Why starting from zero is actually a superpower

Most people think “no credit history” is the same as “bad credit.” It’s not.

Bad credit means you’ve made documented mistakes.

No credit means the system doesn’t know you yet.

That’s annoying (you get worse rates, more deposits, rejections), but it also means you can design your credit profile almost from scratch — deliberately, fast, and with fewer scars than most people.

In this guide we’ll go through a realistic, step by step plan to improve credit score when you’re starting with nothing. Plus a few creative, not-so-obvious moves that go beyond “get a card and pay on time.”

—

The rules of the game (in plain English)

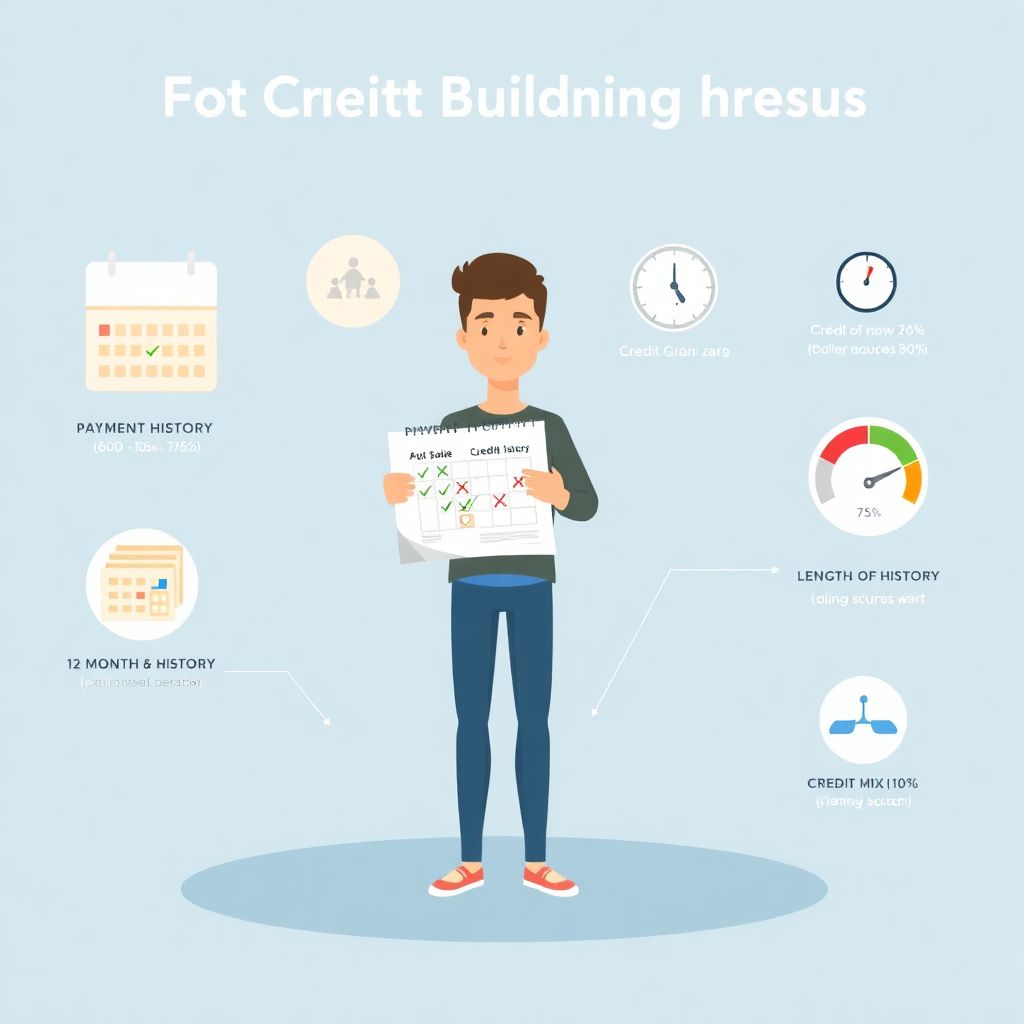

Before we build, we need to know what actually moves your score. FICO and VantageScore formulas aren’t public, but we know the main levers:

– Payment history – ~35%

Do you pay at least the minimum on time? One 30‑day late can tank a young score by 60–100 points.

– Credit utilization – ~30%

How much of your total credit limit you’re using. Under 30% is decent. Under 10% looks great.

– Length of credit history – ~15%

How long your accounts have been open. The earlier you start, the better.

– Mix of credit – ~10%

Using more than one kind of credit (credit cards + installment loans like auto or “credit builder” loans).

– New credit / inquiries – ~10%

How often you apply. A few pulls are fine; lots in a short time = risk.

You don’t need to obsess over the math. Just remember: on‑time payments + low utilization + age. Everything else is bonus.

—

Step 1: Decide how fast you *actually* want to go

Many people google how to build credit from scratch fast and expect a 750 score in two months. Not happening.

Realistic timelines if you’re consistent:

– 3 months: First score appears (often 640–690 range if you do things right)

– 6–9 months: Solid “good” zone (680–720) is very possible

– 12+ months: You can be competitive for good auto rates and decent cards

You’re not powerless here. Speed is about how aggressively and intelligently you stack the right accounts — without blowing up your utilization or missing payments.

—

Step 2: Build your first “data points” the non-boring way

Most guides jump straight to credit cards. Let’s start even earlier with moves that feel like everyday life but still build credit.

2.1. Use bills you already pay to build history

If you pay for:

– Rent

– Phone service

– Streaming / utilities

…you might be able to report those to credit bureaus.

Examples (check current availability where you live):

– Rent-reporting services – Some report your past 12–24 months of on‑time rent. That can instantly give your file “age” and a solid payment history.

– Utility/phone reporting tools – Certain services add positive history from your phone/internet/utility payments.

Is this mandatory? No. But if you’ve been paying $900 rent on time for 2 years, why shouldn’t that help your credit score with no credit history? It’s a low-effort way to seed the file before you even open a card.

—

2.2. Piggyback carefully as an authorized user

This is the “boring” suggestion that can be extremely powerful if done right:

– You ask a trusted family member/partner to add you as an authorized user on an old card they handle well.

– You don’t need to actually use the card.

– Their good history can appear on your report, instantly boosting the age and payment history.

But here’s the catch:

If they carry high balances or miss payments, you inherit the mess. So the rules are:

1. Card at least 3+ years old

2. Utilization under 30%, ideally under 10%

3. No late payments on that card

If any of that isn’t true, skip it. You’re borrowing their reputation; you only want it if it’s actually good.

—

Step 3: Choose your first card like an engineer, not a shopper

We finally get to credit cards. When people ask about the best credit cards to build credit from scratch, what they actually need is a tool that:

– Reports to all three major bureaus (Experian, Equifax, TransUnion)

– Approves people with thin or no files

– Has low or no annual fee

– Doesn’t trap you with junk fees

You’ve got three main paths.

—

3.1. Secured card: the training wheels that don’t look like training wheels

Secured credit cards to build credit for beginners work like this:

– You give the bank a refundable deposit, often $200–$500

– That deposit becomes your credit limit

– The bank reports your activity just like a normal credit card

– After 6–12 months of good behavior, many issuers upgrade you and refund the deposit

Why secured cards are underrated:

– Approval odds are much better when you’re starting from zero

– They let you simulate a “perfect” credit user from day one

– You control your limit by choosing your deposit

Technical detail block:

> TECH DETAIL: Ideal secured card usage

> – Deposit: $300–$500 if you can, so the limit isn’t tiny

> – Spending: <10–20% of limit at any given time (so on a $300 limit, keep reported balance under $30–$60)

> – Activity: Use it every month, not just once in a while

> – Payment: Pay in full before the due date, but leave a small amount to report before the statement closes

If you have literally zero score, secured cards are often the most predictable way to get approved.

—

3.2. Student or “starter” unsecured cards

If you’re a student or you have verifiable income, you might qualify for an unsecured starter card:

– No deposit

– Lower limits (often $300–$1000 at first)

– Sometimes basic rewards on groceries, gas, etc.

These can be among the best credit cards to build credit from scratch if you can get approved, because your cash doesn’t get locked as collateral.

However, approvals with no history are hit-or-miss, so don’t shotgun 10 applications. Two to three targeted apps max. If denied, pivot to secured.

—

3.3. Store cards: the tempting shortcut (usually skip)

“Save 20% today if you open a card!”

Store cards approve easily, but:

– Limits are often low

– Interest rates are brutal

– They nudge you to overspend at that one store

One or two responsibly used store cards won’t kill you, but they’re rarely your best first move when figuring out how to build credit score with no credit history. Treat them as a later optional add-on, not the foundation.

—

Step 4: The 90-day “behavior pattern” that shapes your score

Once you have your first card (or two), the next 90 days matter a lot. Lenders are watching how you behave with that tiny bit of trust.

Here’s a simple 90-day system:

1. Pick 1–2 small recurring expenses (e.g., Netflix, Spotify, gas once a month) and put them on the card.

2. Set automatic payment of the full statement balance from your bank account.

3. Keep total usage under 20% of your limit at all times.

4. Don’t open more new accounts during this phase unless it’s part of a planned move (see the advanced section below).

The goal: create three months of robotic, boring, flawless data. That’s how bureaus decide you’re predictable.

> TECH DETAIL: Statement date vs. due date

> – Statement date: Snapshot sent to bureaus. Whatever balance exists that day is what gets reported.

> – Due date: When you must pay at least the minimum to avoid a late mark.

>

> Advanced trick: Pay your card down a few days before the statement date so your reported utilization stays low, then pay off the remainder by the due date.

—

Step 5: Adding a second “type” of credit (without a car loan)

Credit scoring models like to see different types of credit: revolving (cards) and installment (fixed payment over time). You don’t need to buy a car or take on huge debt to get this benefit.

Two creative options:

5.1. Credit-builder loan: interest you pay to your future self

A credit-builder loan is weird at first glance:

– The bank/credit union “loans” you, say, $300–$1000

– But instead of giving you the money, they lock it in a savings account or CD

– You make fixed monthly payments (e.g., $25–$50)

– At the end, you get your money back (minus a bit of interest)

Why this is clever:

– You get installment loan history without real spending

– Payment history and mix both improve

– You build up a small savings cushion by accident

Technical detail block:

> TECH DETAIL: Ideal credit-builder setup

> – Term: 12–24 months (long enough to help your “age”)

> – Payment: Something you can pay comfortably without fail

> – Reporting: Confirm they report to all three major bureaus

> – Autopay: Turn it on and forget about it

Combine a credit-builder loan + one credit card, and your file suddenly looks much more mature.

—

5.2. Refinancing a bill you already pay

Nonstandard move:

If you already have a legit installment like:

– Financing on your phone

– A buy-now-pay-later you’re handling well

– A small legit personal loan from a credit union

…consider refinancing it through a lender that reports to credit bureaus if your current one doesn’t. Same payment, but now your good behavior becomes part of your score history.

—

Step 6: Advanced stacking — building fast without looking desperate

You want speed, but not chaos. Lenders get nervous if you open a bunch of accounts at once.

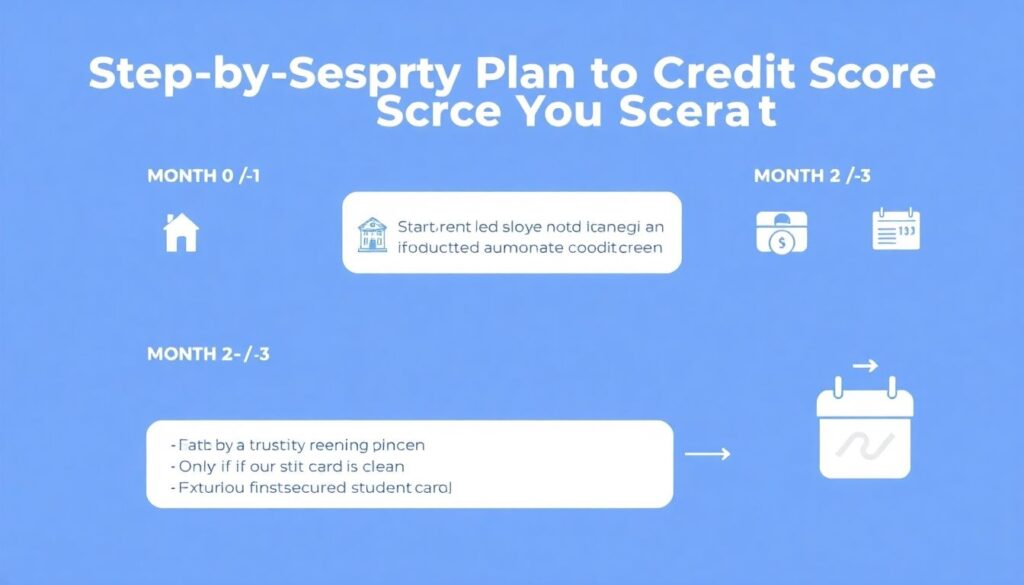

A sane, aggressive timeline for how to build credit from scratch fast:

1. Month 0 – Set up rent/utility reporting if available. Become authorized user if possible.

2. Month 1 – Open 1 secured or starter unsecured card.

3. Month 2–3 – Open a small credit-builder loan.

4. Month 4–6 – If scores and income look decent, consider a second card (maybe a student card or a basic cash-back card).

5. Month 7–12 – Chill. Let accounts age. Use them lightly and perfectly.

By month 12, many people can reach 700+ with zero lates if they follow this.

> TECH DETAIL: How many inquiries is “too many”?

> – 1–3 hard pulls in a year: totally normal

> – 4–6: still fine for someone building credit, but pace yourself

> – 7+ in a few months: can start scaring lenders, especially if from credit cards

Space out applications by at least 60–90 days unless there’s a very specific strategy (like rate shopping for an auto loan) where multiple pulls get counted as one.

—

Step 7: Non-obvious habits that boost your score quietly

7.1. Build-in “anti-stupid” automations

Humans forget things. Algorithms don’t care.

– Set calendar reminders 3 days before every due date.

– Turn on email + SMS alerts for: approaching your limit, payment due, and suspicious activity.

– Use autopay for at least the minimum so you can’t accidentally be 30 days late.

You can pay extra manually, but that floor-level autopay is your shield against score-killing mistakes.

—

7.2. Use your limits strategically (even if you don’t need them)

If your income supports it and temptation isn’t an issue, ask for credit limit increases every 6–12 months:

– Keep your spending the same.

– Higher limit = lower utilization = better scores.

Example:

– You spend $200/month.

– With a $500 limit, your utilization could be 40%.

– With a $2000 limit, the same $200 is just 10%.

You didn’t change behavior, only the denominator.

Many issuers let you request increases online with a soft pull (no score impact). Do it when your income goes up or after several months of perfect payments.

—

7.3. The “card-in-a-drawer” tactic done right

Some people open a card and never use it, thinking it helps just by existing.

The truth:

– A completely dormant card can be closed by the issuer, reducing your available credit and possibly hurting your score.

– Instead, put a tiny recurring charge on it (e.g., $5 subscription) and autopay it.

This way the card stays active, builds age, and helps utilization, while you barely think about it.

—

Step 8: What NOT to do (even if it sounds clever)

1. Don’t co-sign for someone else this early

You’re still fragile. If they mess up, you eat the damage.

2. Don’t carry a balance “to build credit”

That’s a myth. You can pay in full and still get 100% of the score benefit. Interest is a fee, not a requirement.

3. Don’t close your oldest card lightly

It anchors your average age. If there’s no annual fee, keep it open, even if you rarely use it.

4. Don’t chase every shiny reward card immediately

Fancy cards want proven history. Build your foundation first; hacks later.

—

Putting it all together: a practical 12‑month roadmap

Here’s a condensed step by step plan to improve credit score from scratch:

1. Month 0–1

– Start rent/utility reporting if possible

– Ask a trusted person to add you as an authorized user (only if their card is clean)

– Open your first secured or student card

2. Month 2–3

– Automated payments set up

– Usage under 20% of your limit

– Open a small credit-builder loan

3. Month 4–6

– Maintain perfect payments

– Consider a second card if your first months are clean and income supports it

– Pay attention to statement dates to keep reported balances low

4. Month 7–12

– Request a credit limit increase if available

– Keep all accounts lightly active and on autopay

– Avoid needless new applications

– Monitor your scores and reports for errors

By the end of a year, you won’t just have “a score.”

You’ll have a clean, deliberate credit profile that can unlock cheaper loans, better apartments, and lower deposits — all without drowning in debt.

You’re not trying to impress the credit bureaus with how much you can borrow.

You’re showing them you’re boring, predictable, and ruthlessly on time.

That’s what a strong credit score really is. And starting from scratch, you’re in the perfect position to build it right, the first time.