Category: Financial Literacy for Kids

-

Debt management for parents with young children: practical steps to regain control

Evolution of Family Debt Management From Stigma to Strategy For most of the 20th century, family debt was something people hid, not managed. Parents took loans from a single local bank, relied on cash, and hoped rising incomes would quietly erase balances. Credit cards, student loans, and online shopping changed the game: access to money…

-

Financial literacy for nurses: money management tips to build wealth and stability

Why financial literacy matters in nursing today You care for patients under pressure, on rotating shifts, and often with overtime that swings from feast to famine. That reality makes money habits more, not less, important. Since 2023, costs have cooled but not vanished: U.S. CPI inflation eased from roughly 6% in 2022 to about 3–4%…

-

How to build a realistic debt reduction timeline that actually works

Why a debt reduction timeline beats vague intentions A timeline turns a fuzzy wish into a measurable plan, and the psychology behind it is simple: when the next action and date are obvious, follow‑through rises. Instead of promising yourself to “pay more when possible,” you estimate cash flow, map payments to calendar months, and set…

-

Appliances buying guide for smart, efficient homes with expert tips

Map Your Needs Like a Pro Before chasing shiny features, map your real-life rhythms. Count weekly cooking hours, loads of laundry, and storage habits; then convert that into specs, not vibes. If you batch-cook, you need rapid preheat and a convection fan with even airflow; for snackers, a smaller cavity plus a robust air-fry mode…

-

Understanding debt collectors: a beginner’s guide to your rights and options

Who debt collectors really are and why they contact you Debt collectors aren’t movie villains; they’re businesses hired to recover overdue accounts, often for pennies on the dollar. That incentive shapes their tactics: frequent calls, quick settlement offers, and pressure to act fast. Beginners often panic, ignore calls, or overshare. A calm, documented approach works…

-

How to build a budget for your family that keeps everyone on track

Why family budgeting still matters in 2025 A century ago, families tracked cash in envelopes; by the 1990s, software replaced shoebox math; the 2010s brought apps. Yet the core goal hasn’t changed: align money with values. The stakes are high. In 2024, Federal Reserve data showed U.S. credit card balances above $1.1 trillion, while the…

-

How to build a financially secure future on a fixed income: practical steps and tips

Building a financially secure future on a fixed income isn’t about deprivation; it’s about clarity, repeatable habits, and smart use of simple tools. When your paycheck or pension doesn’t flex, your plan must. The good news: predictability can be a superpower if you set up systems that capture small wins automatically. Below you’ll find an…

-

Financial aid and scholarships for college: how to navigate options and maximize funding

Why money talk doesn’t have to be scary Paying for college has a reputation for being confusing, but it’s much more manageable when you treat it like a series of small, clear steps. Think of financial aid as a toolkit: grants you don’t repay, scholarships that reward your story and effort, work-study that adds experience,…

-

Creating a financial plan for special needs families: key steps and expert tips

Start with a clear baseline Before you buy products or call experts, map the current reality. List all sources of income, government benefits, therapies, and recurring costs, then contrast them with your child’s support needs across school, work, and daily living. Build a month-by-month cash snapshot for a year to catch seasonal spikes like camp…

-

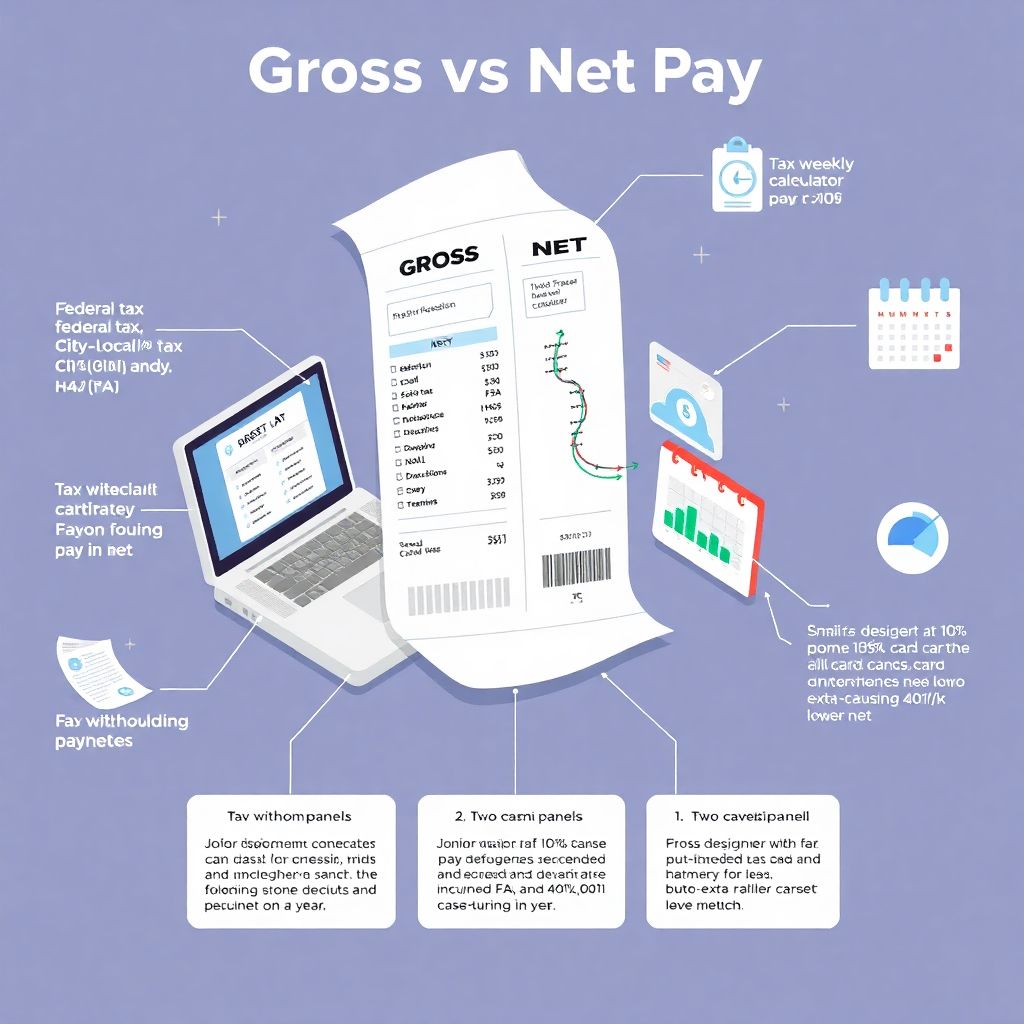

And take-home pay explained: how to calculate your net salary

You don’t get paid what your contract says—you get paid what lands in your account after taxes and deductions. That gap is where most beginners stumble. They confuse gross with net, forget pre-tax benefits, and misread pay periods. One week they celebrate a raise; the next, their take-home shrinks because withholding changed. Before you negotiate…