Why a debt reduction timeline beats vague intentions

A timeline turns a fuzzy wish into a measurable plan, and the psychology behind it is simple: when the next action and date are obvious, follow‑through rises. Instead of promising yourself to “pay more when possible,” you estimate cash flow, map payments to calendar months, and set checkpoints. This approach exposes trade‑offs: dinner out vs. two weeks shaved off a balance. It also prevents optimism bias by forcing you to model interest accrual and minimums. With a realistic timeline, interest no longer hides in the background—it becomes a line item that you can attack with targeted moves, informed by actual numbers rather than hope.

Start with a clean inventory of debts and constraints

Before comparing strategies, collect hard data: balances, APRs, minimums, due dates, and any teaser rates that expire. Then, calculate your guaranteed monthly surplus after rent, food, transport, and a small emergency buffer. That surplus is your engine; your timeline’s accuracy depends on how honest you are here. Build in seasonality—tax refunds, annual insurance bills, or freelance spikes—so your plan reflects real life rather than a flat line. If you want precision, plug these figures into a debt payoff calculator to simulate timelines and see the cost of interest over different strategies without guesswork.

Snowball vs. avalanche vs. hybrid: what actually works

The avalanche method targets the highest APR first and wins on math, cutting interest fastest. The snowball method targets the smallest balance first and wins on momentum, delivering quick wins that stick. A hybrid assigns most extra cash to the top APR while diverting a sliver to close out tiny balances that clutter your mind. Behavior matters: if motivation dips derail you, snowball may be “mathematically slower” but practically faster. If you’re disciplined, avalanche is efficient. Test both in a debt snowball calculator alongside an avalanche scenario; compare payoff dates and interest paid to choose the design you’ll actually follow.

Use tools that make the math and tracking painless

You don’t need a spreadsheet doctorate. Use a modern debt payoff calculator to project timelines with different monthly contributions, and rerun it whenever income or rates move. Complement that with the best debt payoff apps that auto‑import transactions, remind you before due dates, and visualize progress with simple charts. Automation isn’t a luxury here—it reduces decision fatigue. If an app lets you simulate “what if I add $50?” in seconds, you’ll experiment more and land on a timeline that balances ambition and sustainability instead of relying on willpower alone.

When consolidation or management beats DIY

If your APRs are punitive or payments are scattered, debt consolidation loans can turn chaos into one predictable installment, ideally at a lower rate and fixed term. The trade‑off: you must stop new charging and avoid extending the term so far that interest creeps back. For accounts already behind or rates you can’t negotiate down, reputable debt management programs through nonprofit agencies can compress rates and structure payments without new credit. Both options can shorten a timeline, but only if you maintain a budget and keep old cards inactive; otherwise you just reshuffle balances while time slips away.

Build the timeline: from monthly surplus to calendar plan

Translate your surplus into a month‑by‑month map. Keep minimums on all accounts; funnel the entire extra amount toward your chosen target debt. When that debt dies, roll its full payment into the next target—this “payment snowball” is the core mechanic that accelerates progress. Mark milestone dates on a calendar, including expected payoff months for each account. Add a 5–10% friction factor to absorb life’s surprises—car tires, co‑pays, school trips—so the plan survives contact with reality. Reconcile your actual payments against the plan each month and reforecast the remaining timeline quarterly.

Add buffers and triggers so setbacks don’t break the plan

Emergencies happen; the solution isn’t perfection but resilience. Maintain a mini emergency fund, even if it delays the first payoff by a month, because every crisis funded by a card resets your progress. Add triggers: if utilization spikes above a threshold, pause extra payments and refill cash reserves; if you receive windfalls, assign a fixed percentage to debt and a slice to savings to prevent rebound charging. For variable income, define “floor” and “stretch” payments. Your timeline should be elastic within guardrails—flexible enough to absorb shocks while preserving the overall destination.

Practical weekly habits that keep the timeline moving

– Reconcile transactions and due dates every Sunday; automate minimums to avoid fees.

– Schedule one extra micro‑payment mid‑month to shave daily interest on revolving balances.

– Review your debt payoff calculator projection monthly and adjust for any income changes.

– Funnel found money (rebates, resale proceeds) immediately to the current target account.

– Audit subscriptions quarterly; redirect cancelled fees to the snowball automatically.

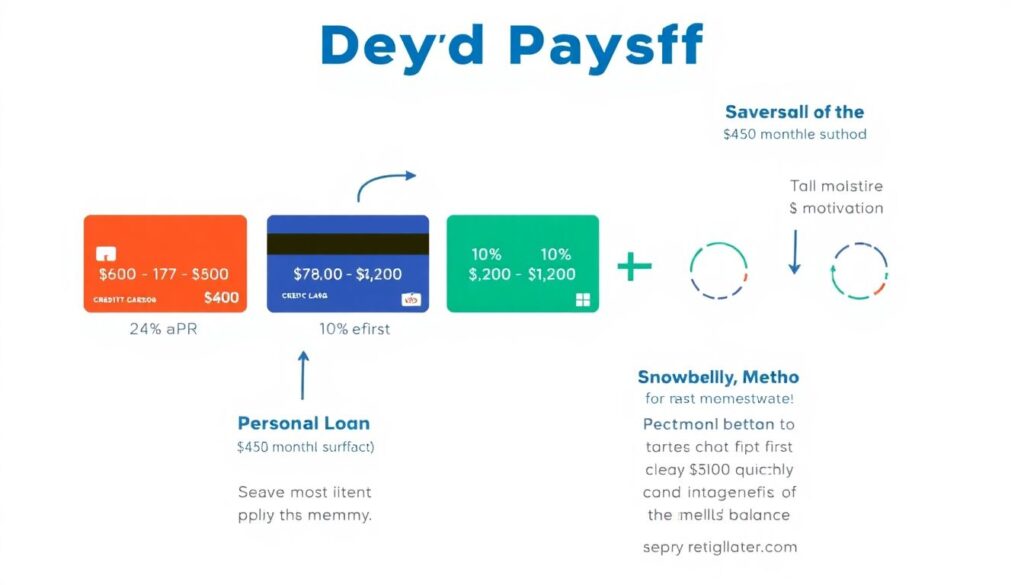

Case example: choosing the right method for your profile

Imagine three cards at 24%, 19%, and 13% APR with balances of $600, $2,800, and $3,200, plus a personal loan at 10%. With $450 surplus, an avalanche targets 24% first and saves the most interest, clearing the $600 quickly and building momentum anyway. If you’d stall without a fast win, snowball still closes the $600 first, then $2,800, creating psychological lift. Test both paths in a debt snowball calculator and a standard payoff simulator; if the difference in total interest is small but motivation is fragile, snowball may deliver a faster real‑world finish.

Red flags and myths to ignore

Beware “set it and forget it” thinking; rates can change, and variable APRs amplify mistakes. Consolidation isn’t a cure if you keep lines open and continue spending. Ignoring minimums to speed one account risks fees that erase gains. And no, micro‑payments don’t harm credit—on the contrary, consistent on‑time history and falling utilization help. If a service promises instant fixes, step back and ask for terms in writing; legitimate debt management programs disclose fees and timelines clearly and never pressure you to stop paying creditors without a plan.

Bottom line: realism, iteration, and momentum

A realistic debt reduction timeline is not a rigid script but a living model. Pick a strategy you’ll sustain, run the numbers with tools that lower friction, and install habits that make progress routine. Compare avalanche, snowball, hybrid, and structured options like debt consolidation loans with clear eyes, then lock your choice into a calendar and automate as much as possible. Revisit the plan as circumstances evolve, and keep your emergency buffer intact. Do this, and the finish line stops being abstract—you can point to the month you’ll be free and watch it inch closer, week by week.