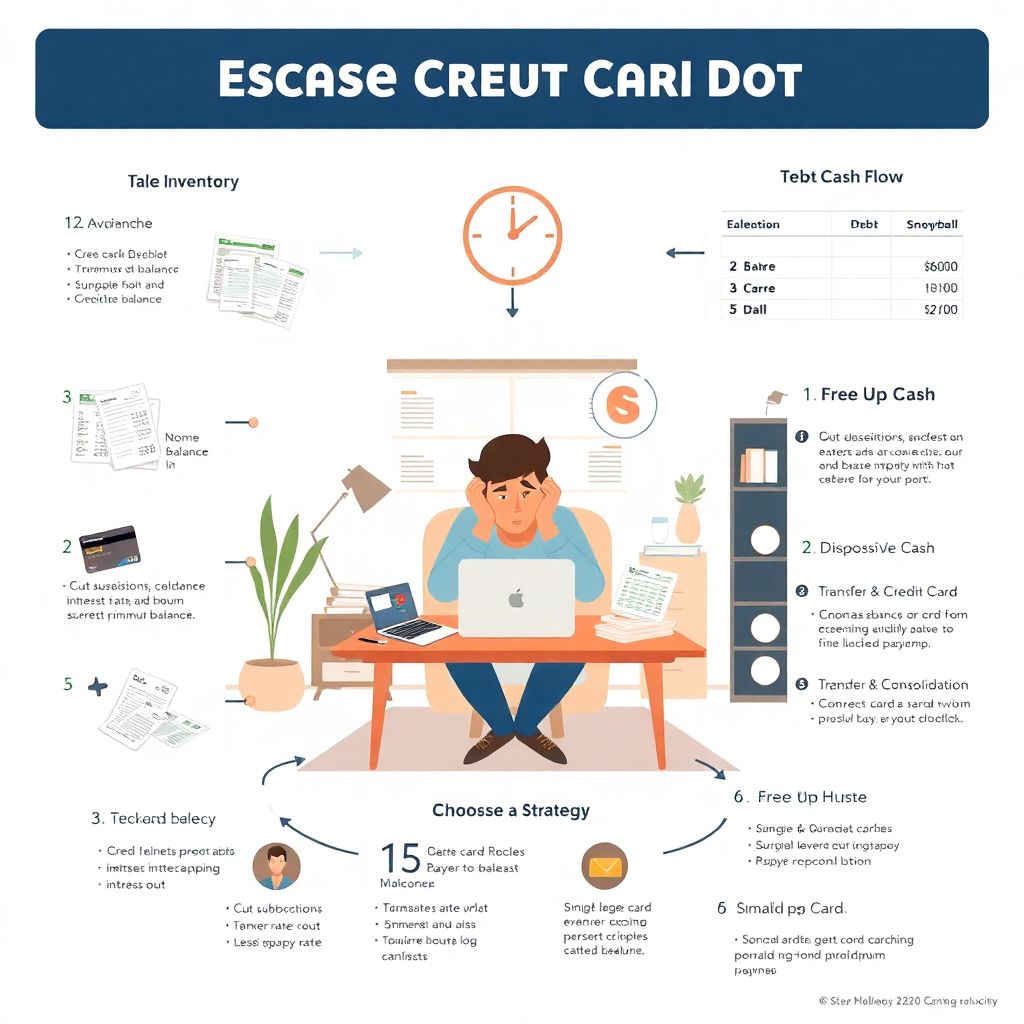

Practical guide to getting out of credit card debt fast and safely

Why Getting Out of Credit Card Debt Feels So Hard (and Why It’s Totally Possible) Credit card debt is sneaky. You start with a small balance, tell yourself you’ll pay it off next month, and suddenly you’re staring at multiple cards, minimum payments, and interest that eats half your paycheck. It feels overwhelming because the…

-

Education savings for kids: comparing 529 plans and choosing the best option

Большинство родителей интуитивно понимают, что откладывать на образование нужно «как можно раньше», но на практике упираются в хаос терминов и противоречивых советов. 529‑планы выглядят как готовое решение, однако между штатами, типами счетов и инвестиционными стратегиями различия настолько велики, что ошибка на старте может стоить десятков тысяч долларов недополученного роста. Ниже разберёмся, как реально работают эти…

-

Reducing utility bills: smart strategies to cut costs and save energy at home

The Hidden Leaks in Your Bill If your utility bill feels unpredictable, start by treating your home like a small lab. Map when spikes happen, then match them to habits: laundry on cold evenings, electric oven during peak price windows, space heaters in leaky rooms. A quick win is booking a home energy audit near…