Category: Debt Management

-

Debt settlement and negotiation: a practical guide to reducing what you owe

From Ancient Debtors’ Prisons to Modern Negotiation Debt settlement looks very modern, but its roots go back thousands of years. Вabylonian and Greek laws предусматривали списание долгов, но часто через жесткие меры вроде долгового рабства. В Европе до XIX века применялись тюрьмы для должников, тогда как банкротство воспринималось как моральное падение. Лишь с ростом индустриального…

-

How to build a personal finance toolkit that works for your money goals

Why You Need a Personal Finance Toolkit (And Not Just “Willpower”) Most people try to sort out деньги с помощью одной‑двух привычек: “буду меньше тратить”, “начну копить с зарплаты”. Через пару месяцев энтузиазм сдувается, и всё тихо возвращается на круги своя. Рабочий подход другой: сделать себе набор простых инструментов, которые берут на себя скучную часть…

-

Personal finance for veterans: a beginner’s guide to money management

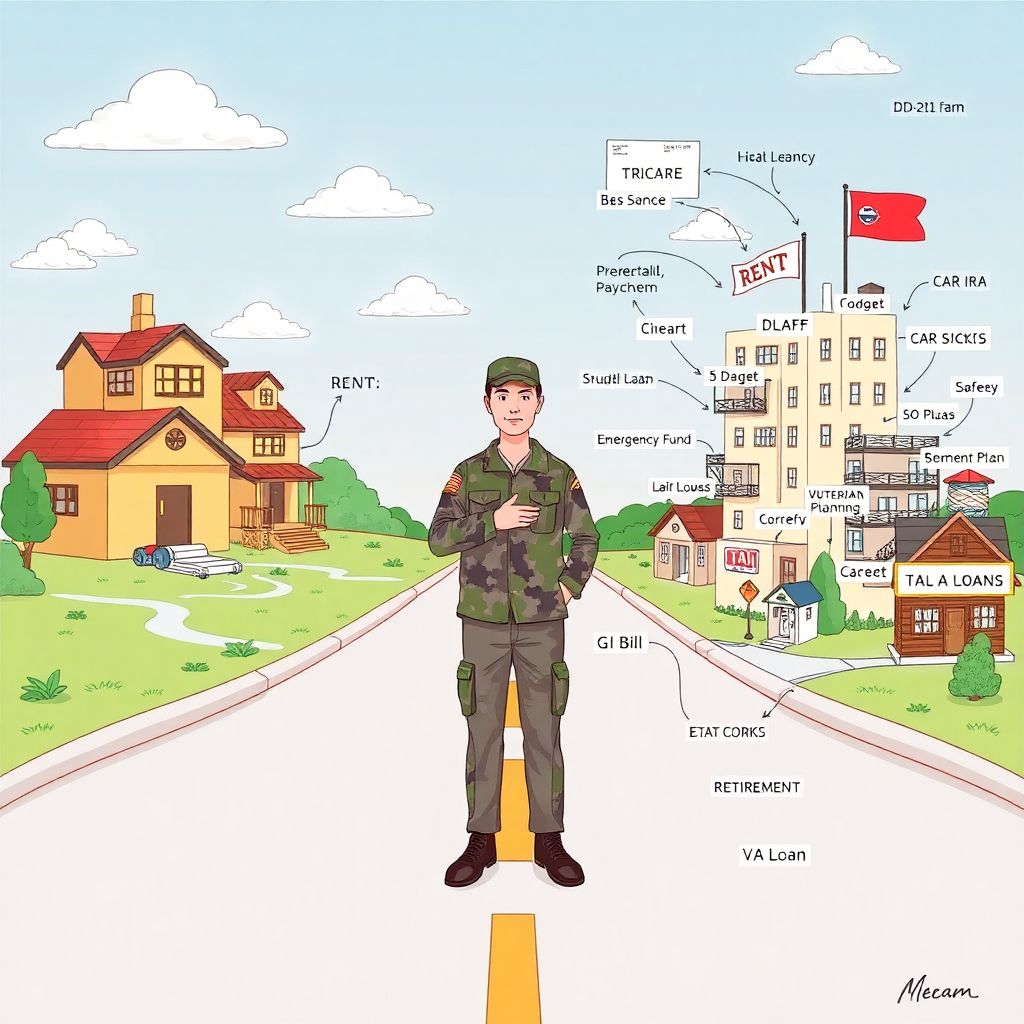

Why Personal Finance Feels Different for Veterans Leaving the military is not just смена работы; это полная смена финансовой экосистемы. Пока вы служите, многое за вас уже решено: жильё субсидируется, медицинское обслуживание понятное, пенсия и льготы прогнозируемы, налоговые вычеты специфичны. После DD-214 вы внезапно оказываетесь в мире, где за каждое финансовое решение нужно голосовать долларом…

-

How to build a budget around your values and spend money more intentionally

Why a Values-Based Budget Beats Any Money Hack Most people try to budget by cutting coffee, downloading a random app, and hoping willpower does the rest. That works for about… two weeks. Then life happens, motivation падает, и всё возвращается на круги своя. The real problem isn’t that you’re “bad with money”; it’s that your…

-

How to protect your finances during inflationary times and keep savings safe

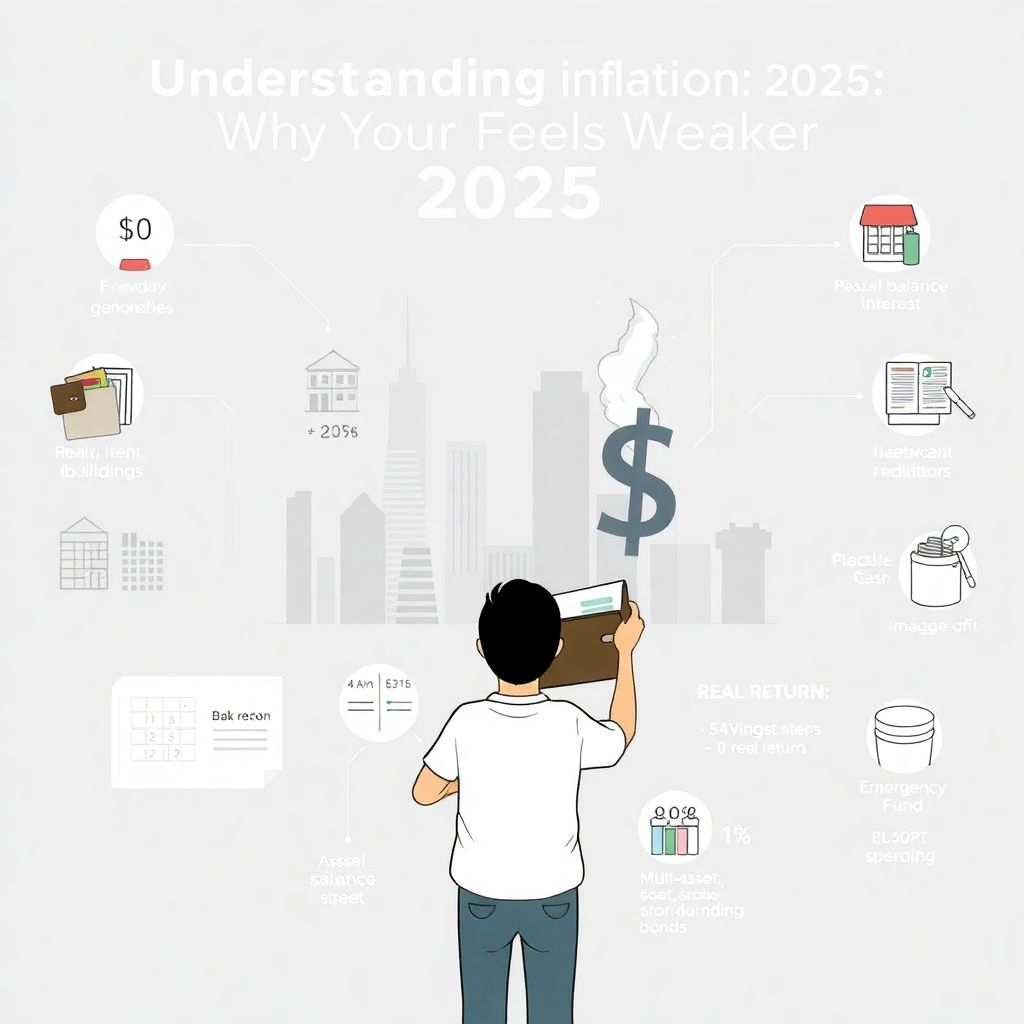

Understanding Inflation in 2025: Why Your Money Feels Weaker Inflation in 2025 isn’t a one-off spike; it’s the tail of a long shock that started with the pandemic, supply-chain failures, and then years of ultra‑loose monetary policy followed by aggressive rate hikes. If you feel like your salary and savings buy less every year, that’s…

-

Financial literacy for college graduates: from smart budget planning to wealth

Why Financial Literacy Matters Right After College You graduate, toss the cap, and suddenly everyone expects you to know how taxes, rent, credit scores, and retirement accounts work. Spoiler: almost nobody does at first. Still, this stage is critical. The money choices you make in the next 3–5 years can either set you up for…

-

The essentials of personal finance for working parents: smart money habits

Why personal finance feels different when you’re a working parent Personal finance advice usually assumes you either have no kids or unlimited free time. Working parents live in другой реальности: two schedules, daycare drop‑offs, sick days, school emails at 10 p.m., and a budget that can implode because someone suddenly needs new sneakers, a costume,…

-

Personal finance for beginners and beyond: a complete practical guide

Why Personal Finance Matters More Than Ever in 2025 Personal finance used to be simple: steady job, pension, maybe a paid-off house by retirement. That world faded decades ago. Since the 1970s, inflation waves, credit cards, online banking, the 2008 crisis, and then the pandemic reshaped money rules. By 2025 we live in an economy…

-

Financial literacy for nonprofits: money management basics for sustainable impact

Why Financial Literacy Matters for Nonprofits in 2025 Money in a nonprofit is never the main mission, но без базовых навыков управления деньгами миссия разваливается. Financial literacy for nonprofits — это умение читать цифры, планировать ресурсы и принимать решения на основе данных, а не интуиции. В 2025 году доноры, фонды и государственные грантодатели требуют прозрачности…

-

How to save for a home down payment faster and reach your first house goal

Why saving for a home feels so different in 2025 Buying a place in 2025 is not the same game your parents played. Home prices grew faster than wages for years, rent eats a big chunk of income, and TikTok is full of “house poor” horror stories. At the same time, we have tools they…