Why budgeting for five feels harder than it should

When you’re feeding, clothing and entertaining three kids, “normal” budget advice often collapses. Between 2022 and 2024, U.S. consumer prices rose roughly 6.5%, 3.4% and about 3.2% year‑over‑year (Bureau of Labor Statistics), while food‑at‑home prices alone jumped more than 11% in 2022 and another 5% in 2023 (USDA). If your bank account feels permanently stressed, it’s not just you. A practical guide to budgeting for a family of five has to start from this reality: you’re managing volatility in groceries, housing and childcare at the same time. So we’ll talk less about guilt and more about systems that tolerate chaos: clear definitions, simple diagrams in words, and tools you can actually use when someone is screaming for snacks.

Key terms: making the jargon work for you

Before choosing a family budget planner for 5, it helps to decode the vocabulary. “Net income” is what hits your account after tax and benefits; that’s the only number that matters for planning. “Fixed expenses” are bills that barely change month to month (rent, insurance). “Variable expenses” swing with behavior (groceries, gas). “Sinking funds” are mini‑savings pots for irregular but predictable costs like car repairs or back‑to‑school shopping. A “zero‑based budget” simply means every dollar of income is assigned a job: spend, save, or debt payoff. Once these definitions are clear, comparing apps, spreadsheets or notebooks stops being abstract and turns into a very practical question: which tool makes these categories easiest for you and your partner to see.

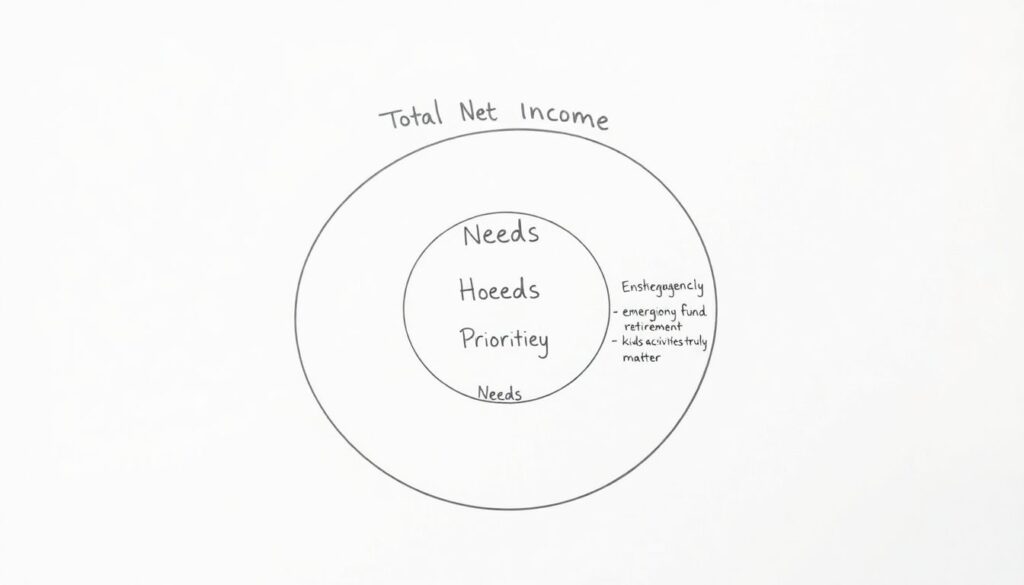

A verbal diagram of a solid family budget

Picture a three‑ring diagram drawn on paper. The outer ring is your total net income. Inside it, a second ring is “Needs”: housing, basic food, utilities, essential transport, minimum debt payments. Inside that, a third ring is “Priorities”: emergency fund, retirement, kids’ activities that truly matter. Anything that doesn’t fit into those inner rings is “Nice‑to‑have.” For a monthly budget template for family of 5, many households aim for roughly 50–60% of income on Needs (rents and mortgages ballooned about 15–20% from 2022–2024 in many U.S. metros), 20–25% on Priorities, and the rest on Nice‑to‑have. The exact ratios matter less than the habit of asking: which ring does this expense belong to?

Choosing tools: apps vs spreadsheets vs paper

There’s no single best budgeting app for families of five, but there are clear trade‑offs. Apps with bank sync shave off admin time but can overwhelm you with data; spreadsheets are insanely flexible but rely on discipline; paper is visual and tactile but harder to share. For a busy household, good tools share three traits: fast entry from a phone, easy category summaries, and support for those sinking funds. Many parents find a simple shared Google Sheet plus a lightweight tracking app beats feature‑heavy software. The right “stack” is usually one primary tracker for transactions and one static overview that acts as your long‑term financial dashboard for decisions and annual planning.

Building a monthly baseline that survives real life

Let’s turn this into numbers. Step one: list last three months of net income. Step two: pull bank and card statements and roughly average your real spending. Do not start from ideals; start from evidence. In 2023, the average U.S. household spent about 12–13% of its budget on food and 33–35% on housing; a family of five often exceeds both because of extra rooms and higher calorie needs. Use those ranges as a sanity check. Your baseline plan shouldn’t be aspirational; it should be a cleaned‑up reflection of what already happens. Once that’s in place, you can deliberately cut 5–10% from a few categories instead of fantasizing about halving the grocery bill in one month.

Simple category system for a family of five

To avoid “category explosion,” keep it lean. A practical set looks like this:

– Housing & utilities (rent, mortgage, power, internet)

– Food (groceries + eating out, optionally split later)

– Transport (fuel, transit, maintenance)

– Kids (clothes, fees, activities, school costs)

– Health & insurance

– Debt payments

– Fun & gifts

– Savings & sinking funds (emergency, car, holidays, back‑to‑school)

This setup is minimal yet detailed enough to explain where money leaks. For a family of five, the Kids and Food categories usually see the most pressure; by isolating them, you can see if the budget problem is mostly youth sports, impulsive takeout, or just inflation punching you in the face.

Groceries and cheap meal plans for a family of five

Food is where many parents quietly panic, especially after the double‑digit price spike in 2022. USDA estimates suggest a “moderate‑cost” at‑home food plan for a family with three school‑age kids now runs several hundred dollars more per month than in 2021. Cheap meal plans for a family of five hinge on three ideas: bulk staples, overlapping ingredients, and realistic cooking time. Think of a week where chicken, beans, rice, and seasonal veggies appear in multiple forms: burrito bowls, stir‑fries, soups. A rough textual diagram: columns are days of the week, rows are core proteins and starches, and you simply fill each cell with a specific recipe using the same base items so waste and cost both drop.

Practical tactics: how to save money with a family of 5

Instead of chasing dozens of hacks, focus on a few high‑yield moves:

– Cap “frictionless” spending (subscriptions, in‑app buys, random Amazon orders) with strict monthly ceilings.

– Batch decisions: one grocery shop per week with a list, one clothing purchase per season.

– Lock in recurring savings: library over new books, second‑hand sports gear, hand‑me‑downs organized by size bins.

Across clients and surveys from 2022–2024, families that combine planned grocery runs with pre‑set spending caps often carve out 5–15% of income for savings within six months. The trick is not perfection; it’s automating enough good behavior that you can afford occasional chaos.

Digital vs analog: comparing planners in practice

When you compare an app‑based family budget planner for 5 with a classic spreadsheet, think in scenarios. Imagine one parent at soccer practice entering snack and gas costs on their phone, while another checks overall cash flow before paying a medical bill. Apps excel at “in the moment” capture and give instant graphs—pie charts of this month’s categories, bar charts of spending over the last three months. Spreadsheets win for “what if” analysis: testing a new rent, job change, or daycare cost. Many families end up with a hybrid: the app is the cockpit; the spreadsheet is the hangar where you run simulations before making big commitments like moving or buying a car.

Putting it all together for the next 12 months

To close the loop, set one‑year targets instead of vague hopes. Decide on a basic emergency fund number, even if it’s just one month of expenses to start. Use your preferred tool—app, sheet, or notebook—to create a rolling monthly budget template for family of 5 where categories auto‑repeat and you tweak only what changed (like seasonal clothes or camps). Revisit it every month for 15 minutes, not to beat yourself up but to ask: what surprised us, and how do we adjust the rings in our mental diagram? Over a year, those tiny course corrections, aligned with realistic data from 2022–2024 and grounded in your actual habits, beat any dramatic but short‑lived financial “detox.”