The Ultimate Guide to Personal Finance for Beginners and Beyond

Money hasn’t changed much in thousands of years. People earn it, spend it, try to save some, and often worry there isn’t enough. But the rules of the game around money have changed radically—especially in the last 30–40 years.

If you’re just starting with personal finance in 2025, you’re stepping into a world where a lot of old-school advice still works… but the tools, risks, and opportunities look very different from what your parents had.

Let’s walk through it step by step, без воды и лишней теории.

—

From Envelopes to Apps: How We Got Here

Back in the 1970s and 1980s, “personal finance” for most people meant three things:

1) get a job,

2) don’t overdraft your bank account,

3) maybe buy a house if you can.

Credit cards were still relatively new, index funds hardly existed for everyday investors, and nobody was talking about a personal finance course for beginners—you either learned from your parents or from hard experience.

Fast‑forward:

– 1980s–1990s: Credit cards exploded. In the US, household debt rose sharply. The first personal finance books started hitting bestseller lists.

– 1990s–2000s: Online banking appeared. Index funds and ETFs started opening stock markets to people with a few hundred dollars instead of a few hundred thousand.

– 2010s: Smartphone revolution. Budgeting and investing moved into your pocket. Robo‑advisors showed up. You could invest in a diversified portfolio in 10 minutes from your couch.

– 2020s: Pandemic, inflation spikes, crypto booms and crashes. Suddenly everyone realized that not having a cash cushion or a plan is painfully expensive.

By 2025, personal finance has turned into a full‑blown industry: apps, influencers, robo‑advisors, online schools, and an army of “money gurus” on social media. That’s good (more access) and dangerous (more noise and scams).

—

Why Personal Finance Matters More Than Ever

Here’s the uncomfortable reality: real wages in many developed countries have barely grown compared with the cost of housing, education, and healthcare.

– According to OECD data, housing costs in major cities have grown 2–4 times faster than median incomes over the last 20–30 years.

– Student loan balances in the US crossed $1.7 trillion in the early 2020s.

– Inflation shock of 2021–2023 eroded savings worldwide, with many households seeing 5–10% of their purchasing power vanish in just a couple of years.

At the same time, technology made it easier than ever to:

– Overspend with one tap

– Take on high‑interest debt instantly

– Speculate in complex assets you don’t really understand

So personal finance today isn’t just about “being good with money.” Это про выживание и нормальный уровень жизни в мире, где финансовые ошибки наказываются гораздо жестче.

—

Step Zero: Know Your Money Flow

Income, Expenses, and Why You Feel Broke

Before talking about “how to start investing for beginners,” you need a boring foundation: a clear picture of what’s coming in and what’s going out.

In 2025 you don’t have to use a notebook or Excel unless you like it. There are dozens of online budgeting tools for personal finance that can:

– Sync with your bank accounts and cards

– Auto‑categorize spending

– Show you trends and forecasts

But the tech doesn’t matter if you’re lying to yourself about your habits.

A simple starting structure:

– Fixed essentials – rent/mortgage, utilities, basic food, transport, minimum loan payments

– Lifestyle – restaurants, subscriptions, travel, shopping, hobbies

– Financial priorities – savings, investing, insurance, debt repayment beyond minimums

Aim for at least 10–20% of income going toward “future you” (savings + investments + extra debt payments). If it feels impossible, that’s not a moral failing; it’s a signal that either income needs to go up, or lifestyle needs to come down, or both.

—

Budgeting Without Hating Your Life

Classical advice loved strict envelopes and rigid rules like “you get $50 a week for fun and that’s it.” For many people, that leads to burnout and then a binge of overspending.

A more flexible 2025‑friendly approach:

– Pick a simple rule, like 50/30/20 (50% needs, 30% wants, 20% future).

– Use one of the best personal finance apps to track in the background instead of manually recording every coffee.

– Review once a week for 10–15 minutes: “Where did my money actually go? Do I like that?”

If you consistently overshoot, don’t blame willpower. Adjust the system:

– Reduce friction for good behavior (automatic transfers to savings on payday).

– Increase friction for bad behavior (remove saved cards from shopping sites, lower daily ATM limits, disable “1‑click” payments).

—

Debt: The Silent Tax on Your Future

Good Debt vs. Bad Debt (And Why Labels Can Mislead)

Historically, “good debt” meant mortgages or education, “bad debt” meant credit cards and consumer loans. But in a world where housing bubbles and overpriced degrees are common, the line is blurry.

Healthy way to think:

– If the debt increases your earning power or stable assets and the interest is reasonable → probably acceptable.

– If the debt is for something that disappears in weeks or months (gadgets, clothes, random lifestyle) and the interest is high → it’s eating your future.

In many countries, average credit card interest still sits above 18–20% annually. Mathematically, it’s almost impossible to invest your way out of that. Paying it down is one of the highest guaranteed “returns” you can get.

—

How to Escape the Debt Spiral

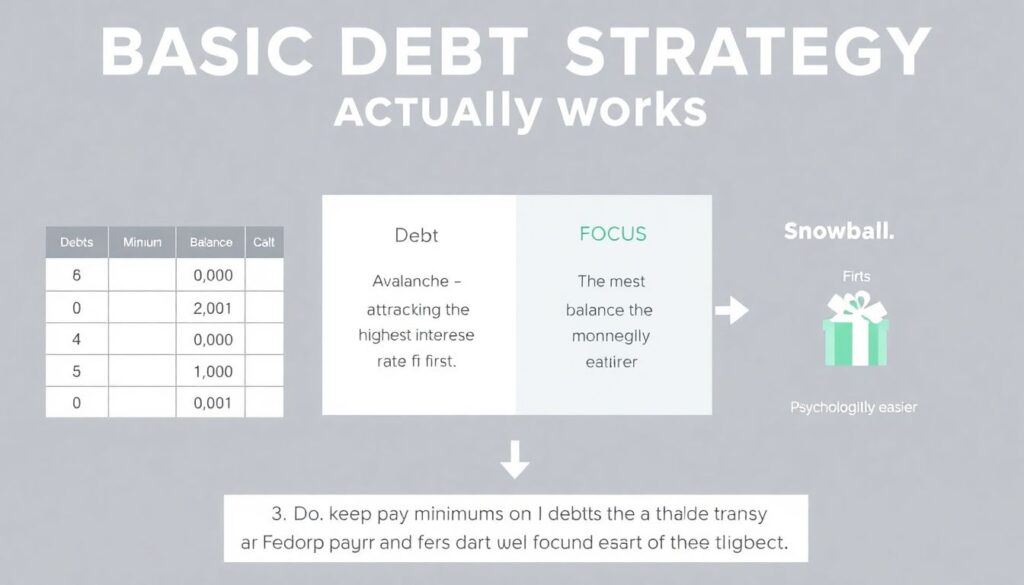

Basic strategy that actually works:

– List all debts with balance, interest rate, minimum payment.

– Choose a focus method:

– Debt avalanche – attack highest interest rate first (most efficient).

– Debt snowball – attack smallest balance first (psychologically easier).

– Keep paying minimums on all, and throw every extra dollar at your chosen target.

If you’re deeply stuck (collections, missed payments, constant anxiety), this is the moment when a financial advisor for beginners or a certified non‑profit credit counselor can literally save years of your life. Just vet them: avoid anyone who pushes mystery products or refuses to explain fees clearly.

—

Savings: Your Safety Net in an Uncertain Economy

Emergency Fund in 2025: How Much Is Enough?

Old advice said “3–6 months of expenses.” In an era of gig work, layoffs in tech, and unstable housing markets, that’s now more like a minimum than a goal.

Realistic tiers:

– Starter cushion – $500–$1,000: covers small emergencies.

– Basic buffer – 1–3 months of bare‑bones expenses.

– Resilient fund – 6–12 months, especially if:

– you’re self‑employed or freelance,

– you support dependents,

– or you’re in a volatile industry.

Keep this money simple: high‑yield savings account or money market fund. The goal is liquidity and safety, not high returns.

—

Investing: From Scary Word to Normal Habit

Why Investing Became Non‑Optional

Historically, you could dump money in a savings account and earn meaningful interest. In the 1980s, bank deposit rates could hit double digits in some countries. Those days are gone.

Even though interest rates rose sharply after 2021, long‑term forecasts from many central banks still assume inflation around 2–3% and lower real returns on safe assets. Translation: if you never invest, your savings will quietly shrink in real terms over decades.

That’s why understanding how to start investing for beginners is no longer a “nice extra,” it’s part of basic financial literacy.

—

How to Start Investing for Beginners Without Burning Out

Think of investing as a system, not a one‑time decision.

Core principles:

– Start small, but start now. Even $50–$100 per month matters when you have years ahead.

– Prioritize diversification. Broad index funds and ETFs spread your risk across many companies.

– Automate contributions. Set automatic monthly transfers into your investment account right after payday.

– Ignore daily noise. Markets will always be noisy: pandemics, elections, wars, AI booms and busts.

A basic progression:

– Step 1: Eliminate or reduce high‑interest debt.

– Step 2: Build at least a small emergency fund.

– Step 3: Open a low‑fee brokerage or robo‑advisor account.

– Step 4: Choose a globally diversified ETF or index fund strategy.

– Step 5: Automate and review 1–2 times per year, not every day.

If you’re overwhelmed, a short personal finance course for beginners focused on investing basics can save you from emotional, expensive mistakes like panic‑selling at the bottom or chasing every hot tip.

—

Technology: Your New Financial Co‑Pilot

Apps and Tools That Actually Help

The last decade changed the landscape completely. What used to require a human banker or broker is now handled by algorithms and intuitive interfaces.

Where tech really shines today:

– Budget tracking and cash‑flow analytics

– Automated saving and “round‑up” investing

– Low‑cost diversified portfolios based on your risk level

– Goal tracking: home down payment, kids’ education, FI/RE targets

A not‑so‑secret truth: the best personal finance apps are usually the ones you’ll actually use consistently, not the ones with the fanciest feature list. Sometimes a simple app that shows you “You spent 27% more on food this month” is more powerful than a complex planner with 50 menus you ignore.

—

Online Budgeting Tools and the New Data Economy

When you use online budgeting tools for personal finance, you are also feeding data into a vast financial ecosystem:

– Banks and fintechs learn how people actually spend and save.

– Regulators see trends in household debt and stress.

– Startups design new products (good and bad) based on your behavior.

From a macroeconomic angle, this detailed data allows:

– Better economic forecasts of consumer spending and recession risks.

– More targeted financial inclusion products for underserved groups.

– But also more sophisticated marketing designed to separate you from your money.

Rule of thumb: use the tools, but read the privacy policy, turn off unnecessary data sharing, and don’t assume “free” always means cost‑free—often, you’re paying with your data.

—

How Personal Finance Shapes the Broader Economy

Households as the Engine of Growth

Household spending drives 50–70% of GDP in many developed economies. When millions of people manage money poorly—over‑indebted, no savings, panic‑selling investments—it doesn’t just hurt them individually. It can:

– Deepen recessions

– Amplify financial crises

– Increase inequality

– Put pressure on public safety nets

On the flip side, when more people:

– Build emergency funds

– Invest for the long term

– Avoid high‑interest traps

…we get more stable capital markets, healthier banks, and less strain on government budgets. In other words, boring habits like “automatically save 15%” have macroeconomic consequences.

—

The Financial Education Boom and Industry Impact

Since around 2020, demand for financial knowledge has surged:

– Search queries for investing and budgeting topics climbed significantly after each market shock and inflation wave.

– Fintech startups attracted billions in venture capital by promising to “democratize finance.”

– Universities, platforms, and creators launched thousands of courses and channels.

This has reshaped the financial services industry:

– Banks are racing to add in‑app education and simplified products.

– Traditional advisors must justify higher fees in a world where robo‑advisors are cheap and accessible.

– Regulators are tightening rules around influencers and high‑risk products marketed to beginners.

Looking forward to 2030, analysts expect:

– More embedded finance (financial features inside non‑financial apps).

– Stronger consumer‑protection frameworks for digital finance.

– Wider use of AI to offer hyper‑personalized financial guidance—while regulators wrestle with bias, mis‑selling, and data abuse.

Your personal money habits are now directly connected to these big industry and policy shifts.

—

Do You Need a Human Advisor in the Age of AI?

When a Financial Advisor Makes Sense

Robo‑advisors and apps handle a lot, but there are messy human situations where a real person helps:

– Major life transitions: marriage, divorce, children, inheritance

– Complex taxes or multiple countries involved

– Business ownership, stock options, or significant real estate assets

– Parents or relatives who rely on you financially

In those cases, a financial advisor for beginners who charges transparent fees, acts as a fiduciary (legally required to put your interests first), and is willing to educate you—not just sell you products—can be worth far more than their cost.

If you can’t afford full‑service advice yet, hybrid models (low‑cost robo‑advisors with occasional human consultations) are becoming common by 2025 and are often a good compromise.

—

Looking Toward 2035: Forecasts and Trends

What the Next Decade May Bring

No one can predict markets precisely, but several long‑term trends are likely:

– Longevity: People live longer; retirement horizons lengthen. You may need to fund 25–30 years of life after full‑time work.

– Pension shifts: More responsibility moves from governments and employers to individuals. Defined‑benefit pensions become rarer; defined‑contribution plans and DIY investing become the norm.

– Automation and AI: Job markets change faster; income volatility increases for many professions.

– Climate and geopolitics: More frequent disruptions that can affect prices, supply chains, and investment risks.

What does that mean personally?

– Relying solely on a government pension is likely risky.

– Learning basic investing is almost mandatory.

– Flexibility—both financial and professional—is a major asset.

Analysts from institutions like the World Bank and IMF have been warning for years: without better household financial resilience, future shocks (pandemics, crises, climate events) will hit ordinary people hardest. Your personal finance plan is part of that resilience.

—

A Simple, Realistic Action Plan

Putting It All Together

If you feel overwhelmed, shrink the problem. Don’t try to “fix your finances” in a weekend. Build a sequence.

You can use this checklist as a starting point:

– Track one month of spending with an app or simple spreadsheet.

– Identify your true “bare‑bones” monthly cost of living.

– Set up automatic transfers:

– to an emergency fund,

– to a debt payoff plan,

– to a basic investment account (even a tiny amount).

– Cancel or downgrade at least one recurring expense you don’t really value.

– Pick one short, practical personal finance resource (book, course, or series) and finish it within 30 days.

And then repeat: review, adjust, and keep going. Small, boring, consistent steps beat dramatic but short‑lived efforts every time.

—

Final Thought: Beginners Today, Veterans Tomorrow

In 2025, being “bad with money” is no longer something you can safely ignore. But it’s also not a life sentence. Personal finance is a skill, not a personality trait.

Our grandparents dealt with envelopes and pensions, our parents navigated credit cards and mortgages. We’re navigating apps, AI, volatile markets, and longer lifespans. Different tools, same core idea: make sure your money supports the life you actually want, not just the lifestyle algorithms try to sell you.

Start where you are, with what you have, and build from there. The “ultimate guide” isn’t this article or any course—it’s the set of habits you practice over years.