Why Fund Expenses Matter More Than You Think

When you buy a fund — mutual fund, index fund, or ETF — you’re not just buying a basket of stocks or bonds. You’re also buying a pricing structure. Those “small” percentages listed as expense ratios, management fees, or trading costs quietly shape your long‑term results, often more than fancy strategies or market timing.

In practice, understanding fund expenses is about answering a simple question: “How much of my return do I actually keep?” Once you see how the math works, choosing cheaper, cleaner products becomes almost automatic.

—

Краткая историческая справка: от дорогих фондов к ценовой войне

In the 1970s and 1980s, actively managed mutual funds dominated. High expense ratios (1.5–2%+ per year) were normal, and investors rarely questioned them. Performance reporting was less standardized, disclosure was less user‑friendly, and most people simply trusted their broker or bank.

Everything started to shift when low‑cost index funds appeared and later when ETFs took off. Vanguard pushed the idea that capturing the market return at very low cost often beats paying high fees for stock picking. As data accumulated, it became painfully clear: on average, high‑fee active funds underperformed cheaper index funds once fees were deducted.

That led to a “fee compression” trend. Today, fund providers are locked in a pricing war, competing to offer the lowest expense ratio index funds and even zero‑fee products in some markets. For you as a beginner, this is good news — but only if you know what to look for and how to avoid the remaining high‑cost traps.

—

Базовые принципы: какие расходы вообще существуют

Let’s break down the main types of fund expenses you’ll actually see in documents and on broker platforms. You don’t need to memorize everything — just recognize the big categories.

1. Expense ratio (ongoing annual fee)

This is the core number. It’s expressed as a percentage per year of the assets you hold in the fund, e.g., 0.05% or 1.50%.

– It silently comes out of the fund’s assets every day.

– You don’t see a line item on your statement; you just get a slightly lower return.

2. Management fee (part of the expense ratio)

This is what the manager charges for running the portfolio. For many ETFs with lowest management fees, this is the lion’s share of the total expense ratio.

3. Other operating expenses

Custody, administration, audit, legal. They’re rolled into the total expense ratio. You typically don’t see the breakdown unless you dig into the prospectus.

4. Trading costs inside the fund

Every time the manager buys or sells a security, there are spreads and commissions. These don’t appear in the expense ratio but still reduce performance.

5. Distribution and marketing fees (12b‑1 in the US)

Some mutual funds charge ongoing marketing/distribution fees, often 0.25–1% per year, effectively paying intermediaries to sell the fund. That’s an avoidable drag.

6. Entry/exit loads and transaction commissions

Front‑end load: you pay when you buy.

Back‑end load: you pay when you sell.

Plus, your broker may charge a commission per trade.

At a practical level, when you analyze a fund, you want to know:

– What is the *total* expense ratio?

– Are there *any* loads or sales charges?

– Are there hidden trading or distribution costs implied by the strategy?

—

Как маленький процент убивает большие деньги

The dangerous thing about fund expenses is that 1% sounds tiny. It doesn’t feel like much. But in compounding terms, it’s massive.

Imagine two funds tracking the same index:

– Fund A: expense ratio 0.05%

– Fund B: expense ratio 1.05%

You invest $10,000 in each, earn a gross 7% per year before fees, and hold for 30 years:

– Fund A net return ≈ 6.95% per year

– Fund B net return ≈ 5.95% per year

After 30 years:

– Fund A: about $76,000

– Fund B: about $51,000

That 1% fee difference quietly cost you roughly $25,000 on a single $10k investment. No extra risk, no extra work. This is why mutual fund fees comparison is not an academic exercise — it’s real money over real time.

—

Практический подход: с чего начать разбор расходов

If you’re just starting, you don’t need a PhD in finance. You need a checklist you can use in 5–10 minutes when you look at a fund.

When evaluating a fund:

– Find the expense ratio (TER) and write it down.

– Check for loads or sales charges — if any, move on unless there’s an exceptional reason.

– Confirm whether the fund is index-based or active and compare its fees to typical levels for its category.

– Look at fund size and turnover: tiny funds with high turnover often hide higher implicit trading costs.

Then ask yourself one brutal question: “What exactly am I getting in exchange for these extra basis points?” If the answer isn’t crystal clear, don’t pay up.

—

Примеры реализации: как это выглядит на практике

Let’s walk through a simplified, real‑world‑style comparison. Assume you’re choosing a US stock fund for long‑term investing.

– Fund 1: Broad US index ETF

– Strategy: tracks a large diversified index

– Expense ratio: 0.03%

– No loads, low turnover

– Fund 2: Actively managed US stock mutual fund

– Strategy: manager picks stocks to beat the index

– Expense ratio: 1.20%

– 0.50% 12b‑1 distribution fee, moderate turnover

On a broker screen, both might show similar past 3‑year returns. That tempts many beginners to think, “Performance is what matters, not a 1% fee difference.” But the odds of the active fund consistently beating the cheap index fund *after* paying that extra cost are statistically low.

If you’re building a simple “core” portfolio, you’d usually lean toward these types of holdings:

– Broad, diversified index funds for stocks and bonds

– Low‑fee ETFs from major providers

– No‑load mutual funds with transparent costs

That’s exactly where you’ll typically find some of the best low cost mutual funds for beginners — broad market funds with tiny expense ratios and simple mandates.

—

Как выбирать фонды с низкими коэффициентами расходов на практике

You’ve probably seen the phrase how to choose funds with low expense ratios in blog posts and guides, but what does that look like step by step?

Use this simple workflow:

– Step 1: Define the asset class

Decide what you need: US stocks, international stocks, bonds, etc. Fees are only meaningful compared to peers in the *same* category.

– Step 2: Get a shortlist

On your broker’s platform or a fund screener, filter:

– Index funds/ETFs only (if you want passive exposure)

– No load

– Funds available to your account type (e.g., no institutional‑only share classes)

– Step 3: Sort by expense ratio

Start from the lowest and move upward. For core holdings, consciously stay in the bottom cost tier of that asset class.

– Step 4: Check tracking and liquidity

For index funds:

– Compare how closely they track the benchmark index.

– Look at fund size and trading volume for ETFs (wider spreads = additional hidden cost).

– Step 5: Sanity‑check the provider

Established firms with a track record of low‑cost products and transparent communication are usually safer.

If two funds are essentially identical in exposure but one is slightly cheaper, the cheaper one generally wins by default.

—

Где искать самые дешёвые фонды

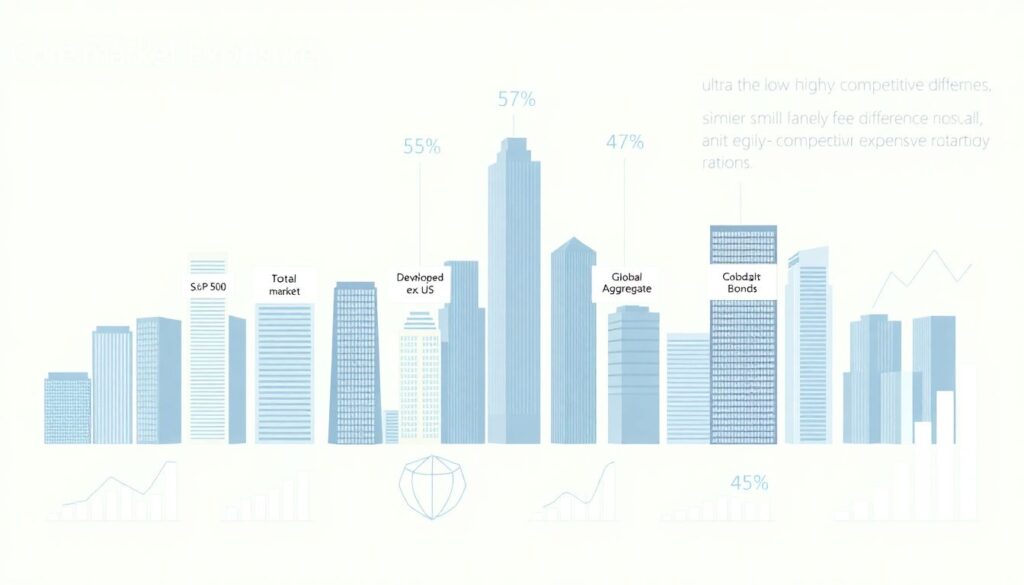

For core market exposure, you’ll often see a cluster of lowest expense ratio index funds from the biggest providers. They all target very similar indexes: total market, S&P 500, developed ex‑US, global aggregate bonds, and so on.

With ETFs, fees have become so competitive that the differences are sometimes just a few basis points. In that case, give some weight to:

– Trading spread and average daily volume

– How your broker handles ETF trading (commissions, smart routing)

– Tax considerations in your jurisdiction

You’re not just hunting “the absolute lowest fee”; you want the combination of low cost + clean implementation.

—

Частые заблуждения о расходах фондов

A lot of new investors get tripped up by similar myths. Clearing them up can dramatically improve your decision‑making.

1. “High fees mean better management.”

In most data sets, the opposite is true: on average, higher‑fee funds underperform cheaper alternatives over long periods. You’re not buying a luxury good; you’re buying future cash flows.

2. “Past outperformance justifies higher costs.”

Performance tends to revert to the mean. A hot fund with high expenses often cools off later, but the fees stay. Never pay a permanent premium for a temporary winning streak.

3. “It’s only 1%, it doesn’t matter.”

Over 20–30 years, “only 1%” can easily strip away 20–40% of your potential terminal wealth. The impact is non‑linear because of compounding.

4. “All index funds are automatically cheap.”

Some index funds are inexplicably expensive despite tracking plain‑vanilla benchmarks. Don’t assume; always check the actual number.

5. “I’ll focus on costs later, once my portfolio is bigger.”

The best time to build a low‑cost structure is *before* your balance grows. Habits formed with small sums scale up.

—

Как сравнивать комиссии на практике (без перегруза теорией)

You don’t need a spreadsheet full of ratios to do an effective mutual fund fees comparison. A lightweight approach is enough for most people.

When you compare two or three funds:

– Look at the expense ratio first. Reject obvious outliers.

– Check whether higher expenses come with genuinely *different* exposure (e.g., niche sector, factor tilt) rather than just “same index, higher fee.”

– Consider holding period. If you plan to hold for 10+ years, even a 0.10–0.20% difference is worth caring about.

– For ETFs, glance at spread and liquidity; a slightly higher fee may be offset by tighter spreads, but only at the margin.

Mentally, treat ongoing fees as a guaranteed negative return. Markets might or might not be generous, but that fee comes out every year like clockwork.

—

Практический чек‑лист для начала

Before you buy your next fund, run through this quick list:

– Is this fund the right asset class for my plan?

– Is it index or active, and does that match my intention?

– What is the total expense ratio, and where does it sit versus peers?

– Are there loads, 12b‑1 fees, or other avoidable charges?

– For ETFs, what are the average spread and volume?

– Am I getting *anything clearly valuable* in exchange for every extra 0.1%?

If you apply this consistently, you’ll naturally gravitate toward funds that belong in any list of etfs with lowest management fees and straightforward index trackers. Over time, that discipline can be worth more than any stock tip you’ll ever hear.

—

Итог: сделайте низкие расходы частью своей стратегии

Fund expenses are one of the few variables in investing that are:

– Easy to see

– Under your direct control

– Predictably linked to better outcomes when minimized

You can’t control market returns, interest rates, or macro shocks, but you *can* control how much you pay to participate. Build a habit of checking fees every time you consider a fund, anchor your core holdings in low‑cost index products, and treat any extra cost as something that must constantly justify its existence.

Do that, and you’ll have turned a “boring technical detail” into one of your most powerful long‑term advantages.