Category: Budgeting Basics

-

Understanding financial statements: a practical guide for clear analysis

Why financial statements matter when you actually need decisions If you’ve ever stared at a P&L and wondered, “So… should we hire or wait?”, this guide is for you. Financial statements aren’t museum pieces; they’re decision dashboards. The income statement shows pace, the cash flow statement shows stamina, and the balance sheet shows posture—together they…

-

Paying off medical debt: smart strategies to reduce bills and regain control

Smart Strategies for Paying off Medical Debt in 2025 Historical context: how we got here From the 1970s fee-for-service boom to the managed care wave of the 1990s and the ACA’s coverage expansion in the 2010s, the mechanics of medical billing evolved faster than consumer protections. By 2025, surprise billing curbs and charity-care rules improved…

-

Pay for higher education the money-smart way: strategies to reduce college costs

Smart foundations: mapping costs and cash flow From sticker price to net price Before hunting for funds, pin down what you’ll actually pay. The sticker price rarely matches the net price after grants, discounts, and tax benefits. Compare offers using each school’s cost of attendance, then subtract gift aid and realistic work-study. Build a year-by-year…

-

Reducing hobby spending: a practical guide to cut costs without losing the fun

Comparing Approaches: Frugal Frameworks That Actually Work Choosing a cost-cutting method starts with mapping the hobby’s cost drivers—tools, consumables, space, and time. One camp favors substitution: swap premium materials for community resources, libraries, and cheap hobbies for adults that still scratch the itch for mastery. Another camp restructures frequency and scope: shorter sessions, micro-projects, or…

-

Frugal family fun: the ultimate guide to budget-friendly activities at home and out

Why Frugal Fun Is Smarter in 2025 В 2025 году семейный досуг стал более гибким, локальным и технологичным: растут цены на развлечения, но параллельно расцветают общинные инициативы, библиотеки перезапускают программы, а города открывают дворы-лаборатории и микро-музеи. Экономить уже не значит отказываться от качества; грамотная навигация по городским ресурсам позволяет комбинировать науку, искусство и движение без…

-

How to save for a child’s milestone purchases with smart budgeting and planning

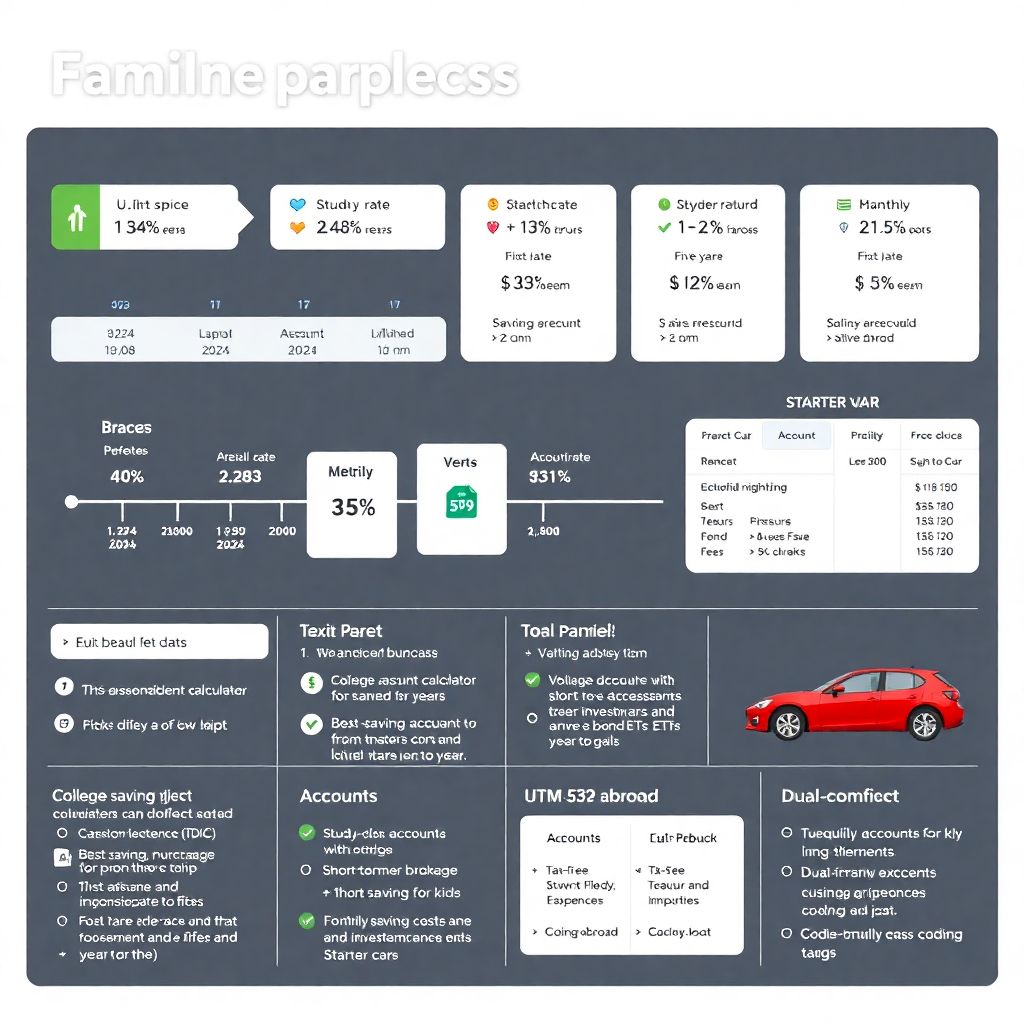

Why milestone purchases deserve a plan Big-ticket moments creep up faster than we think: braces, a first laptop, study-abroad fees, or the down payment on a starter car. In 2024, the U.S. personal saving rate hovered near 4% (BEA), while used-car prices and extracurricular costs stayed elevated, squeezing family budgets. Treat each milestone as a…

-

Smart home budgeting: technology that helps you save money on energy and bills

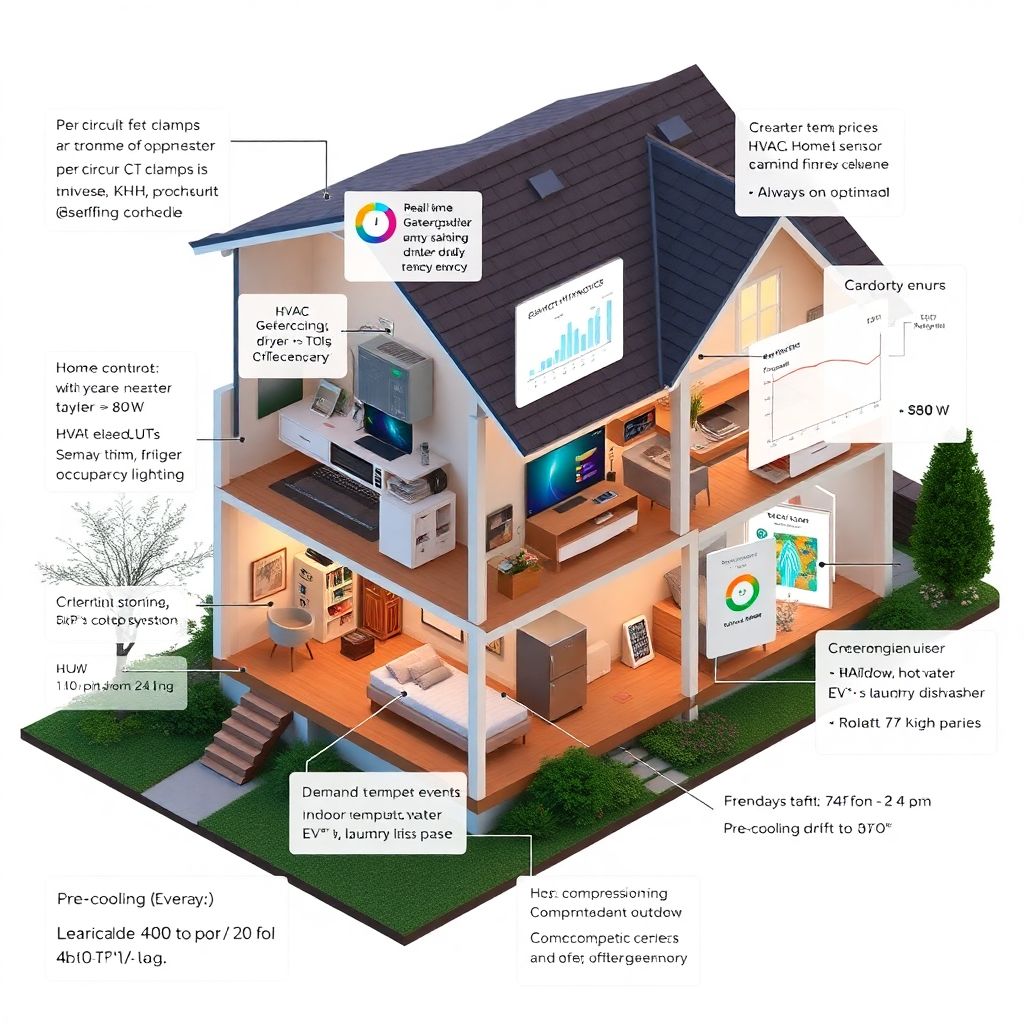

Why smart budgeting at home isn’t just “nice to have” anymore Across the U.S. and EU, residential energy costs have risen 15–30% since 2021, while HVAC alone consumes roughly 40–50% of a typical home’s electricity. That’s the bad news. The good news: modern sensors, APIs, and automation platforms let you cut that spend without living…

-

Personal finance for singles: a practical guide to managing money and building wealth

Why personal finance hits differently when you’re single Going solo means you’re both the CFO and the safety net. In the U.S., nearly 29% of households are one-person, and the Federal Reserve reports about 37% of adults would struggle to cover a $400 emergency without borrowing or selling something. With one income, shocks aren’t averaged…

-

Building a personal brand to boost your financial growth and professional success

Most people chase tactics, but sustainable personal brand financial growth comes from a repeatable system: clear positioning, consistent proof of value, and measurable audience capture. Think of your brand as an asset with its own P&L: it acquires attention (top of funnel), converts trust (mid), and monetizes via offers (bottom). When you map it like…

-

Creating a financially resilient household in 2025 through smart money management

What “financially resilient household” really means A financially resilient household isn’t just frugal; it’s designed to absorb shocks and recover quickly. Definitions first: resilience is the capacity to keep living standards stable after a hit (job loss, medical bill, rate hike). Liquidity is cash you can reach within three days without penalties. Runway equals liquid…