Most people don’t think about their credit file until a loan gets denied or an interest rate looks shockingly high. Then the panic starts: how to fix your credit report fast, and is it even realistic? The good news: you usually don’t need magic, just a focused plan and a bit of persistence. Experts in consumer finance say that the biggest gains in score often come from correcting data errors and restructuring existing debt, not from complex tricks or expensive miracles.

Why Speed Matters When Cleaning Up Your Credit Report

Time really is money in the credit world. According to U.S. data from the CFPB, roughly 20–25% of consumers find at least one potentially material error in their credit files. Even a single wrong late payment can add percentage points to your interest rate, raising the total cost of a mortgage or auto loan by thousands of dollars over the life of the contract. That’s why specialists emphasize process efficiency: the faster you identify and fix distortions, the sooner your borrowing costs normalize and the less you lose to interest drag.

Step 1: Pull All Three Credit Reports and Read Them Like an Auditor

If you want to clean up credit report quickly, start by pulling reports from all three major bureaus—Equifax, Experian and TransUnion—through AnnualCreditReport.com. Print or save PDFs and go line by line: personal data, accounts, balances, payment history, public records, hard inquiries. Think like an auditor, not a casual reader. Experts recommend highlighting anything that looks off: wrong limits, duplicate accounts, status codes you don’t recognize. Small discrepancies can signal bigger reporting problems, so document everything with dates and screenshots before you move to the dispute phase.

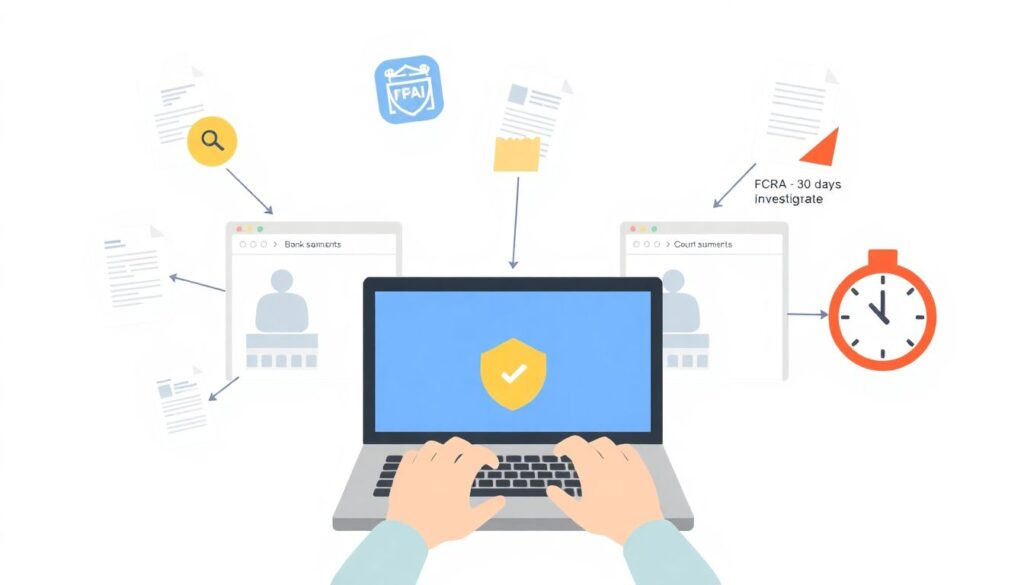

Step 2: Dispute Errors on Credit Report Online, Phone Is Plan B

The fastest correction path today is to dispute errors on credit report online directly through each bureau’s portal. Upload supporting evidence: bank statements, payoff letters, identity theft reports, court documents. Under U.S. law (FCRA), bureaus typically have 30 days to investigate and respond. Credit attorneys suggest staying ultra-specific: reference the exact account, tradeline, and nature of the error, and clearly state the remedy you want—deletion, correction, or update. Use certified mail only for complex or high‑stakes disputes where you’ll want a paper trail for possible escalation.

What to Prioritize in Your First Dispute Round

Неre’s what most credit experts suggest targeting first for maximum score impact and speed:

– Wrong late payments or charge‑offs on accounts that were actually paid on time

– Debts that were settled or discharged but still show as open or past due

– Accounts that clearly don’t belong to you, often signs of mixed files or identity theft

– Duplicate collections for the same underlying debt, which distort utilization and risk metrics

Step 3: Triage Legitimate Debts, Then Negotiate Strategically

Fixing your file isn’t only about errors. Once inaccuracies are under dispute, you need a game plan for legitimate derogatory items. Credit counselors recommend a triage model: prioritize revolving credit (especially credit cards) where utilization ratios most strongly influence your score. Aim to drive overall utilization below 30%, then under 10% for optimal scoring. For charged‑off or collection accounts, look into pay‑for‑delete agreements, in which a collector agrees to remove a tradeline after settlement. Get every deal in writing before sending a payment to avoid “we never promised that” issues.

When Credit Repair Services Make Sense

Not everyone has time or patience to manage disputes and negotiations solo. That’s where regulated credit repair services to remove negative items can play a role—but only if you stay realistic. Reputable providers will not guarantee a specific score, erase accurate bankruptcies, or “add” years of fake history. Instead, they focus on systematic dispute management, communication with furnishers, and education. Compliance analysts recommend month‑to‑month contracts, transparent pricing, and the right to cancel at any time as baseline requirements before you sign anything.

Choosing the Best Support: DIY vs Professional Companies

If your file is relatively simple—maybe one or two mistakes and some high balances—DIY is often faster and cheaper than outsourcing. However, if you’re dealing with identity theft, multiple collections, or older public records, even seasoned planners sometimes look for help from the best credit repair companies for bad credit. Evaluate them like any other financial vendor: length of time in business, regulatory complaints, sample contracts, and whether they provide written action plans. Avoid firms pushing “seasoned tradelines” or suggesting you create a new identity; that’s not repair, it’s fraud.

Stats, Economic Impact and Forecasts for the Credit Repair Space

Regulators estimate that inaccurate reporting affects tens of millions of consumer files globally, which creates huge aggregate costs in higher interest, declined approvals and limited credit access. Fintech analysts expect the credit‑repair and scoring‑optimization market to keep growing at high single‑digit annual rates through 2030, driven by open‑banking data, AI‑based score modeling and real‑time reporting tools. As lenders adopt more granular risk models, even modest improvements in your file—one deleted collection, one corrected limit—can shift you into a cheaper pricing tier, directly improving household cash flow and long‑term saving capacity.

Industry-Level Effects: How Cleanup Changes the Credit Ecosystem

Widespread consumer action on how to fix your credit report fast doesn’t just help individuals; it pressures the entire ecosystem. Banks and data furnishers face higher incentives to improve internal controls, reduce miscoding, and respond faster to disputes. Over time, more accurate files mean lower default forecasting error, better capital allocation and slightly reduced risk premiums baked into interest rates. At the same time, the growth of digital tools that help you clean your reports is reshaping the industry, forcing traditional bureaus, lenders and repair firms to compete on transparency, response speed and data quality.

Practical Checklist to Clean Up Your Report Quickly

To wrap up, here’s a compact, expert‑driven roadmap you can execute over the next 60–90 days:

– Pull all bureau reports, mark inaccuracies, and organize evidence in a single folder

– File targeted online disputes, track deadlines, and follow up if responses are vague

– Attack utilization by paying down revolving balances strategically, not randomly

– Negotiate settlements or pay‑for‑delete when possible, always with written confirmation

– Re‑pull reports after 45–60 days to verify that corrections and updates actually posted

Follow this process consistently, and you convert “credit repair” from a vague wish into a structured project with measurable financial payoff.