Historical context of family vacation budgeting

In the early 20th century, family vacations were largely a privilege of the upper middle class, linked to rail tourism, sanatoriums and long seaside stays. Budgeting was informal: families simply consumed saved cash until it ran out. After World War II, with mass car ownership and paid leave, road trips became common and households started planning trips within an annual household budget, but mostly by intuition. By the 1980s–1990s, package tourism and charter flights made cheap family vacation packages popular, yet financial control often remained weak, based more on advertising promises than cost analysis. Since the 2000s and especially by 2025, with dynamic pricing, online aggregators and inflation spikes, structured planning, expense tracking apps and scenario modeling have become essential tools for predictable and stress‑free travel.

Modern digital ecosystems radically changed the mechanics of planning. Instead of a single travel agent, families now face hundreds of online options, from low‑cost airlines to home‑sharing platforms. This abundance increases the risk of impulsive decisions and budget overruns. At the same time, fintech tools—budgeting apps, shared cards, virtual envelopes—allow to define precise cost ceilings per category: transport, accommodation, food, entertainment, insurance. By 2025, successful family vacation planning integrates three layers: pre‑trip financial modeling, real‑time monitoring of cash flow during travel, and post‑trip analysis to refine assumptions for future years. Historical evolution shows a clear trend: from spontaneous spending toward data‑driven, iterative vacation budgeting based on measurable indicators.

Basic principles of building a vacation budget

Effective budgeting for a family vacation starts with defining constraints, not destinations. First, calculate a realistic annual travel ceiling as a fixed percentage of net household income, then decompose it into a per‑trip limit. Within this cap, break costs into fixed (tickets, visas, insurance) and variable (food, local transport, entertainment). Such categorization helps avoid the trap where cheap flights mask overall high trip cost. When considering all inclusive family vacations on a budget, evaluate the total cost of ownership: upfront package price plus hidden items such as resort fees, transfers, and optional excursions. Use conservative exchange rate assumptions and add a contingency buffer of 10–15% to absorb currency fluctuations and unforeseen events without taking on debt.

A second core principle is time‑shifting expenses to reduce price volatility. Book high‑impact items—long‑haul flights, popular accommodations—well in advance, but keep flexibility for low‑risk components like local tours. Apply basic yield management logic: travel outside peak school holidays where possible, use shoulder seasons and mid‑week departures to compress cost per day. Construct a per‑diem budget per person, separating mandatory needs (meals, public transport passes) from discretionary spending (souvenirs, premium attractions). For families targeting the best budget family vacation destinations, perform a comparative cost‑of‑living analysis using local price indices; sometimes a farther location with lower daily expenses yields a better total budget outcome than a nearby but expensive city.

Practical implementation and real‑world examples

Consider a four‑person household planning a week away with a strict $2,000 cap. Start by allocating envelopes: 40% transport, 35% accommodation, 15% food, 10% activities. Search engines may show attractive cheap family vacation packages, but instead of choosing by headline price, input each option into a simple spreadsheet, itemizing inclusions and exclusions. For a self‑organized trip, simulate multiple route scenarios and lodging types (apartment vs. hotel) and calculate cost per night per person. Integrate loyalty points or airline miles as a separate “non‑cash” line to avoid double‑counting. Once a draft plan is built, run a stress test: increase key costs by 20% and check if the budget still holds, adjusting duration or destination accordingly.

Implementation continues during the trip via operational control. Use shared budgeting apps where each adult logs transactions in predefined categories in real time. Visual dashboards help detect overspending early, allowing timely corrections such as switching from restaurants to self‑catering for several days. Families seeking affordable family beach vacations might, for instance, pick a less hyped coastal town with reasonable grocery prices and free public beaches, compensating for modest infrastructure with longer stay duration. Before departure, pre‑purchase museum passes, transit cards or city cards when they provide measurable savings; these tools effectively act as pre‑committed caps on specific expense categories and transform unpredictable costs into fixed, planned outlays.

Frequent misconceptions and cognitive traps

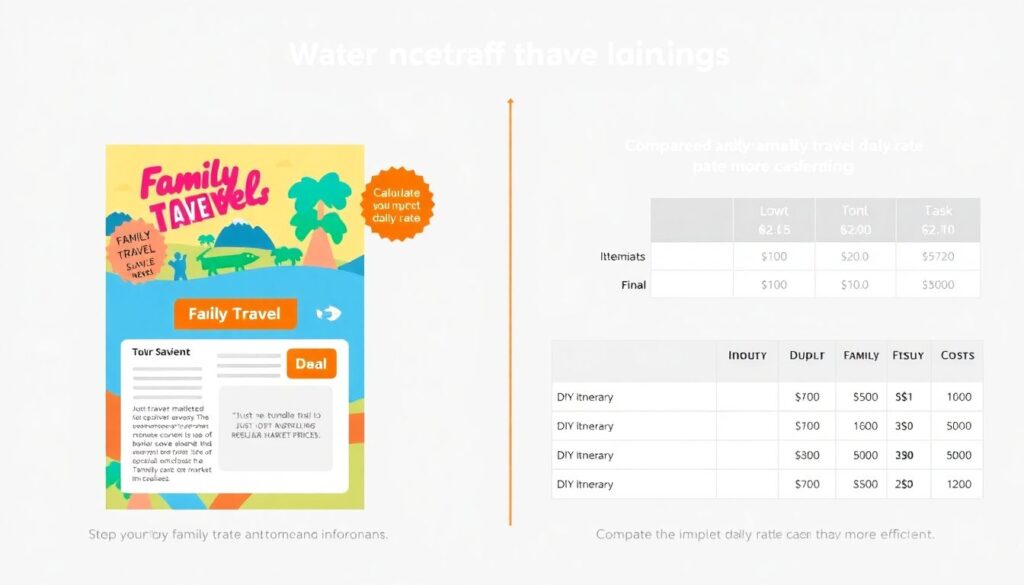

One common misconception is that packaged products automatically ensure savings. In reality, not all family travel deals and discounts are cost‑efficient; some merely re‑bundle market prices with heavy marketing. To evaluate them, compute the implicit daily rate and compare it against a DIY itinerary with similar service levels. Another myth is that “kids travel free” offers sharply cut costs, while additional surcharges on meals, extra beds and activities can negate the benefit. Likewise, consumers often underestimate ancillary charges—baggage, resort taxes, parking, roaming—because they are fragmented and not highlighted at booking; rigorous budgeting requires consolidating these hidden expenses into pre‑trip projections.

A second widespread illusion is that the “cheapest destination” is always optimal. Families sometimes chase headline airfare deals while ignoring structural expenses like mandatory car rental or high dining prices. This can derail the intent to prioritize the best budget family vacation destinations where the total cost of stay aligns with income. Another trap is over‑reliance on historical prices: post‑pandemic demand patterns, fuel costs and inflation make 2019 benchmarks obsolete by 2025. Finally, some travelers assume that continuous cost‑cutting will not affect experience quality, yet reducing buffer funds too aggressively increases exposure to stress and emergency debt. Robust vacation budgeting balances cost optimization with resilience and psychological comfort.