Category: Debt Management

-

Financial literacy for people returning to work: key money skills

Why Financial Literacy Matters So Much When You’re Coming Back to Work Coming back to work after a break – whether it was for childcare, illness, burnout, relocation, or a career pivot – is a double restart. You’re rebuilding your professional life and, often, your money habits at the same time. That’s why financial literacy…

-

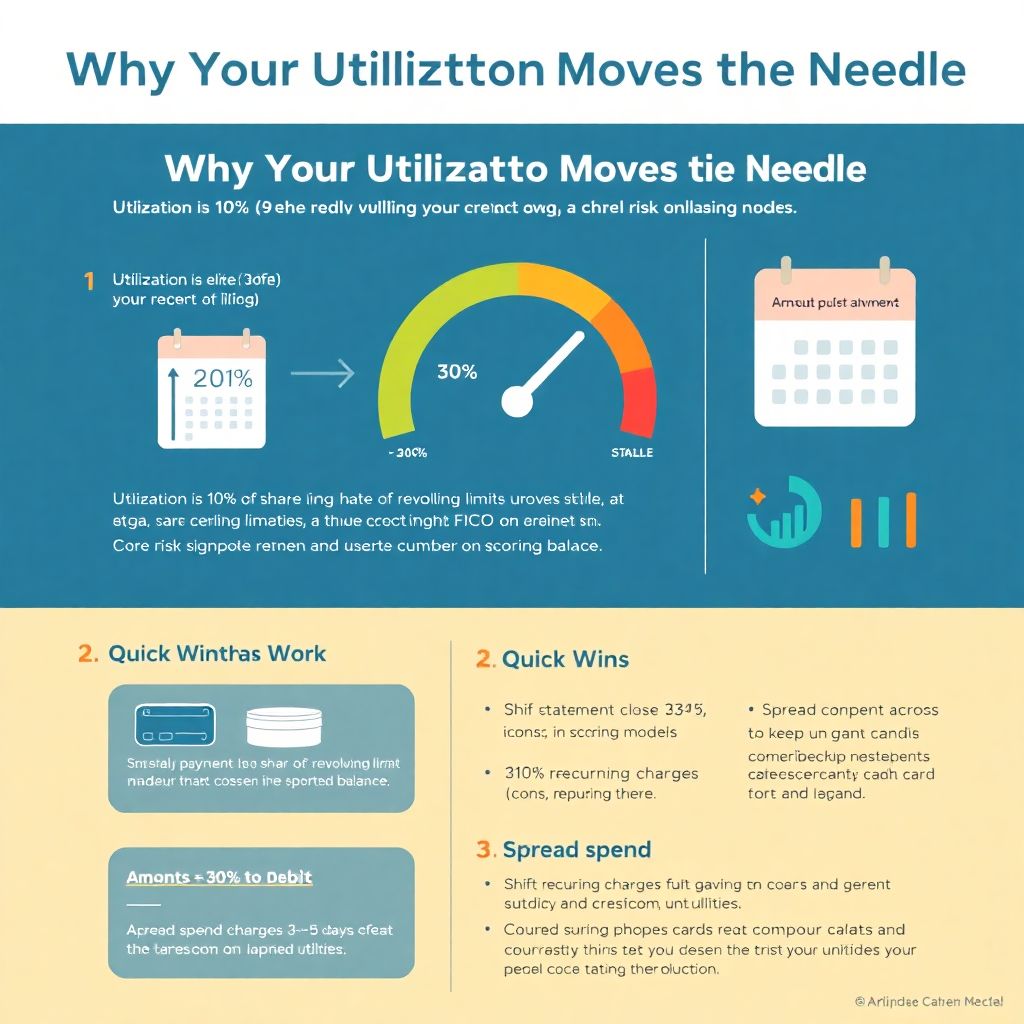

Improve your credit utilization rate with simple steps to boost your score

Why your utilization rate moves the needle Credit utilization is the share of revolving limits you’re actually using, and bureaus treat it as a core risk signal. In most scoring models, amounts owed account for roughly 30% of your FICO score; utilization is the biggest slice there. Keep it below 30% for stability and under…

-

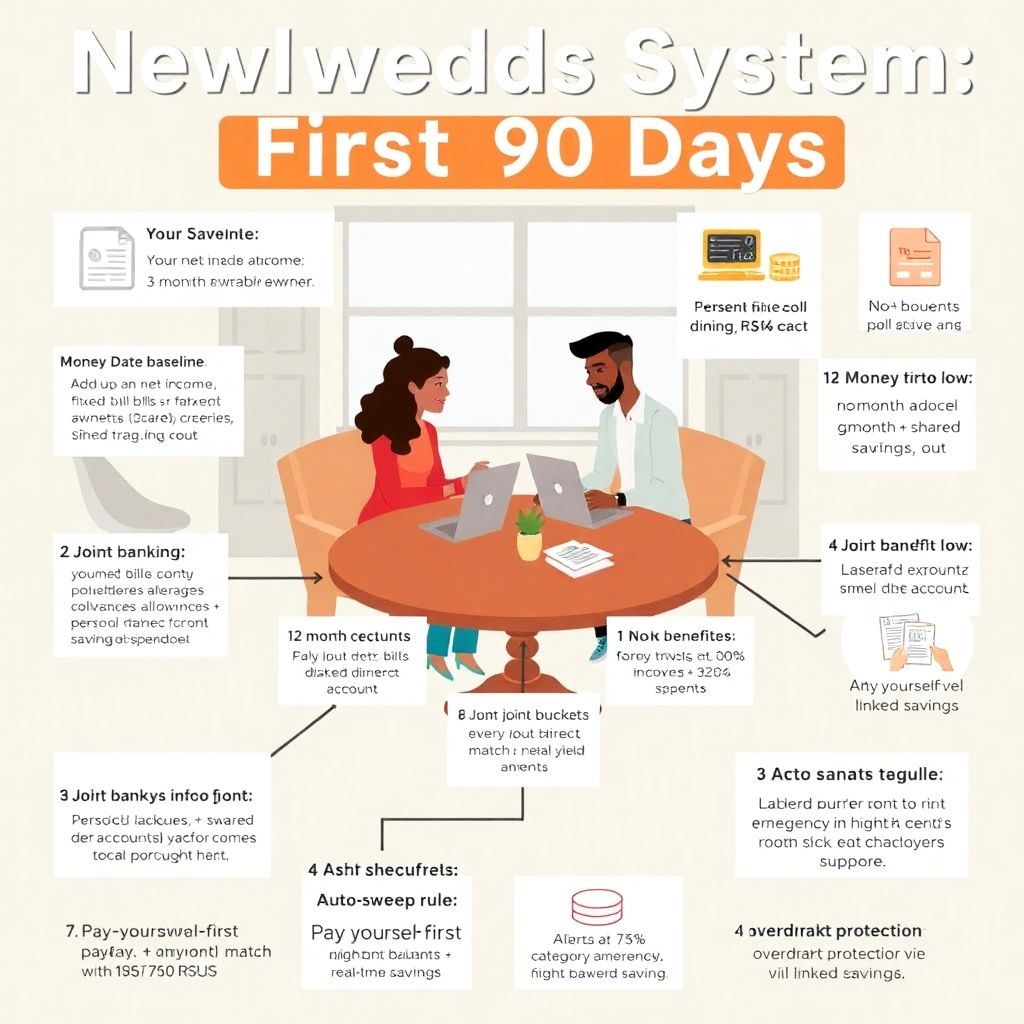

Smart financial moves for newlyweds to build a secure financial future

Set your shared money baseline Start with a 60‑minute money date Forget the stiff “budget meeting.” Brew coffee, open laptops, and pull up the last three months of statements. Your goal isn’t perfection; it’s clarity. Add up take‑home pay, list must‑pay bills, and average variable spending like groceries, fuel, and eating out. A couple I…

-

Financial confidence starts with small wins on the path to lasting security

Why “small wins” beat grand financial plans in 2025 In 2025, building financial confidence isn’t about nailing a perfect budget once; it’s about stacking small, repeatable wins that compound. The macro backdrop keeps shifting—after the rate hikes of 2022–2024, borrowing costs remain elevated compared with the 2010s, while inflation has cooled from its peak but…

-

Budgeting for groceries: a budget-friendly pantry plan to save money weekly

Why grocery budgeting often falls apart You start motivated, then life happens: a busy week, a sale that looks irresistible, and suddenly the cart is full of “just in case” items. Newcomers overestimate cooking time, underestimate portions, and forget perishables’ shelf life. The biggest slip? No plan for how to save money on groceries beyond…

-

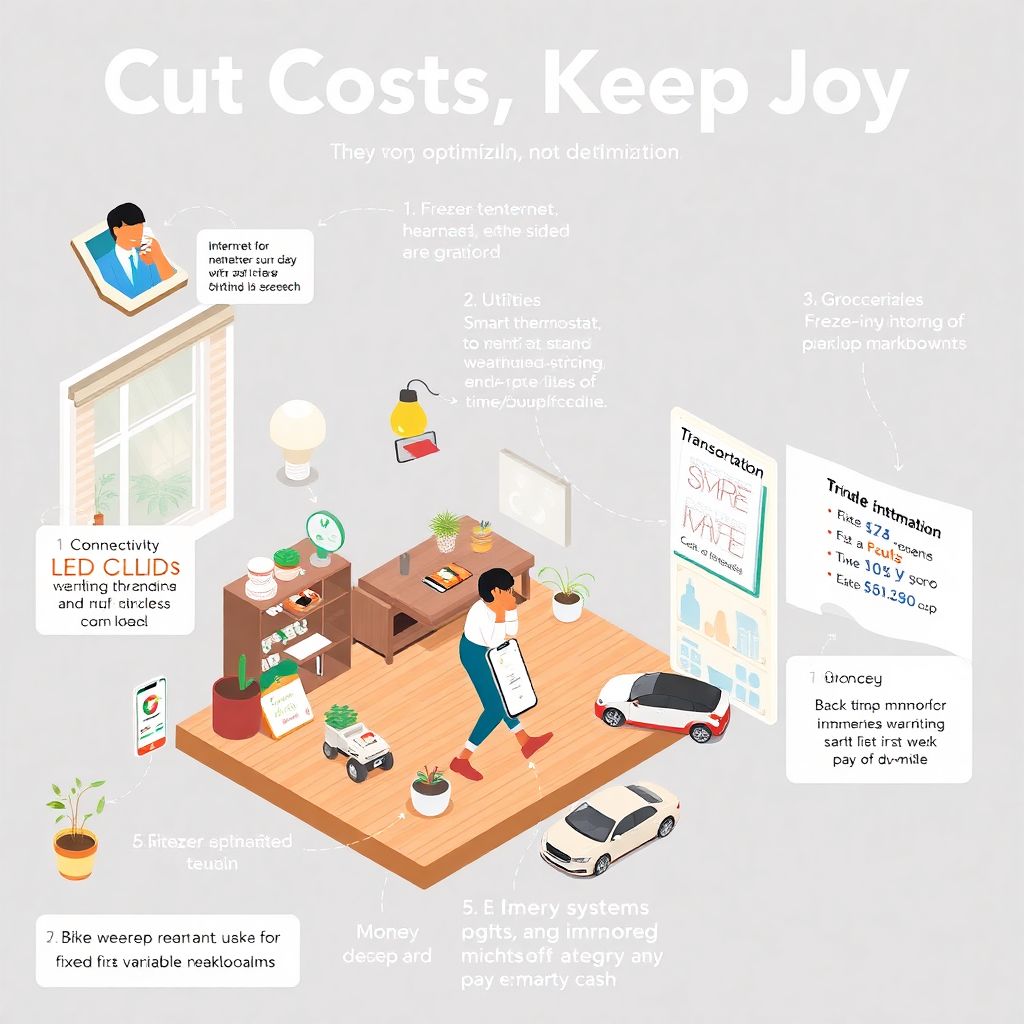

Reducing living expenses without sacrificing quality: the ultimate guide to smart savings

Why Cutting Costs Doesn’t Mean Cutting Joy Reducing living expenses isn’t about deprivation; it’s about optimization. The goal is to redirect cash from low-value habits toward high-impact living—better food, smarter tech, more time. When you approach frugality like an engineer, every dollar gets a job and your quality of life improves, not shrinks. Think of…

-

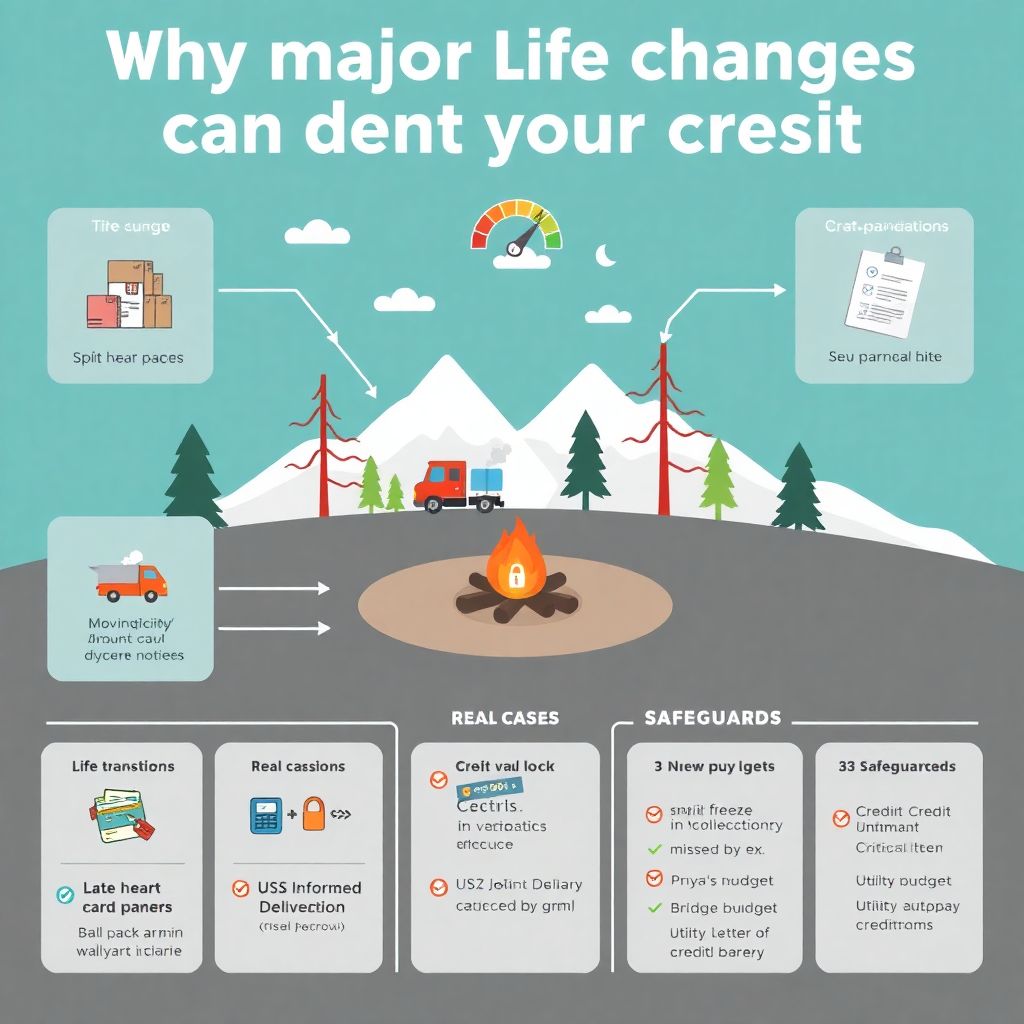

How to protect your credit during major life transitions

Why major life changes can dent your credit When life swerves—new baby, move, divorce, layoff—credit often takes collateral damage. Budgets shift, due dates slip, and new inquiries pop up right when your score is most fragile. Lenders read instability as risk, so a couple of late payments can echo for years. The fix isn’t martyring…

-

Inheritance and estates: a practical guide to managing them effectively

Why inheritance planning matters now Managing inheritance and estates isn’t just for the ultra-wealthy; it’s a practical way to keep family decisions calm, taxes minimized, and assets moving where you intend. Demographics are doing the heavy lifting here: Cerulli Associates projects roughly $84 trillion will shift across generations in the U.S. by 2045, much of…

-

Investment strategy for a global market: how to build a resilient plan

Why a truly global lens matters in 2025 A decade ago, staying mostly in domestic assets could be excused by home‑bias comfort and plentiful tech-led returns in the U.S. Today, concentration risk is palpable: by late 2024, the U.S. represented roughly 60% of MSCI ACWI by market cap, yet only about a quarter of global…

-

How to create a solid financial plan after a career break and rebuild stability

Why planning after a break is different now Context and recent numbers you can trust After a career pause, your finances rarely snap back overnight: income timing shifts, benefits restart on a delay, and habits formed during the break can linger. Over the last three years, the backdrop has changed fast. In 2023–2024, U.S. prime‑age…