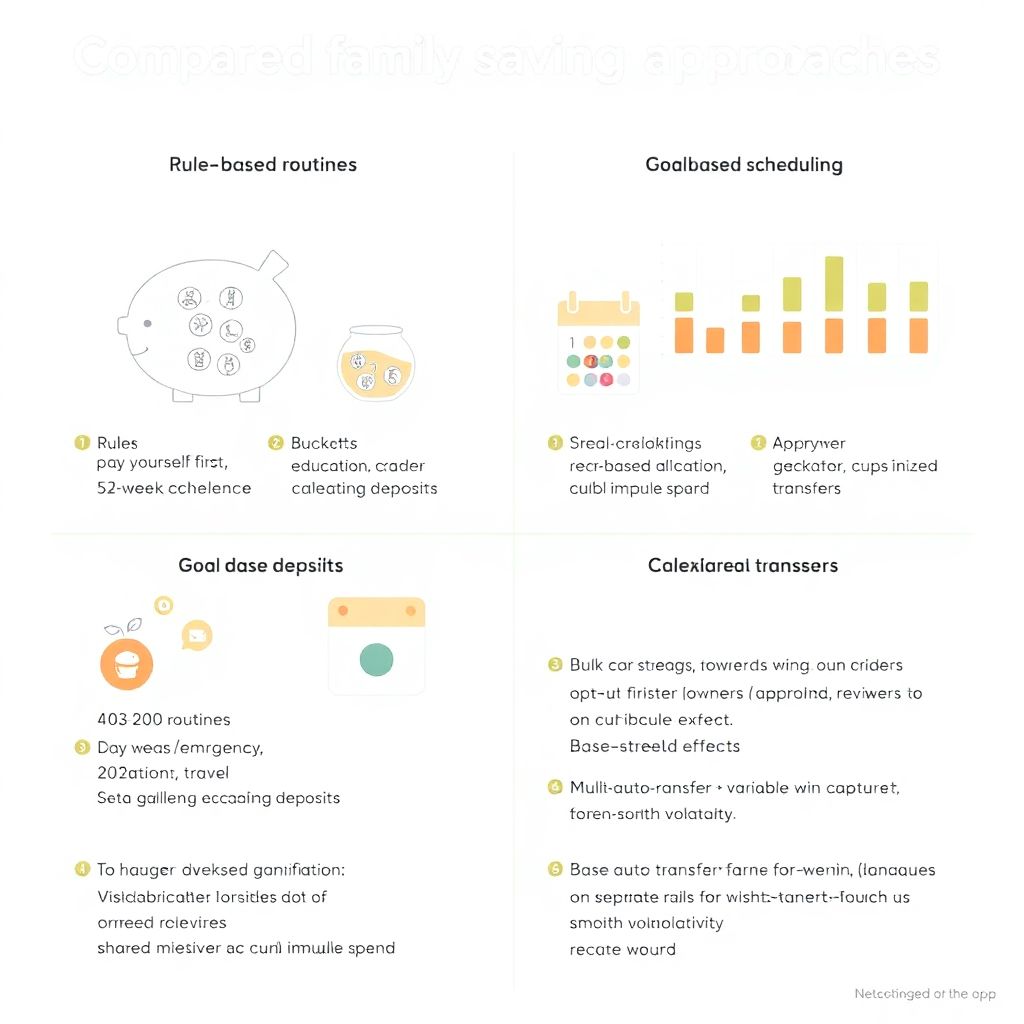

Comparing family saving approaches

Family savings challenges converge on three dominant paradigms: rule‑based routines, goal‑based scheduling, and behavior‑driven gamification. The rule‑based path includes round‑ups, “pay‑yourself‑first,” and classic laddering like the 52 week money saving challenge, which escalates deposits to train consistency. Goal‑based scheduling frames buckets for emergency, education, and travel with zero‑based allocation and calendarized transfers. Behavior‑driven gamification introduces streaks, shared milestones, and opt‑out friction to curb impulse spend. For multi‑earner households, joint governance matters: define owners, approvers, and reviewers to avoid free‑rider effects. Experts suggest combining a fixed base auto‑transfer with variable “win captures” (refunds, bonuses) to smooth cash‑flow volatility, while decoupling short‑term wants from long‑term capital formation using separate rails and explicit criteria.

Pros and cons of technologies

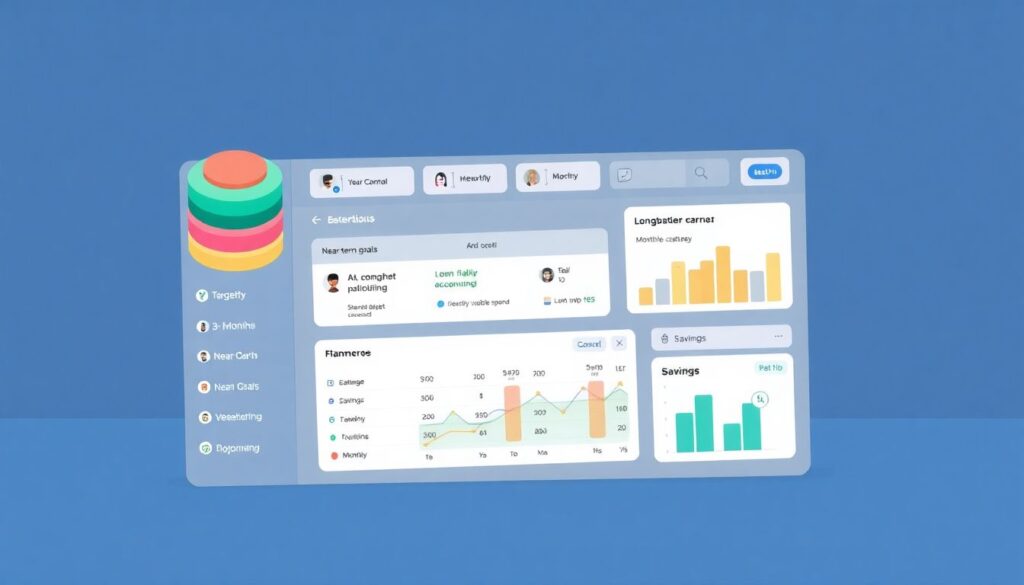

Digital tooling reduces coordination costs but introduces integration and privacy trade‑offs. The best budgeting apps for families leverage open‑banking APIs, shared spaces, and child cards, enabling per‑category limits and anomaly alerts; however, data latency and broken connections can distort cash views, and some gamified UIs nudge unnecessary upgrades. Paper artifacts still have utility: a money saving challenge printable can externalize goals for younger kids and improve commitment via visible progress, though it lacks automation and auditability. Spreadsheets remain flexible but error‑prone without version control. Automation through rules engines (round‑ups, paycheck splits) is powerful, yet misconfigured rules may overdraft during lumpy expense months. Experts recommend privacy‑by‑design vendors, MFA, read‑only connections where possible, and periodic access reviews for all linked accounts.

Selection recommendations and expert guidance

Start with a measurable target stack: 3–6 months of expenses, near‑term goals, and long‑term compounding. A shared family budget planner should define categories, ownership, and reconciliation cadence (weekly for variable spend, monthly for strategy). Park emergency and mid‑term funds in the best high-yield savings accounts to preserve liquidity and earn competitive APY; segregate goal buckets using subaccounts to prevent leakage. Choose challenges that match volatility: fixed weekly transfers for stable income, percentage‑of‑inflow rules for variable earners. Certified financial planner practitioners advise automating base transfers on payday, then layering conditional boosts tied to discretionary underspend. Behavioral economists add that pre‑commitment (locking future raises into savings) and social proof (shared dashboards) increase adherence; run quarterly retros with clear KPIs and adjust thresholds, not principles.

Trends shaping 2025 family finance

In 2025, three vectors dominate: smarter automation, richer collaboration, and instant settlement. AI copilots in budgeting apps surface anomaly detection, category drift fixes, and forecasted cash gaps with explainable models, while shared goal spaces let adults and teens co‑own micro‑budgets under configurable limits. Real‑time payment rails reduce transfer lag, enabling just‑in‑time sweeps to savings without stranding liquidity. Embedded finance expands round‑up and cashback orchestration across merchants, and account aggregation becomes more resilient as APIs replace screen scraping. Expect challenges to blend on‑chain style transparency (immutable logs) with friendly UX, and dynamic difficulty that adjusts deposits to income seasonality. Printable artifacts won’t vanish; instead, families will hybridize digital trackers with visible prompts to keep momentum when screens are off, reinforcing durable saving habits.