Category: Financial Literacy for Kids

-

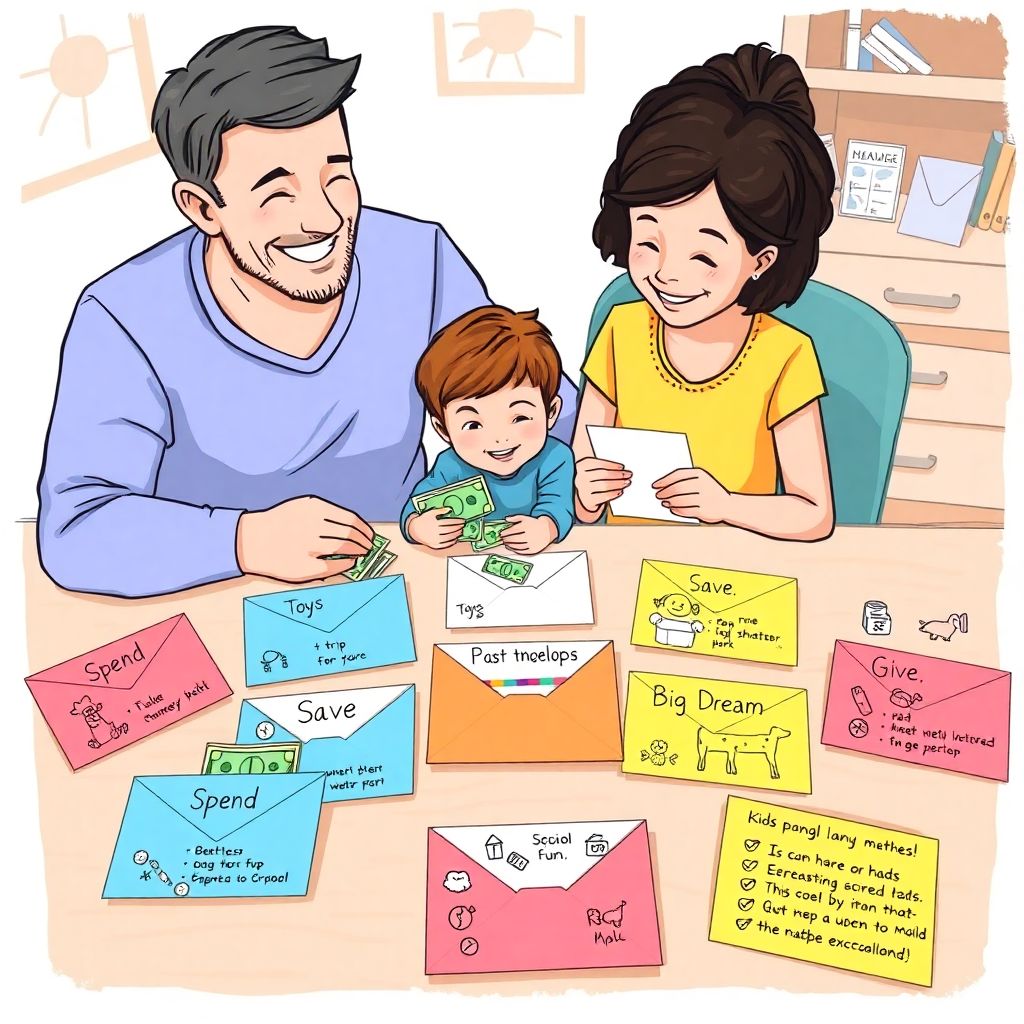

Envelope method for kids: teach children to spend, save and give wisely

Why the Envelope Method Works So Well for Kids Kids understand things, когда их можно потрогать. Цифры в приложении выглядят абстрактно, а вот настоящие конверты и купюры кажутся реальными и «серьёзными». Поэтому envelope method for kids money management так хорошо ложится на детское мышление. Ребёнок буквально видит, как деньги приходят и уходят, как один конверт…

-

Teaching kids about money through fun games and activities for ages 4–10

Why Money Lessons Matter Before Age 10 Most parents думают о финансах ближе к подростковому возрасту, но исследования показывают, что базовые установки о деньгах формируются до 7 лет. К 10 годам ребёнок уже интуитивно понимает, что такое «дорого», «дёшево» и «срочно нужно». Если в этот период подключить продуманные teaching kids about money activities, формируется финансовое…

-

Creative saving challenges for families: turn monthly saving into a fun game

Why Turning Saving into a Game Actually Works Over the last three years, families have been quietly turning saving into a kind of sport. Between 2022 and 2024, different surveys in the US and Europe showed that roughly 40–55% of households tried at least one savings challenge, and about a third stuck with it for…

-

How to build an emergency fund when you’re living paycheck to paycheck

Why an emergency fund matters even when money is tight When you’re living paycheck to paycheck, how to build an emergency fund can sound almost insulting: “With what money?” But that’s exactly why you need it. Без запаса любая мелочь — сломался телефон, задержали зарплату, выпал больничный — превращается в финансовый пожар. По данным Federal…

-

What is a stock, really?. Explaining investing to kids with favorite brands

Why Your Kid Already Knows More About Stocks Than You Think If your child can list ten favorite brands before breakfast—LEGO, Disney, Apple, Nike, Minecraft, Roblox—then they already hold the key to understanding what a stock is. They might not know the word “shareholder,” but they absolutely know what it means to care about a…

-

Crushing debt step by step: parent’s guide to debt snowball vs avalanche

Why Parents Feel Crushed by Debt (And Why This Guide Is Different) Parenthood changes how you think about debt. It’s no longer just about numbers. It’s about rent or mortgage, daycare, groceries, school trips, medical bills, and the low‑grade anxiety of “what if something happens to my job?” This guide walks through the debt snowball…

-

Interest rate news explained: what the latest changes mean for your wallet

The headlines shout “rate hike” or “rate cut”, but what does that actually mean for your daily budget, your rent, or your savings account? Let’s unpack the latest interest rate news today in plain English and connect it directly to your wallet, not to abstract charts from economists. — What an Interest Rate Really Is…

-

How to build an emergency fund on a tight budget and start saving fast

Why an Emergency Fund Matters Even When Money Is Tight When доходы едва покрывают расходы, идея откладывать деньги звучит почти как шутка. Но именно в такой ситуации подушка безопасности нужна больше всего. Emergency fund — это отдельно хранимый запас денег, который вы не трогаете для повседневных покупок и используете только при неожиданных ударах: увольнение, поломка…

-

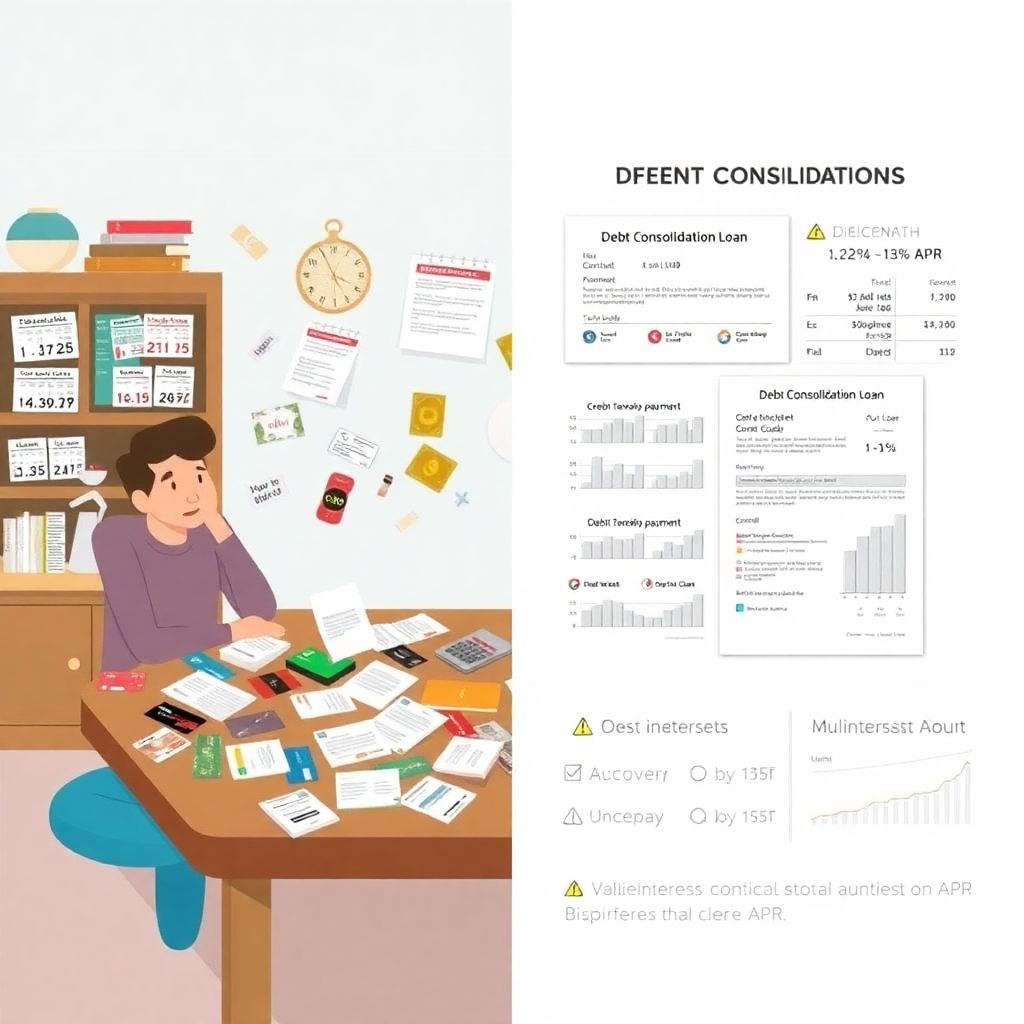

Consolidating debt: when it makes sense and when it’s a trap for borrowers

What “consolidating debt” actually means in real life Debt consolidation sounds fancy, but in practice it’s simple: you take several existing debts with different rates and due dates and roll them into one new loan or line of credit. Instead of juggling four credit cards, a store card and a personal loan, you make a…

-

How to budget for a new baby without going broke with smart money tips

Why a Baby Blows Up Your Budget Faster Than You Expect Most parents google “how to budget for a new baby” в момент, когда уже куплена первая милейшая пижама и пару десятков «обязательных» аксессуаров. Проблема в том, что мозг в этот период работает не как у бухгалтера, а как у влюблённого: хочется дать ребёнку лучшее…