Why inflation-protected securities exist: a quick history

The idea of shielding savers from rising prices isn’t new. After the inflation shocks of the 1970s, the U.K. launched index‑linked gilts in 1981, tying principal to inflation. The U.S. followed in 1997 with TIPS, and their relevance resurfaced after the 2021–2022 price surge. In 2025, inflation has cooled from the peak yet remains a live risk, so investors again ask how to protect purchasing power without abandoning bonds altogether. That’s precisely the niche inflation-protected securities fill: they keep returns anchored to real, not just nominal, value.

How TIPS work in plain English

Treasury Inflation-Protected Securities start with a fixed coupon rate, but the principal they’re applied to moves with the CPI-U. When inflation rises, the principal steps up; coupons paid on that higher base rise too, preserving real income. If deflation appears, principal can adjust down, yet you still receive at least par at maturity. Market prices can swing because real yields move, so TIPS can lose value short term even while guarding long-term purchasing power—a nuance new buyers often miss.

What counts as inflation-protected bonds?

Beyond U.S. TIPS, several countries issue inflation-linked bonds, and the U.S. also offers Series I Savings Bonds. Funds and ETFs package these for easier access. For liquid portfolios, marketable TIPS are the workhorse; for small, patient savers, I Bonds cap risk but have annual limits. The “best inflation-protected bonds” depend on goals: traders might choose short-duration ETFs, while retirees often prefer a ladder to match expenses. Your horizon and tolerance for price swings should drive selection.

- Building an emergency reserve that won’t erode in real terms over years.

- Funding future costs with known dates—tuition, a home down payment, or retirement cash flows.

- Diversifying a bond sleeve when inflation uncertainty is the main worry, not credit risk.

Benefits and the fine print

The core benefit is simple: TIPS pay a real yield plus inflation. They hedge the risk that fixed coupons get eaten by rising prices. But trade-offs matter. Market value still reacts to real yields, so volatility isn’t zero. Taxation can be awkward in taxable accounts because inflation adjustments are recognized before maturity. And if inflation undershoots what the market expected, TIPS may lag nominal Treasuries—even though your real purchasing power is protected.

- Real rate risk: when real yields rise, prices fall; duration magnifies the effect.

- Deflation: coupons shrink with principal, though maturity pays at least par.

- Taxes: inflation accretion is taxable annually; IRAs often fit better.

- Liquidity: on-the-run issues trade tighter; odd maturities can be less liquid.

Reading the market: breakeven inflation

Breakeven inflation is the yield gap between a nominal Treasury and a same-maturity TIPS. If a 10‑year nominal yields 4% and a 10‑year TIPS yields 2% real, the breakeven is about 2%. If realized inflation exceeds 2%, TIPS should outperform; if it falls short, nominals win. This framework is your toolkit for any inflation-protected bonds comparison: you’re not guessing inflation blindly—you’re judging whether the market’s built-in forecast looks rich or cheap for your needs.

TIPS investment strategies that actually help

For hands-on investors, a ladder of individual bonds aligns maturities with future spending, locking today’s real yield and the inflation adjustment along the way. For simplicity, broad ETFs provide instant diversification and easy rebalancing. Barbell mixes (short and long TIPS) can tame volatility while keeping exposure to long-run inflation. Don’t forget cash needs: pair a TIPS sleeve with a nominal cash bucket so you’re not forced to sell during rate spikes.

Short vs. long TIPS: choosing your duration

Short-duration TIPS funds focus on near-term inflation protection with lower price swings; they track current CPI more tightly. Long-duration TIPS are more sensitive to real rate moves, so they can be volatile, but they lock in real yields for decades—useful for pensions or long retirements. Many savers blend the two. Whichever route you pick, ensure the duration roughly matches the timeline of the liabilities you’re insulating from inflation.

How to buy TIPS online in 2025

You can buy TIPS online at TreasuryDirect for auctions and commission-free holdings, or through most brokers for both auctions and secondary trades. Auctions set the real yield; secondary markets let you choose specific maturities and prices. Newcomers often start with ETFs for convenience, then add a small ladder as they learn the mechanics. Keep an eye on bid–ask spreads and premiums to inflation-adjusted principal when you shop individual issues.

- Open a TreasuryDirect or brokerage account with bond access.

- Decide on maturity targets that match your goals and cash flow.

- Compare auction yields to secondary prices before placing orders.

- Automate reinvestment or ladder rollovers to keep the plan on track.

Evaluating funds and ETFs

Not all TIPS funds are twins. Some track the full maturity spectrum; others cap duration to reduce swings. Expenses differ, and in a low real-yield world, every basis point counts. Check the index methodology, effective duration, and real yield to worst. Understand how distributions work: funds pass through both coupons and inflation accretion, which can make payouts lumpy. For global exposure, ensure the index hedges currency so you’re insulating inflation, not FX noise.

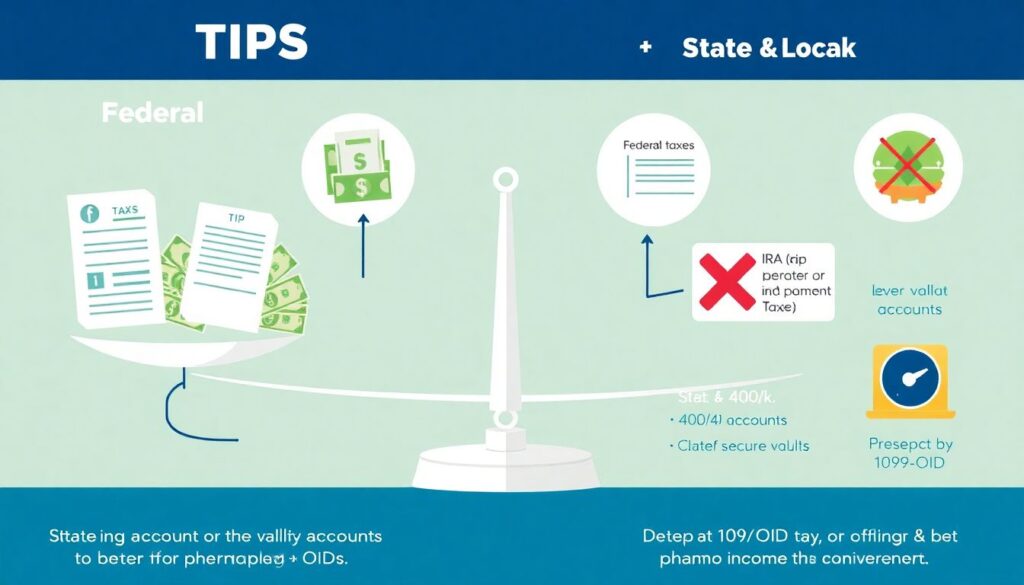

Taxes, accounts, and paperwork

TIPS interest and inflation accretion are taxable federally in the year they occur, but exempt from state and local taxes. That’s why many investors hold them in IRAs or 401(k)s to defer the so-called phantom income. In taxable accounts, use organized recordkeeping: 1099‑OID reports the inflation adjustment, and 1099‑INT shows coupon interest. If tax drag is a concern, short-duration funds can reduce volatility of reported income, though strategy should drive structure.

Pulling it together for 2025

A practical baseline: allocate a slice of your bond portfolio to TIPS, size it to the portion of expenses you want to inflation-proof, and tune duration to your horizon. Use breakeven checks before big shifts, favor low-cost vehicles, and rebalance alongside equities to harvest volatility. Whether you favor a ladder or a fund, consistent process beats prediction. And when you compare choices, make it a genuine inflation-protected bonds comparison—not a guess—anchored to your real-life goals and constraints.