Why Your 30s Are Prime Time to Build Real Wealth

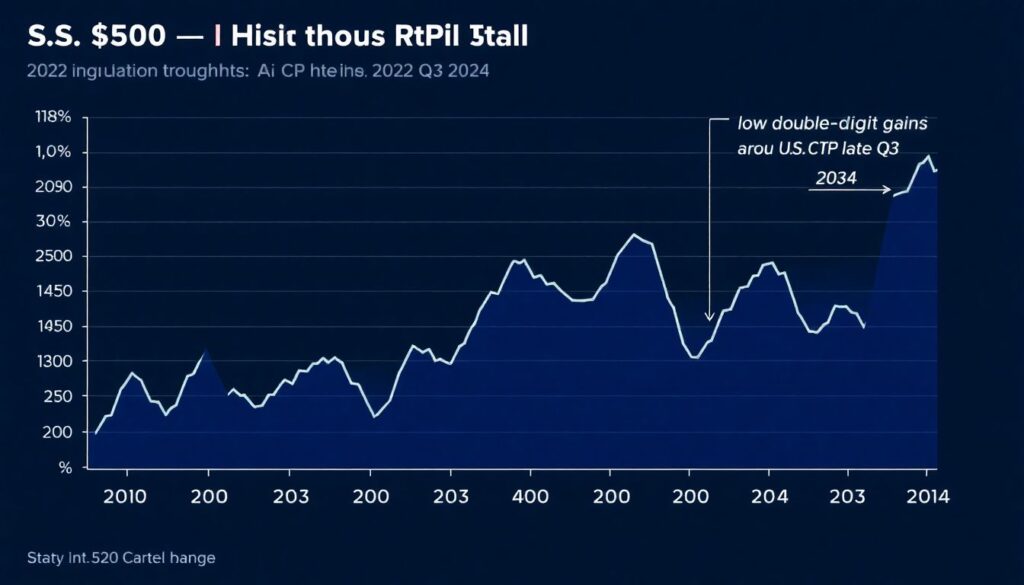

Your thirties combine higher human capital (earning potential) with enough runway for compounding to matter, which makes this decade the sweet spot for disciplined accumulation. You’re likely juggling debt, rent or a mortgage, and maybe childcare, but you also control powerful levers: savings rate, asset allocation, and risk management. The last three years underline why a robust framework beats gut feel: the S&P 500 delivered approximately −18% total return in 2022, a sharp rebound near +26% in 2023, and low‑double‑digit gains YTD through late Q3 2024, while U.S. inflation cooled from roughly 8% average in 2022 to about 4% in 2023 and moved toward the 3–4% zone by late 2024. Meanwhile, the personal saving rate hovered near 3–5% across 2023–2024—too low to hit long‑term targets without intentional planning. In other words, volatility, disinflation, and tight household cash flow coexisted, making systematic investing—not market timing—the rational play.

Set Your Baseline: Cash Flow, Buffers, and Debt

Build a resilient cash engine first

Before you chase alpha, harden your personal balance sheet. Target 3–6 months of core expenses in a high‑yield savings account; with policy rates elevated through 2023–2024, many accounts offered APYs multiple percentage points above pre‑2022 norms, so idle cash can finally earn. Next, quantify your free cash flow using a zero‑based budget: allocate dollars to fixed costs, variable spending, debt service, and investment contributions explicitly. Given that the U.S. personal saving rate sat near multi‑year lows in 2023–2024, your edge is a deliberate savings rate (15–25% of gross for dual goals of retirement and mid‑term milestones). Treat this like a required contribution, not a leftover.

Prioritize high-APR liabilities

Sequence matters. Any revolving debt above a realistic after‑tax portfolio return (e.g., credit cards at 18%+) should be extinguished rapidly—this is guaranteed alpha. For student loans or personal loans in the mid‑single digits, use a barbell: make at least the amortizing minimum plus an incremental overpayment while still capturing employer retirement matches. In 2023–2024 many 30‑year mortgages carried rates in the 6.5–7.5% range; whether to prepay depends on your risk profile and tax situation, but diversified market exposure historically beats extra principal payments over long horizons. Keep liquidity paramount.

How to Start: Portfolio Architecture That Scales

Automate first, optimize second

If you’re asking how to start investing at 30, the answer is: automate contributions into a diversified core and refine over time. Use payroll deferrals to a 401(k) for the match (instant risk‑free return), then fill IRAs and taxable accounts based on your tax bracket. For most investors, a low‑cost, broad‑market trio—U.S. total equity, international developed/emerging equity, and investment‑grade bonds—provides sufficient diversification. In 2022 bonds sold off alongside equities, reminding us that duration risk is real; in 2023, both recovered in different magnitudes. Instead of predicting the next regime, target a policy allocation and rebalance mechanically.

- Core equity: 60–80% of equity slice in U.S. total market; 20–40% abroad to diversify currency and sector exposures.

- Core fixed income: short‑ to intermediate‑term investment‑grade funds to reduce rate sensitivity; add TIPS when inflation expectations rise.

- Satellite (optional): small allocations to factor tilts (value/quality), REITs, or a measured dose of small‑cap if you can tolerate tracking error.

Glidepath for risk: pick a lane

Asset allocation should map to horizon and loss tolerance. A common baseline for financial planning for 30-year-olds is 80/20 or 70/30 equity/bond, acknowledging human capital as a bond‑like asset. If a 20–25% drawdown (as seen in 2022) would force you to sell, de‑risk now. Consider target‑date funds as a one‑ticket solution—they embed an age‑appropriate glidepath, rebalancing, and global exposure. Alternatively, construct a custom policy portfolio and codify rebalancing bands (e.g., ±5 percentage points) to enforce discipline.

Tax Efficiency: Keep More of What You Earn

Account sequencing and asset location

Retirement planning in your 30s benefits from blending pre‑tax, Roth, and taxable accounts to create future flexibility. Max the employer match, then weigh Roth vs. traditional based on your marginal rate today versus expected retirement rate. Place high‑growth equities in Roth for tax‑free compounding; hold taxable bonds and high‑yield assets in tax‑advantaged accounts where possible. In taxable accounts, favor ETFs with low turnover, harvest losses opportunistically, and use qualified‑dividend/long‑term capital gains brackets strategically. This is the quiet compounding that doesn’t show up in headline returns, yet adds significant net alpha over decades.

- Use automatic rebalancing within tax‑advantaged plans; rebalance in taxable only when within tolerance bands and tax costs are justified.

- Direct new contributions to underweight assets to “rebalance with cash” and minimize realizing gains.

- Track adjusted cost basis meticulously; high‑quality brokers provide lot‑level control for efficient sales.

Retirement Math That Works for Millennials

Translate goals into contribution rates

For investment tips for millennials, anchor on savings rate more than chasing hot sectors. A rule‑of‑thumb: a 30‑year‑old targeting retirement at 65, with a diversified 70/30 portfolio and long‑run real returns near 4–5%, generally needs 15–20% of gross income invested consistently. The volatile 2022–2024 window showed that sequence risk is real, but time diversification helps. If you began in 2022, the 2023 rebound and 2024’s steady gains (through late Q3) illustrate why staying invested beats pausing contributions. Layer in employer stock cautiously (cap at 10% of equities) to avoid concentration risk.

Stress-test your plan

Use Monte Carlo analysis or historical bootstrapping to simulate return paths, not just averages. Adjust for inflation scenarios: post‑2022 disinflation improved real yields, but a persistent 3–4% CPI path still erodes purchasing power if your portfolio’s real return is thin. Incorporate liabilities like childcare or eldercare spikes. Finally, define guardrails: if portfolio drawdown exceeds 20%, automatically halt discretionary upgrades and redirect cash to tax‑advantaged contributions and opportunistic rebalancing. Pre‑commitment reduces behavioral drag.

Best Investment Strategies for Your 30s, Ranked by Impact

1) Raise savings rate; 2) Stay diversified; 3) Optimize taxes; 4) Automate behavior

Despite debates about the best investment strategies for 30s, the compounding hierarchy is stubborn: savings rate dominates early, asset allocation second, taxes third, security selection a distant fourth. From 2022’s drawdown to 2023’s surge and 2024’s solid YTD, investors who automated contributions, rebalanced, and ignored noise outperformed most market timers. Use policy‑based rebalancing, dollar‑cost averaging, and periodic increases tied to raises (“save the raise”). These procedural edges compound even when markets don’t cooperate.

- Escalate contributions by 1–2 percentage points each performance review cycle.

- Institute quarterly portfolio check‑ins with prewritten actions; avoid ad‑hoc tinkering.

- Keep costs low: expense ratios under 0.10% for core funds whenever possible.

Tactical Moves for the 2025 Reality

Interest rates, yields, and cash management

With policy rates elevated through 2023–2024, cash, CDs, and short‑term Treasuries finally yielded meaningfully above zero, which changed the opportunity cost calculus. Ladder 3–12 month T‑Bills for emergency funds and near‑term goals; maintain duration discipline in bonds to manage rate volatility. If and when the rate cycle turns, be ready to extend duration incrementally. For equities, avoid chasing the prior year’s winners; ensure you own a broad earnings stream. Remember, factors rotate: quality and profitability often cushion drawdowns better than pure growth during tightening cycles.

Housing and big-ticket timing

Mortgage rates in 2023–2024 often printed above 7%, suppressing affordability and elevating the rent‑versus‑buy breakeven period. If buying, underwrite with a conservative debt‑to‑income ratio and assume limited near‑term price appreciation. Treat a home as a consumption asset with equity characteristics, not your primary growth engine. Keep retirement contributions intact even in the face of down payments; use a longer savings runway rather than pausing compounding.

Putting It All Together: A 12-Month Execution Plan

Month 1–3: Foundation

Open or consolidate accounts, set emergency fund targets, enroll in your 401(k) and capture the full match, and choose default investments (target‑date or a simple three‑fund portfolio). Map your cash flow with a 50/30/20 variant tailored to your goals; given the sub‑5% national saving norms in 2023–2024, aim to outperform the average immediately. Automate transfers on payday to remove frictions and decision fatigue.

Month 4–8: Optimization

Increase contributions by 1–2 percentage points, refinance or consolidate any high‑APR debt, and enable tax‑loss harvesting and dividend reinvestment in taxable accounts. Establish rebalancing bands and alerts. If equity markets correct, accelerate contributions; if they rally, harvest gains within your IPS (Investment Policy Statement). Document everything—your future self benefits from rule‑based decisions when volatility returns.

Month 9–12: Robustness

Run a retirement projection that incorporates Social Security estimates, healthcare inflation, and alternative return regimes. Adjust asset location (Roth for growth, pre‑tax for yield), and verify beneficiaries and estate basics. Finally, perform a fee audit: expense ratios, advisory fees, and hidden trading costs. Small drags are pernicious over decades, and removing them is a risk‑free boost to your internal rate of return.

Key Statistics From the Last Three Years (Context You Can Use)

Market, inflation, and savings trends

To ground your plan in reality: the S&P 500 posted roughly −18% total return in 2022, rebounded about +26% in 2023, and delivered low‑double‑digit gains YTD through late Q3 2024. U.S. CPI inflation averaged near 8% in 2022, cooled to around 4% in 2023, and trended in the 3–4% range by late 2024 as disinflation progressed. The U.S. personal saving rate fluctuated roughly between 3% and 5% across 2023–2024—well below pre‑pandemic norms—underscoring why deliberate contribution rates are essential. These figures explain why diversification, steady contributions, and tax efficiency outperformed reactive strategies for 30‑somethings navigating a noisy macro regime.

Final Word: Make the Boring Stuff Inevitable

System beats spur-of-the-moment

You don’t need a perfect forecast; you need a durable system. Cement automatic contributions, a sensible allocation, and tax‑aware habits, then let time do the heavy lifting. Whether you call this financial planning for 30-year-olds or simply good household capital allocation, the playbook is the same: spend less than you earn, invest the surplus in diversified assets, and keep frictions low. If you apply these best practices consistently, the outcome is predictable enough to be called a roadmap: financial independence on your terms.