Where We Are in 2026: Are We Really Heading for a Recession?

When people ask if we’re heading for a recession in 2026, they’re really asking whether job security, wages and prices are about to turn against households again. Economists watch indicators like yield curve inversions, slowing GDP growth and rising household debt service ratios, but families feel it more directly: hiring freezes, tougher mortgage approvals and shrinking pay raises. Even without an officially declared downturn, a “growth recession” — slow growth plus sticky inflation — can squeeze your family budget almost as much as a classic crash.

Заказать seo оптимизацию сайта оптом вы можете в нашем сообществе тг

Historical Context: What Past Downturns Taught Households

To understand what this could mean for you now, it helps to look back. In the 1970s, high inflation eroded real wages, forcing families to cut non‑essential spending aggressively. The 2001 dot‑com bust mainly hit investment portfolios and tech jobs, while the 2008 financial crisis damaged the housing market and household balance sheets for years. The 2020 pandemic recession was unusual: incomes were buffered by fiscal stimulus, but supply shocks pushed prices up later. Each episode showed that families who adjusted early — trimming fixed costs and building buffers — had far more room to maneuver.

Comparing Approaches to Family Budgeting in Uncertain Times

When you think about how to prepare family budget for recession, there are three broad strategies: defensive, flexible and growth‑oriented. A purely defensive budget focuses on cutting every variable expense and hoarding cash; it maximizes short‑term resilience, but can feel brutal and unsustainable. A flexible approach segments expenses into “must keep”, “can adjust” and “can pause”, letting you dial spending up or down as conditions change. The growth‑oriented strategy preserves selective investments — like education or retraining — even while trimming lifestyle costs, accepting short‑term discomfort for better long‑term earning power.

Pros and Cons of Digital Tools vs Analog Methods

Families now choose between spreadsheet‑based tracking, bank‑integrated dashboards and mobile apps with automation and AI. Traditional spreadsheets are transparent and customizable, but demand discipline and manual data entry. Bank dashboards automatically import transactions, yet often lack granular categorization and multi‑bank views. Dedicated apps use rules, alerts and cash‑flow projections, reducing cognitive load but introducing data‑privacy risks and subscription fees. The key trade‑off is control versus convenience: more automation means less friction, but also more dependence on third‑party algorithms and the accuracy of transaction labeling.

Using Technology Wisely: Budgeting Apps and Automation

If you’re choosing the best budgeting apps for families during economic downturn, look for a few technical features: real‑time syncing across accounts, envelope or category‑based budgeting, and forward‑looking cash‑flow forecasts. Apps that support shared wallets or multi‑user access help partners coordinate spending decisions transparently. At the same time, evaluate encryption standards, data‑sharing policies and two‑factor authentication, because your financial telemetry is extremely sensitive. Automation — like auto‑saving to an emergency fund when income hits the account — is powerful, but you should still perform monthly manual reviews to avoid “set and forget” complacency.

Benefits and Risks of Fintech Solutions

The big upside of modern fintech is behavioral: apps nudge you with notifications, anomaly detection and goal tracking, which can significantly increase saving rates. Algorithmic categorization and recurring‑expense detection highlight subscriptions and hidden fees that bloat your baseline costs. On the downside, over‑reliance on a single platform introduces vendor lock‑in: if pricing changes or the service is discontinued, you scramble to rebuild your system. There’s also a psychological risk: people may feel “I installed the app, therefore I’m responsible”, while continuing the same spending habits that undermine resilience when the cycle turns.

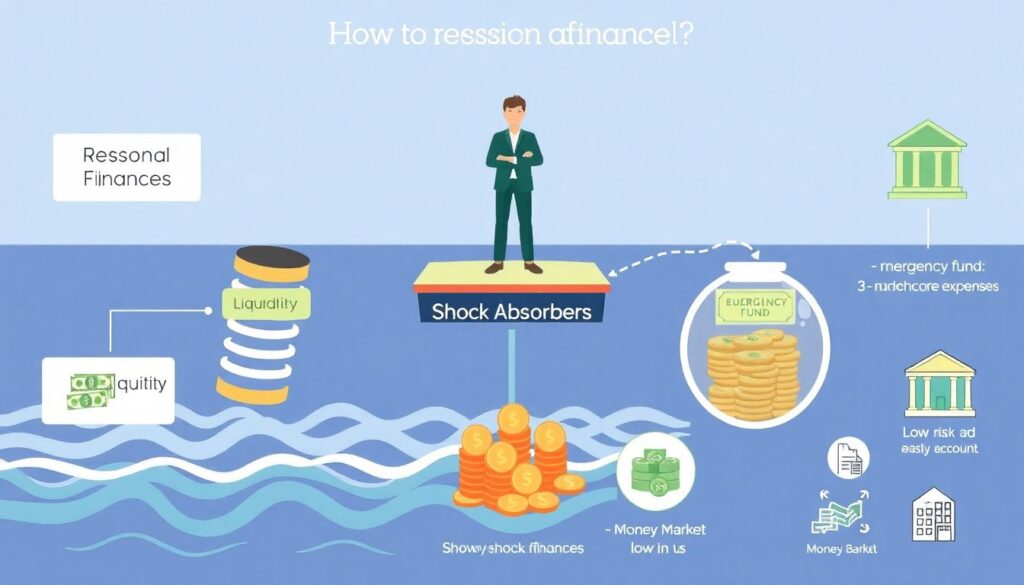

Concrete Steps: Making Your Budget Recession‑Ready

If you’re wondering how to recession proof your personal finances, think in terms of shock absorbers. First is liquidity: aim for an emergency fund covering at least 3–6 months of core expenses, stored in easily accessible, low‑risk instruments like insured savings accounts or money market funds. Second is flexibility: shorten contract terms where possible — for gyms, streaming, even some insurance — so you can downshift quickly. Third is redundancy: having multiple income streams, even small ones, significantly reduces the impact of a single job loss or hours cut.

A Practical Framework for Families

Here’s a simple sequence you can walk through over a weekend strategy session with your household:

1. List net monthly income sources and rank them by stability and predictability.

2. Map all expenses into fixed, semi‑fixed and variable categories, then mark which ones are legally or contractually sticky.

3. Stress‑test your budget by simulating a 20–30% income drop and noting which items you would cut first.

4. Define “tripwires” — specific signals, like a missed bonus or rising credit‑card utilization — that automatically trigger a pre‑agreed cost‑cutting phase.

Saving Before the Storm: Building Buffers Early

The best ways to save money before a recession start with lowering your structural cost base before stress hits. Renegotiating rent, refinancing high‑interest debt and locking in fixed‑rate mortgages where sensible all reduce interest‑rate sensitivity. Next, you can audit subscriptions, memberships and recurring services, eliminating those that don’t materially improve well‑being. Channel the freed‑up cash into high‑yield savings and debt repayment, prioritizing revolving credit with double‑digit APRs. Small, systematic improvements compound surprisingly fast when you make adjustments 12–18 months before a downturn rather than after layoffs begin.

Income Diversification and Side Hustles

In the last two cycles, families that built small but reliable extra income streams were far less exposed. When you evaluate recession proof side hustles for families, focus on services that meet non‑discretionary or business‑critical needs: childcare, eldercare, basic home maintenance, bookkeeping, IT support for small firms. These usually show lower demand volatility than luxury or trend‑driven niches. Another angle is skills that help others save money or comply with regulation — tax prep, energy‑efficiency consulting, local logistics — which become more valuable when everyone is trying to cut costs intelligently.

Choosing the Right Strategy for Your Situation

There’s no universal answer to how to prepare family budget for recession, because risk exposure varies: public‑sector workers with defined‑benefit pensions face a different profile than freelancers in cyclical industries. A useful framework is to assess three dimensions: income volatility, debt leverage and dependents. High volatility plus high leverage calls for an aggressively defensive posture: larger cash buffers, rapid deleveraging and tight cost controls. Lower volatility and low debt allow for a more balanced approach, where you keep investing in retirement accounts and skills while still building a modest safety cushion.

Trade‑offs: Security vs Quality of Life

Any recession‑ready plan includes uncomfortable choices. Over‑tightening can cause “budget fatigue”, where family members rebel against endless austerity. Under‑tightening keeps everyone happy until a shock arrives and the adjustment becomes far harsher. A pragmatic tactic is to preserve a small, explicit “fun budget” while still hitting savings and debt‑reduction targets. By negotiating these trade‑offs openly, you convert vague anxiety into clear policy: everyone understands what will be cut first, and which items — like basic kids’ activities or mental‑health support — are protected as long as possible.

Trends Shaping Family Finances in 2026

By 2026, several macro trends are reshaping how households think about downturns, even if your local economy hasn’t formally entered a recession. Remote and hybrid work have become structural, not temporary, which changes spending patterns for commuting, housing and childcare. Digital payment systems are near‑universal, so “cash‑stuffing” now often means using digital envelopes instead of physical bills. At the same time, climate‑related disruptions and geopolitical tensions have made supply shocks more common, so families can’t assume that short‑term inflation spikes will fade quickly without impacting real purchasing power.

New Tools, Old Principles

While the interfaces have changed, the core principles remain close to what worked in earlier downturns: spend below your means, avoid excessive leverage and maintain liquidity. Modern tools just operationalize those rules more efficiently. For example, automatic round‑ups to savings, category‑based spending caps and real‑time alerts convert good intentions into daily practice. In that sense, the best budgeting apps for families during economic downturn are simply digitizing envelope budgeting and ledger tracking that previous generations did on paper, but with better time resolution and fewer opportunities to “forget” transactions.

Pulling It Together for Your Family

Recessions are cyclical; what’s not cyclical is how prepared your specific household is when the next one shows up. Instead of trying to predict the exact timing, focus on building margins of safety into your monthly cash flow, your debt structure and your career capital. Treat your home finances like a small business: monitor key metrics, run stress tests, and update your plan as conditions evolve. With that mindset, even if a formal downturn hits, its impact on your day‑to‑day life will feel more like a controlled slowdown than an uncontrolled skid.